Bitcoin Weekly RSI Points To More Upside, But Can the Bulls Defend $107,000?

Bitcoin’s weekly chart shows promising signs of strength as the RSI continues to climb, hinting at the potential for further upside. However, the battle isn’t over yet. With price hovering near the critical $107,000 support, bulls must defend this level to prevent deeper downside pressure.

RSI And Price Alignment: A Textbook Case Of Momentum Confirmation

In a recent market update , EGRAG CRYPTO questioned whether the bulls and bears are even analyzing the same chart, as the current macro weekly structure of Bitcoin shows no signs of bearishness. The broader setup remains firmly bullish, suggesting that the ongoing price movements are part of a healthy uptrend.

The analyst emphasized that when Bitcoin’s price and the Relative Strength Index (RSI) rise simultaneously on the weekly timeframe, it serves as a confirmation of momentum rather than a warning sign. This alignment often signals strong buying interest and market conviction, supporting the argument for continued bullish pressure in the near to mid-term.

EGRAG CRYPTO further highlighted that the Exponential Moving Average (EMA) ribbon remains supportive, reinforcing the trend’s strength. In the expert’s view, the current setup is a clear indication of macro confirmation, not mere market noise. Such alignment between indicators typically precedes significant continuation phases, showing that the trend remains well-structured and sustainable.

However, the expert added a note of caution, stating that traders should only be wary if the RSI climbs into overbought territory above 70, which could suggest a temporary cooldown. For now, with RSI hovering around 50, Bitcoin still has plenty of room to run. This leaves the market with a strong technical foundation and considerable potential for further upside momentum.

Bitcoin Faces Rejection At $111,000: Bulls Lose Grip On Momentum

According to Crypto VIP Signal’s latest analysis , Bitcoin is currently facing challenges after failing to sustain its upward momentum above $111,000. The rejection from this point suggests that selling pressure remains strong, keeping bullish momentum temporarily in check.

Crypto VIP explained that Bitcoin is now retesting the $107,000 support zone, a critical area that could determine the next possible move. Holding this level is essential to prevent a deeper pullback, as it has served as a key foundation during previous consolidation phases.

However, a decisive break below the $107,000 support would likely trigger additional selling pressure, potentially extending the ongoing correction . Monitoring this level closely now appears important, since a bounce from here could reignite bullish sentiment, while a breakdown might expose Bitcoin to further downside risks in the short term.

Dogecoin Faces Final Boss At 0.886 Fib As Bulls Eye $0.25 Reclaim

Dogecoin is back pressing a long-standing resistance cluster as two prominent traders map the next p...

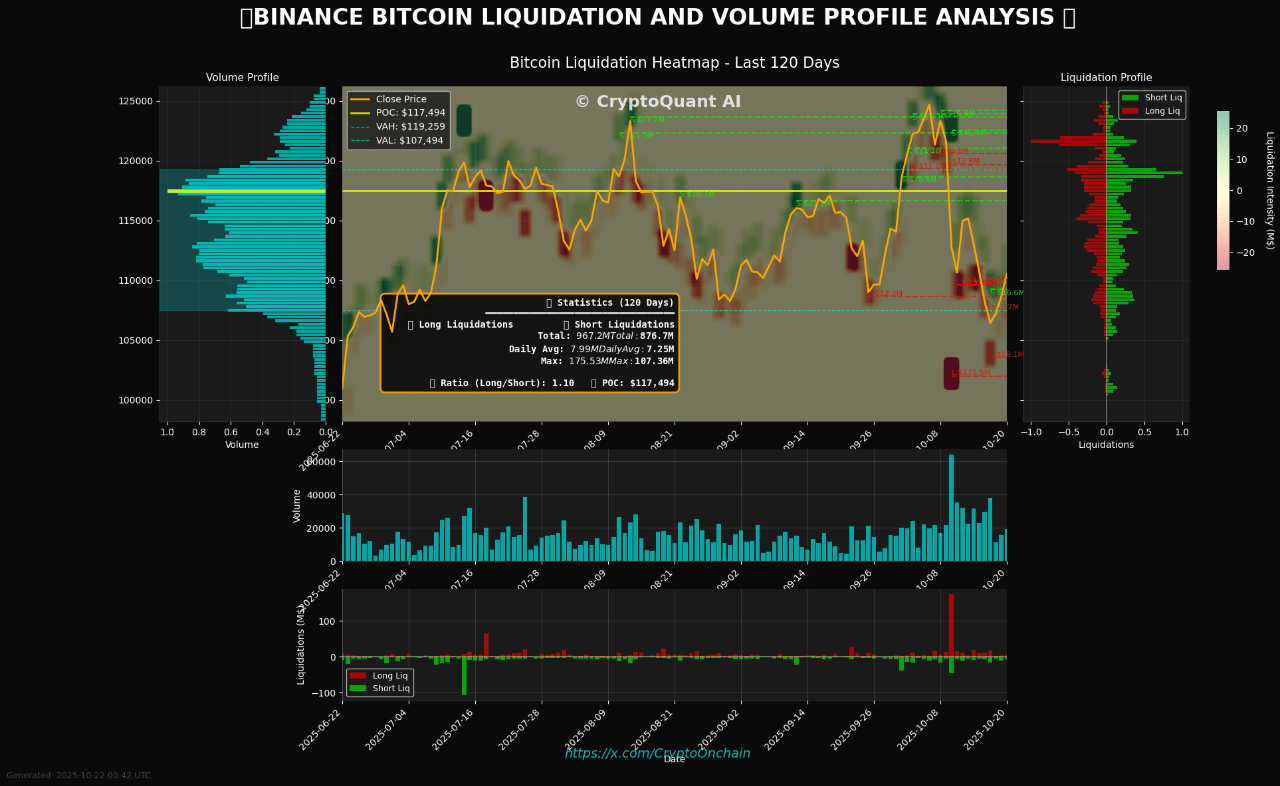

Bitcoin Trapped On Binance: The Battle Between $107K and $119K Heats Up

Bitcoin is struggling to establish a clear direction as volatility tightens and traders face increas...

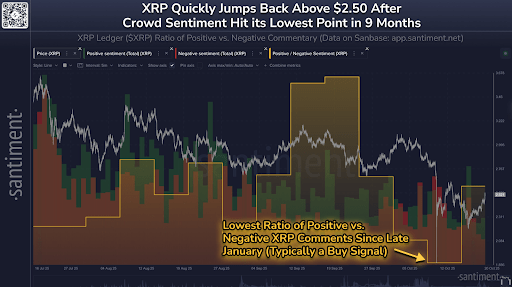

XRP Strengthens Under The Weight Of Heavy FUD And Loss-Selling, What This Means For Price

XRP has shown remarkable resilience after a turbulent event that saw over $19 billion wiped out from...