Inside Upexi: How a Consumer Products Company Became Crypto's Next Big Bet

Just six days after closing a groundbreaking $150 million convertible note offering, Upexi Inc. (Nasdaq: UPXI) was back in the market, snapping up another 83,000 SOL tokens for $16.7 million. The purchase, announced at an average price of $201.34 per token, brought the Tampa-based company's Solana treasury to 1.9 million SOL, worth over $381 million.

It's a remarkable transformation for a company that, until April, was primarily known for medicinal mushroom gummies, pet care products, and caffeine alternative supplements. Today, Upexi has emerged as the poster child for a new category of public companies: crypto treasury plays that are betting big on alternative digital assets beyond Bitcoin.

The journey began in April when prominent crypto trading firm GSR led a $100 million private investment , sending Upexi's stock soaring over 700% in a single day. But it was the company's recent $200 million capital raise, featuring an innovative structure that combined traditional equity with SOL-backed convertible notes, that set Upexi apart in the crowded field of crypto treasury companies.

"The composition of our recent $200 million private placement, which consisted of both equity and convertible notes, was based on market conditions, investor demand, and maximizing shareholder value," explained Brian Rudick, Upexi's chief strategy officer, in an interview with Blockhead . "Notably, the in-kind convertible note is a highly innovative offering with likely significant benefits for both investors and the company."

The SOL-Backed Innovation

The mechanics of Upexi's convertible note structure represent a significant innovation in crypto treasury financing. Rather than issuing traditional debt, the company created convertible notes backed by the very asset it seeks to accumulate: Solana tokens.

"Investors exchanged spot and locked SOL for the convertible note, which they can convert to UPXI common equity at a price of $4.25 per share anytime over the next two years," Rudick explained. "If the notes are not converted to stock, investors simply get their SOL back at maturity, but if they are converted to stock—which the current stock price well above conversion price suggests they may—then investors effectively bought Upexi stock at the conversion price."

This structure offers investors what Rudick describes as the best of both worlds: "The note enables investors to participate in potential upside should the stock price rise above the conversion price, while also offering downside protection if it does not."

The deal not only dramatically increased Upexi's Solana treasury balance" but also "demonstrated our ability to raise additional funds in an accretive manner, and demonstrated Upexi's continued innovation at the nexus of digital assets and traditional markets," according to Rudick.

Why Solana Over Bitcoin?

In a market dominated by Strategy (Nasdaq: MSTR) and its army of Bitcoin-focused imitators, Upexi's choice to focus exclusively on Solana raises an obvious question: why not follow the proven playbook?

Rudick offers three compelling reasons for the company's SOL-first strategy. "First, there are over 25 Strategy copycats, and we'd rather be the canonical Solana treasury company than one of many Bitcoin treasury companies," he said.

The market dynamics also favor Solana's potential for outsized returns. "Bitcoin is a $2.4 trillion asset and the fifth-largest in the world. It will likely take immense sovereign buying for Bitcoin to 5x anytime soon, while Solana, at 4% the market cap of Bitcoin, could potentially 5x over a reasonable period of time."

But perhaps most importantly, Solana's technical architecture offers additional revenue streams unavailable to Bitcoin treasury companies. "As a pre-mined, proof-of-stake network, Solana enables treasury companies underpinned by it to engage in additional value accrual mechanisms not available with Bitcoin, such as staking to make the treasury a productive asset and buying locked SOL at a discount for built-in gains for shareholders," Rudick said.

Staking Advantage

This staking capability represents a crucial differentiator in Upexi's investment thesis. The company is "staking substantially" all of its Solana, and generating a roughly 8% yield, which according to Rudick, "enables us to increase SOL per share on a consistent basis."

The sustainability of these yields appears robust, with Rudick noting that "staking yields have been fairly consistent in the 7-9% range, which is what we expect going forward provided no high-level changes to protocol emissions." While the inflationary rewards component will decrease by 15% annually, "in theory that can be replaced by greater priority fees as the network sees more usage."

With crypto treasury companies trading at significant premiums to their underlying asset values, questions around proper valuation have become increasingly relevant. "Strategy's 1.7x mNAV should be the floor with smaller companies underpinned by smaller end-game winning assets with additional value accrual mechanisms trading at higher multiples," Rudick said.

His reasoning centers on three factors that should drive premium valuations for companies like Upexi. "Smaller companies should trade with an embedded growth premium, as a similarly sized, similarly priced raise will lead to more accretion," he explained.

"Second, companies underpinned by smaller assets, provided they will perform well in the future, have more upside, all else equal, and may therefore trade with additional premium. Lastly, companies with additional value accrual mechanisms like staking and the ability to buy discounted locked tokens may also trade with a premium, as these mechanisms are additional ways to increase shareholder value."

Road Ahead

Despite the significant upside potential, crypto treasury strategies face inherent risks from the volatile nature of digital assets. Rudick acknowledges this reality but emphasizes prudent risk management, saying that Upexi will "only utilize a prudent amount of leverage, as digital assets are highly volatile," adding, "As long as a digital asset treasury company doesn't over-lever, it should be able to weather any market environment."

Looking forward, Upexi's strategy remains focused on accumulation. "Our goal is to grow and HODL our Solana treasury as much as possible in an accretive and risk-prudent fashion," Rudick said. "So we will continue to utilize the capital markets to procure more Solana as much as possible when doing so increases shareholder value."

This commitment was evident in Tuesday's announcement of the additional 83,000 SOL purchase. CEO Allan Marshall framed the acquisition within broader regulatory tailwinds, noting that "The U.S. continues to make progress around digital asset legislation, which has the potential to usher in mass adoption of blockchain technology. Solana and Upexi are well-positioned to benefit, and we will continue to buy and HODL Solana for the benefit of shareholders."

As traditional corporations increasingly seek direct exposure to cryptocurrency returns, Upexi's bet on Solana and its innovative financing structures may well define the next evolution of crypto treasury strategies. Whether this approach can deliver sustainable shareholder value through various market cycles remains to be seen, but Rudick's confidence is unwavering in the company's position as crypto and traditional finance continue to converge.

With nearly 2 million SOL tokens now in its treasury and a clear acquisition strategy, Upexi has positioned itself at the forefront of a trend that's reshaping how public companies think about digital asset exposure. The question isn't whether this strategy will face challenges, but whether Upexi's innovative approach can navigate them successfully while delivering on its promise to shareholders.

Bitcoin Climbs Above $115,000 Amid ETF Inflows Rebound

Your daily access to the backroom....

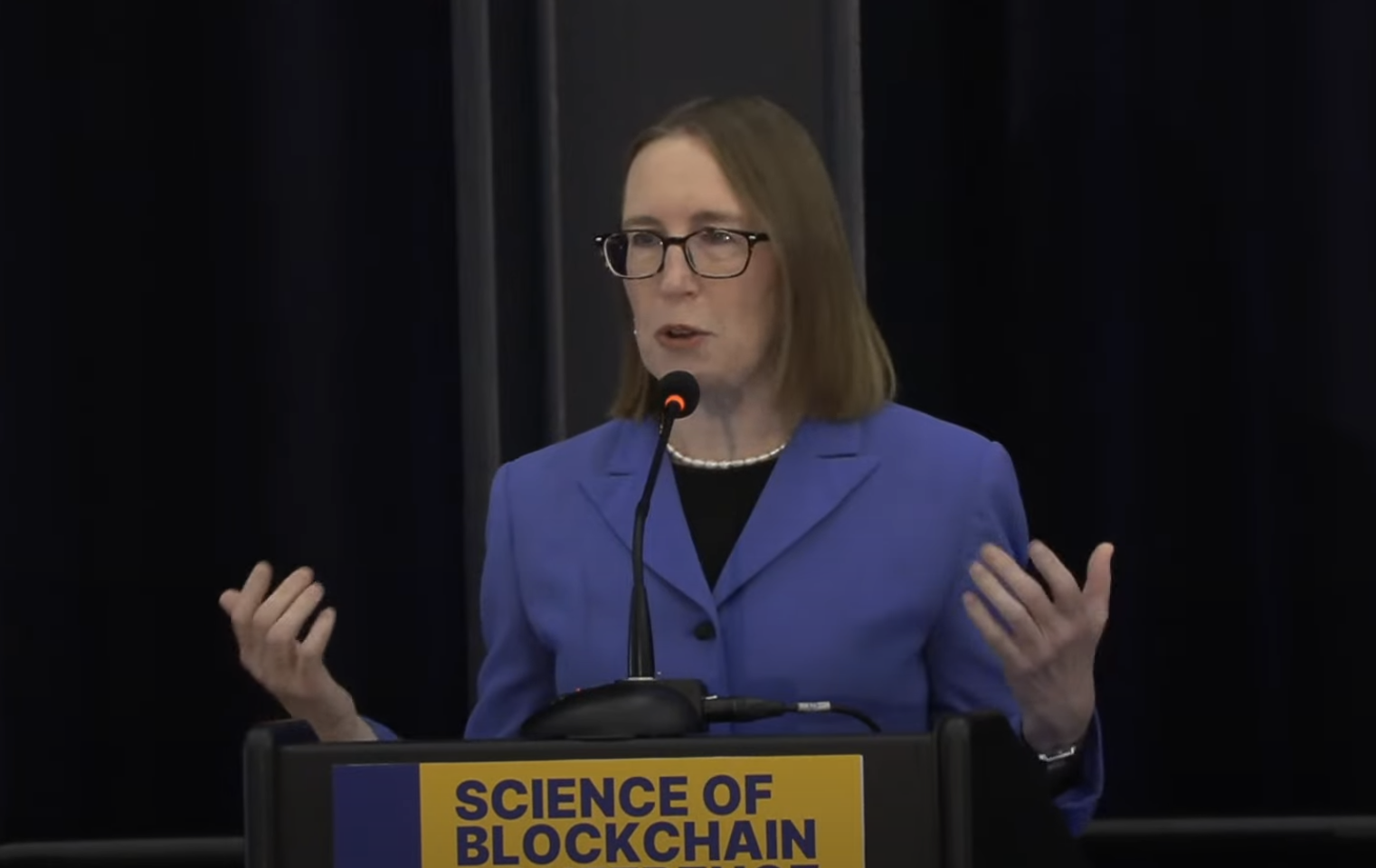

SEC's Hester Pierce Champions Financial Privacy in Rousing Speech

"Key to a person’s dignity is her ability to decide to whom she will reveal information about hersel...

Tornado Cash Verdict: Co-Founder Roman Storm Found Guilty of One Charge

Storm now faces a maximum sentence of five years for the unlicensed money transmitting business char...