SharpLink Gaming Boosts Treasury to Over 521,000 ETH Worth Almost $1.9B

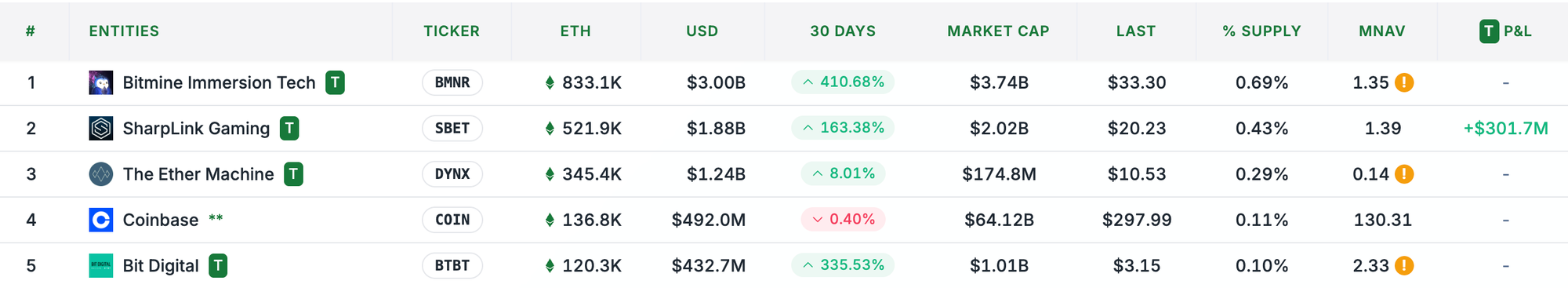

SharpLink Gaming, Inc. (Nasdaq: SBET) announced it has increased its total Ether (ETH) holdings to 521,939 as of August 3, 2025. The company, which has emerged as the second-largest corporate holder of Ether (ETH) globally (according to SER ), is aggressively pursuing its strategy to build a robust and trusted ETH treasury.

The latest acquisition saw SharpLink purchase 83,561 ETH between July 28 and August 3 for around $303.7 million, at an average price of $3,634 per ETH, funded by an ongoing At-the-Market (ATM) facility. The facility raised $264.5 million through the sale of 13.6 million Sharplink common shares in the past week, on top of $279.2 million raised the week before.

NEW: SharpLink now holds 521,939 ETH

— SharpLink (SBET) (@SharpLinkGaming) August 5, 2025

Between July 28 – August 3, SharpLink acquired 83,561 ETH for $264.5M at an average price of $3,634

ETH-per-share (“ETH Concentration”) is now 3.66, up from 3.40 last week, and has increased 83% since we began the strategy on June 2nd

100%… pic.twitter.com/X1MFXFDj37

This ongoing expansion of SharpLink's digital asset portfolio places it squarely in the center of the corporate crypto treasury conversation, a trend popularized by companies like Strategy with its substantial Bitcoin holdings.

For these companies, integrating cryptocurrency into their balance sheets is a bet on the long-term value and utility of digital assets as a hedge against inflation and a store of value. SharpLink's strategy is unique in its focus on Ethereum, highlighting the company's belief in the network's foundational role in decentralized finance.

Since launching its treasury strategy on June 2, 2025, SharpLink has not only accumulated a significant amount of ETH but has also generated 929 ETH in cumulative staking rewards. This staking component of the strategy allows the company to generate yield on its assets, adding a revenue stream beyond simple price appreciation.

Co-CEO Joseph Chalom reinforced the company's vision, stating, "SharpLink remains deeply committed to its mission of creating enduring shareholder value by building the largest and most trusted ETH treasury company." He added that the company is actively exploring various capital formation opportunities to further scale its ETH holdings and align with Ethereum's role in the future of finance.

SharpLink has also introduced a new metric, "ETH Concentration," which now stands at 3.66 and measures the number of ETH held per 1,000 assumed diluted shares, reflecting the company's effort to transparently link its shareholder value directly to its Ethereum holdings.

Consensys CEO and Ethereum co-founder Joe Lubin is the chairman of SharpLink, following a Consensys-led $425 million private placement for SharpLink in May.

SharpLink is currently trading down 3% on Tuesday at $18.59, according to The Block's SBET price page .

Inside Upexi: How a Consumer Products Company Became Crypto's Next Big Bet

Chief Strategy Officer Brian Rudick explains why the company chose SOL over Bitcoin, how convertible...

SEC's Hester Pierce Champions Financial Privacy in Rousing Speech

"Key to a person’s dignity is her ability to decide to whom she will reveal information about hersel...

Tornado Cash Verdict: Co-Founder Roman Storm Found Guilty of One Charge

Storm now faces a maximum sentence of five years for the unlicensed money transmitting business char...