The post Bitcoin Whale Selling Pressure Drops Sharply as Binance Inflows Collapse appeared first on Coinpedia Fintech News

Bitcoin price today slipped closer to the $90,000 level, while whale activity on Binance has dropped sharply. On-chain data from CryptoQuant shows a clear fall in BTC inflows to exchanges, suggesting whales are stepping back after weeks of heavy selling and liquidations.

Meanwhile, Bitcoin’s long-term trend remains positive, leaving room for a possible upside move.

Bitcoin Whale Selling on Binance Falls Significantly

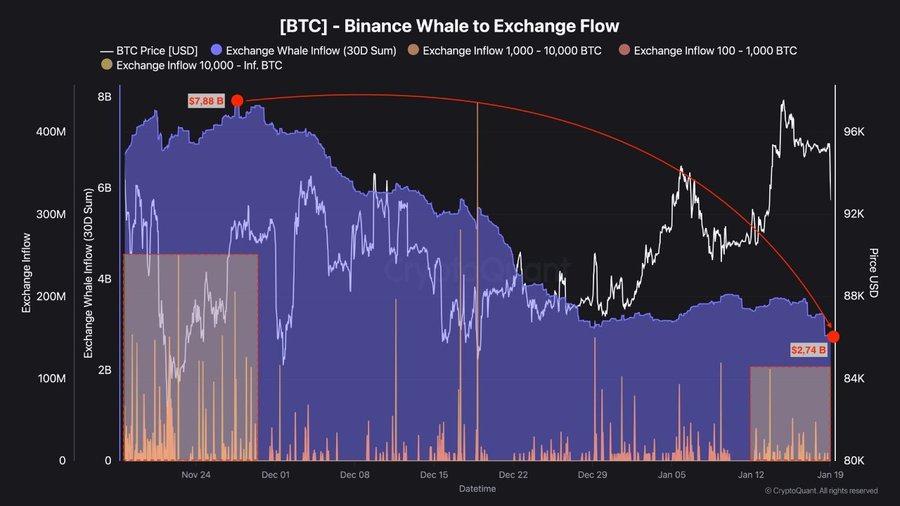

According to the CryptoQuant data, Bitcoin inflows from whales to Binance have dropped sharply in recent weeks. These inflows, often linked with selling activity, have declined from nearly $8 billion at their peak to around $2.74 billion, marking a clear slowdown in whale-linked sell-offs.

The data tracks Bitcoin transfers to Binance across three major whale categories: transactions between 100–1,000 BTC, 1,000–10,000 BTC, and transfers above 10,000 BTC.

A fall across all these groups suggests that large holders are no longer rushing to move coins to exchanges.

What Triggered the Whale Slowdown?

The latest chart shows a very different picture. Whale inflows to Binance have now been cut by nearly 3x compared to late November. Large transactions have become less frequent, and selling clusters have almost disappeared.

This suggests whales are choosing patience over panic. Instead of selling aggressively, they appear to be holding their Bitcoin during the current consolidation phase.

This change comes after a sharp sell-off in recent days, when whales sold around 22,918 BTC, worth nearly $4 billion. That wave of selling triggered market panic, caused over $500 million in long liquidations, and pushed Bitcoin price down by about 2.5%, from around $97,000 to near $90,934.

Bitcoin Price Analysis

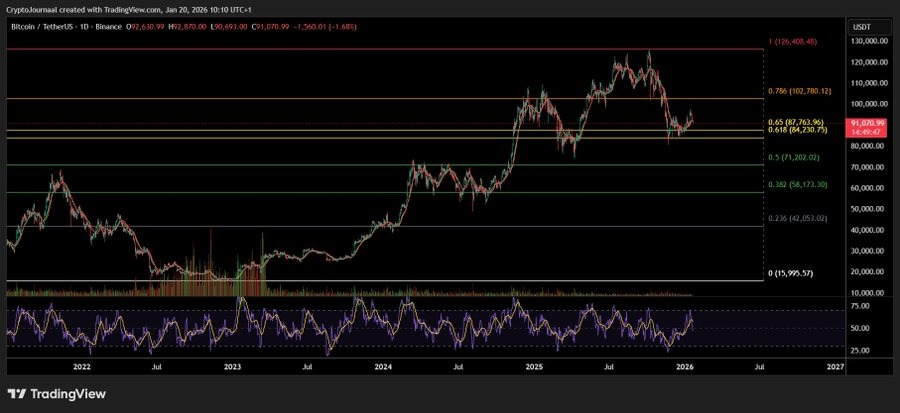

As of now, Bitcoin is still in a long-term uptrend after rising strongly from the $83,000 area to new record highs. However, the price faced strong selling near $126,000, which pushed it lower.

Since then, Bitcoin has moved into a key support range between $84,000 and $92,000, where it is now moving sideways.

If Bitcoin breaks above $92,000–$95,000 and holds, buying strength could return and push the price toward the $100,000–$102,000 area.

But if Bitcoin drops below $84,000, selling pressure may increase and lead to a deeper pullback.