XRP Strengthens Under The Weight Of Heavy FUD And Loss-Selling, What This Means For Price

XRP has shown remarkable resilience after a turbulent event that saw over $19 billion wiped out from the crypto market. The token, which had fallen below $1.90 just ten days ago, is now showing signs of strength and looking like it’s going to break past $2.50 anytime soon. This rebound comes amid an atmosphere of widespread fear, uncertainty, and doubt (FUD) across the market. Despite the shaky sentiment, on-chain data suggests that this is a buy signal for XRP.

XRP Rebounds Strongly After Market Capitulation

Santiment’s latest data reveals that XRP’s recovery from its flash crash lows around $1.90 to $2.20, and then towards $2.50, has unfolded in tandem with one of the most intense waves of negative sentiment recorded this year. Notably, the platform’s crowd sentiment ratio reached its lowest level since January, reflecting the extreme point of pessimism among traders.

This extreme pessimism was a result of the XRP price crashing alongside many other cryptocurrencies. News and macroeconomic events , particularly the US tariff announcement on China, caused many XRP holders to sell at a loss under intense Fear, Uncertainty, and Doubt (FUD). This, in turn, caused the crowd sentiment to tank massively.

Data from the on-chain analytics platform Santiment shows that the ratio of positive versus negative comments surrounding XRP fell to 1.856, its lowest point since late January 2025. The chart from Santiment illustrates how this ratio has been deteriorating steadily since mid-September. It dropped from 1.93 on September 19 to 1.44 by October 1 before plunging to 1.01 on October 8 and staying around that level for nearly a week.

This sustained period of pessimism shows shaken confidence among XRP traders during the recent price volatility. However, there are early signs of stabilization. The sentiment ratio has begun to recover slightly, rising to 1.35 at the time of writing. This means that some optimism is returning now that XRP is trying to reclaim $2.5.

What This Means For XRP’s Next Move

XRP’s ability to rebound under such heavy FUD suggests the asset may be entering a stronger accumulation phase . According to Santiment, the low ratio of positive to negative comments is typically a buy signal, especially for traders who have been looking to accumulate at lower prices. Santiment noted this by saying that “prices typically move opposite to retail’s expectations.”

If XRP manages to maintain its position above $2.50, it could be interpreted as confirmation of renewed bullish momentum. From here, the next price targets would be earlier support levels at $2.72 and $2.80 in the short term. Stronger bullish momentum would see XRP extend the rally and break above $3.

At the time of writing, XRP is trading at $2.4, down by 1% in the past 24 hours.

Dogecoin Faces Final Boss At 0.886 Fib As Bulls Eye $0.25 Reclaim

Dogecoin is back pressing a long-standing resistance cluster as two prominent traders map the next p...

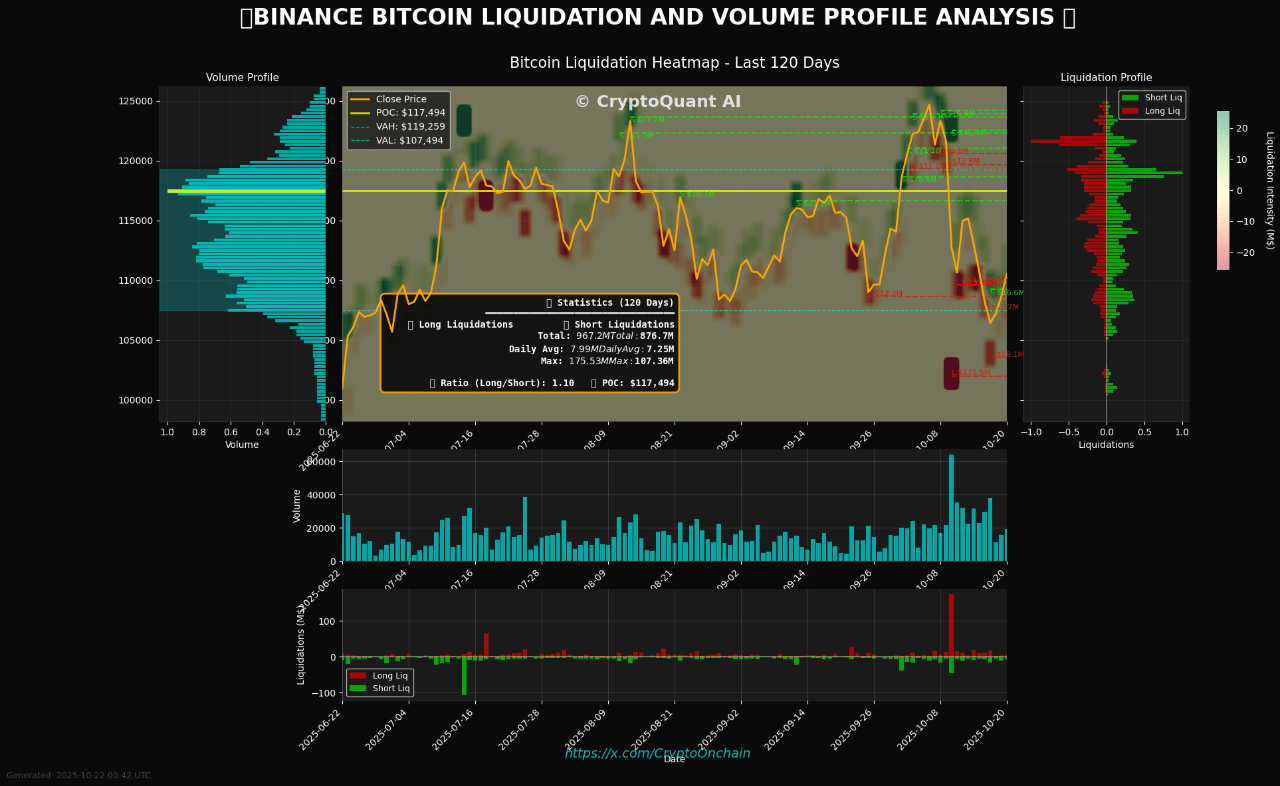

Bitcoin Trapped On Binance: The Battle Between $107K and $119K Heats Up

Bitcoin is struggling to establish a clear direction as volatility tightens and traders face increas...

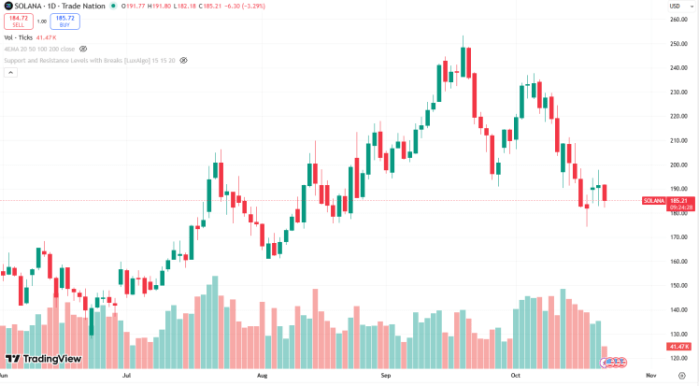

Solana $192 Breakout Could Lead to Rally as Solana Meme Coins like $SNORT Amp Up

What to Know: $SOL sees mid-term holder supply drop as market uncertainty rattles Solana. The token ...