Ripple Price Prediction: Can XRP Rebound as This New Crypto Eyes 20x?

The crypto market is heating up again, and while veteran coins like Ripple (XRP) continue to hold strong, newer tokens are stealing the spotlight. Investors who once favored established names are now looking for smaller projects with stronger upside potential. One project gaining attention is Mutuum Finance (MUTM) , a DeFi protocol that some analysts believe could deliver up to 20x token growth by 2026.

Ripple (XRP)

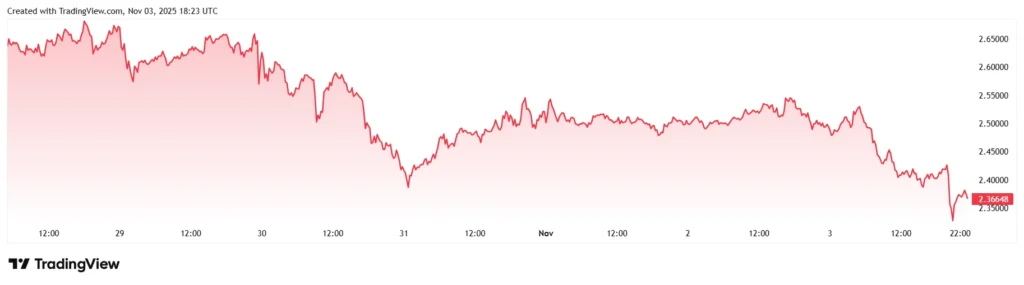

Ripple (XRP) remains one of the largest and most recognized cryptocurrencies in the world. As of late October 2025, XRP trades around $2.50, with a market capitalization near $150 billion. Its price has hovered within the $2.40 to $2.60 range for several weeks, showing strong support at the lower end but facing consistent resistance around the $3 mark.

Technical analysts note that XRP would need to break through this resistance level convincingly before it could target the $4.50–$4.70 range. For now, its limited momentum suggests that large percentage gains are unlikely in the short term. The token’s enormous market cap also acts as a natural ceiling for sharp increases. A move from $3 to $6 would double its price, but given its size, such growth is less realistic compared to smaller-cap assets.

Beyond price, XRP still faces ongoing challenges. Regulatory scrutiny over Ripple’s role in XRP’s distribution continues to cast uncertainty over its long-term performance. While recent rulings have been favorable, the project’s close ties to its parent company make it less decentralized than most of today’s DeFi protocols.

Analysts project XRP could see modest growth of around 20–30% by mid-2026, assuming a positive market environment. That means while it may remain stable, the chances of another 10x or 20x surge are minimal.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is one of the most talked-about new crypto projects entering the market. It aims to build a decentralized, non-custodial lending and borrowing protocol powered by smart contracts. Users will be able to lend crypto assets to earn yield or borrow by using their holdings as collateral — all without intermediaries.

The protocol features two main components that form its lending structure. Through the Peer-to-Contract (P2C) model, users can deposit tokens into liquidity pools and receive mtTokens, which automatically accumulate yield as borrowers repay interest. For example, depositing 1 ETH generates 1 mtETH, which grows in value over time.

The second component, the Peer-to-Peer (P2P) marketplace, enables direct lending between users. Borrowers can select variable or stable interest rates, while the protocol enforces Loan-to-Value (LTV) limits to manage risk. If a borrower’s collateral drops below safety levels, automatic liquidation ensures that lenders are protected and liquidity remains stable.

Presale Progress and Strong Investor Demand

Mutuum Finance’s presale is already making waves. The project is now in Phase 6, where each MUTM token costs $0.035. Once this round ends, the price will increase by nearly 20% to $0.04, before reaching the confirmed launch price of $0.06.

From a total supply of 4 billion tokens, 45.5% (1.82 billion) are allocated to presale investors. So far, the project has raised more than $18.4 million, gathered over 18,000 holders, and sold approximately 790 million tokens, marking about 85% completion of the current phase.

Early participants who bought during Phase 1 at $0.01 have already seen a 250% price increase, and once the token reaches its launch price, that growth could rise to 500%. Analysts note that such steady performance across multiple stages signals genuine investor confidence.

Why MUTM Could Outperform Ripple

Analysts highlight several reasons why Mutuum Finance (MUTM) could potentially outperform Ripple (XRP) in the coming year:

1. Smaller Market Cap and Early-Stage Entry

Ripple’s huge size limits how much it can grow, while MUTM is still in its presale phase. Early investors are getting in at $0.035 per token, far below where large projects like XRP or SOL trade. That gives it far more upside potential, especially if the platform gains traction after its launch.

2. Utility-Driven Value and Revenue Mechanisms

Unlike XRP, which mainly serves as a bridge asset for payments, MUTM’s value is tied directly to lending activity and revenue generation. The protocol uses a buy-and-distribute model, where part of the platform’s fees is used to buy MUTM tokens from the open market and redistribute them to users staking mtTokens. This creates ongoing buy pressure and a link between real protocol activity and token demand.

3. Timing and Momentum

Mutuum Finance is entering the market at an ideal time. DeFi adoption is increasing again, and many investors are rotating from older, slower-growth coins into new projects with stronger fundamentals. Analysts note that several former SHIB and DOGE holders have joined the MUTM presale, seeing higher long-term growth potential. The

upcoming V1 launch

has also added credibility to the project’s progress.

Development Progress and Security

According to the project’s roadmap, Mutuum Finance has already completed Phase 1, which focused on initial smart-contract architecture and audits, and is now deep into Phase 2, where testing and on-chain integrations are being prepared for the Q4 2025 Sepolia Testnet launch.

The V1 protocol release will include key modules such as the Liquidity Pool, mtToken system, Debt Tokens, and a Liquidator Bot to automate risk management. Once live, these systems will form the foundation for the platform’s mainnet rollout in 2026.

Mutuum Finance has already earned a 90/100 Token Scan score from CertiK, one of the top blockchain security firms. The team also runs a $50,000 bug bounty program, encouraging developers and ethical hackers to identify potential issues before full deployment.

Why Investors Are Paying Attention

With Phase 6 already 85% sold out, many analysts believe that now is one of the last chances to buy MUTM at its current price before the next increase. The strong fundraising pace and expanding community base suggest that the token’s demand is likely to keep rising as it nears launch.

Ripple’s growth curve has flattened. Mutuum Finance, on the other hand, offers early entry, sustainable token mechanics, and a clear product development path. With over $18 million raised, a strong audit score, and a confirmed roadmap, MUTM is emerging as one of the potential best crypto coins to buy now for those seeking high-upside DeFi exposure potential before Q1 2026.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Leverage Shares by Themes adds GEMI, BLSH, BMNR to leveraged single-stock ETF suite — debuting first-to-market GEMG

Greenwich, CT, 5th November 2025, Chainwire...

Anti-CZ Whale’s Big Ethereum Long Marks Bold Strategy Shift on Hyperliquid

The Anti-CZ Whale, who opened Ethereum short position previously, has decided to open large long pos...

Experts Rank MoonBull as the Best Crypto Presale to Buy Now – ETH, TRX, ADA, BNB Rally Ahead as Top Picks

The best crypto presale to buy now is here - MoonBull is taking over 2025! Join the MoonBull presale...