Last-Ever Bitcoin Dip Below $100,000 Looms This Week, Standard Chartered Warns

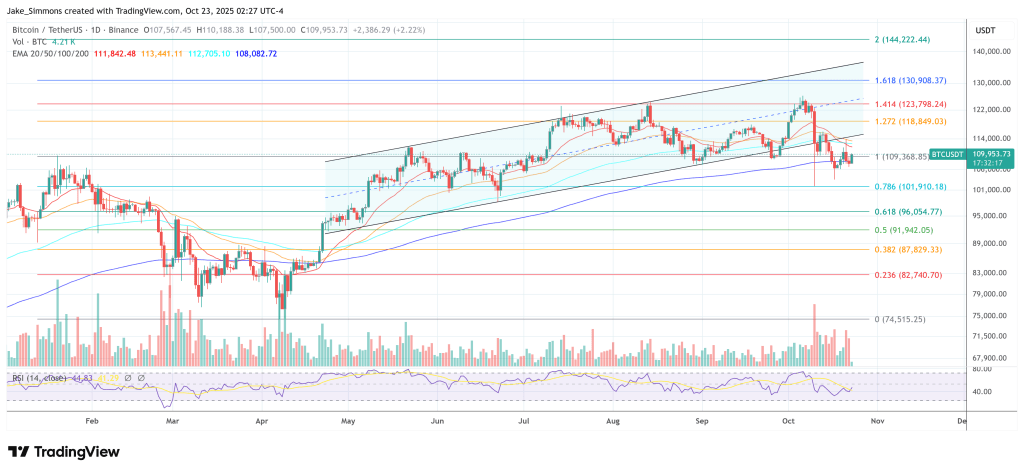

Bitcoin hovered near the mid-$100,000s on Thursday, Oct. 23, as Standard Chartered’s global head of digital assets research Geoffrey Kendrick warned that a move below $100,000 by this weekend “seems inevitable”—while adding that any break could be fleeting the last last time bitcoin is ever below six figures. The remarks, delivered in a mid-week client note and shared by The Block, frame a tactical pullback inside a still-intact macro bull thesis the bank has championed for months.

Last-Ever Bitcoin Dip Under $100,000 Ahead

Kendrick’s message juxtaposes near-term caution with longer-term conviction. In the same research cycle where Standard Chartered reiterated a target of $200,000 by year-end —hinging on ETF demand, corporate treasury uptake, and a friendlier policy backdrop—the strategist has now flagged an air-pocket toward sub-$100,000 as the market digests October’s sell-off and a tepid bounce. “A decline below $100,000 now appears ‘inevitable,’” Kendrick said on Wednesday, while stressing that any dip should be short-lived and likely the “last-ever chance to buy BTC for less than six figures.”

The recalibration follows an early-October swing that saw bitcoin fail to hold above its recent local high—Kendrick cited the Oct. 10 risk-off break and the absence of a strong reflex rally—shifting the bank’s focus to where the market bottoms rather than whether it immediately resumes trend.

In the latest note, Kendrick pointed to a handful of signposts for a base-building phase, including monitoring capital rotation between gold and bitcoin and the trajectory of US dollar liquidity and quantitative tightening. He also observed that bitcoin has respected its 50-week moving average since early 2023, a level he views as an important longer-duration line in the sand.

The near-term crosscurrents complicate, but do not upend, Standard Chartered’s cycle map. As recently as July 2, the bank told clients it expected the largest dollar rally on record in the second half of 2025, with bitcoin at $200,000 by Dec. 31. That framing— ETF inflows , corporate balance-sheet adoption , and regulatory normalization as the dominant drivers—remains the core of Kendrick’s upside case, even as he concedes that a brief trip under $100,000 is now probable. “The decline could mark the last time to ever buy BTC for six figures,” the latest dispatch emphasized.

Market context is aligned with the cautionary near-term tone. Over the past two weeks, bitcoin has shed roughly ten percent, with spot trading today around $108,000 as liquidity thins into the weekend and macro sensitivity to policy headlines remains elevated.

What matters from here is whether the confirmation signals Kendrick highlighted begin to line up. A decisive improvement in dollar liquidity conditions, sustained evidence of rotation back into bitcoin at the expense of gold, and preservation of higher-timeframe trend structures would validate the “last time below $100,000” claim.

Absent those, a deeper retracement cannot be ruled out, but that scenario would represent a deviation from the bank’s published roadmap rather than its base case. For now, Standard Chartered’s message is unambiguous: brace for a dip under six figures, but treat it—quoting Kendrick directly—as “the last-ever chance to buy BTC for less than six figures,” provided the medium-term catalysts reassert.

At press time, BTC traded at $109,953.

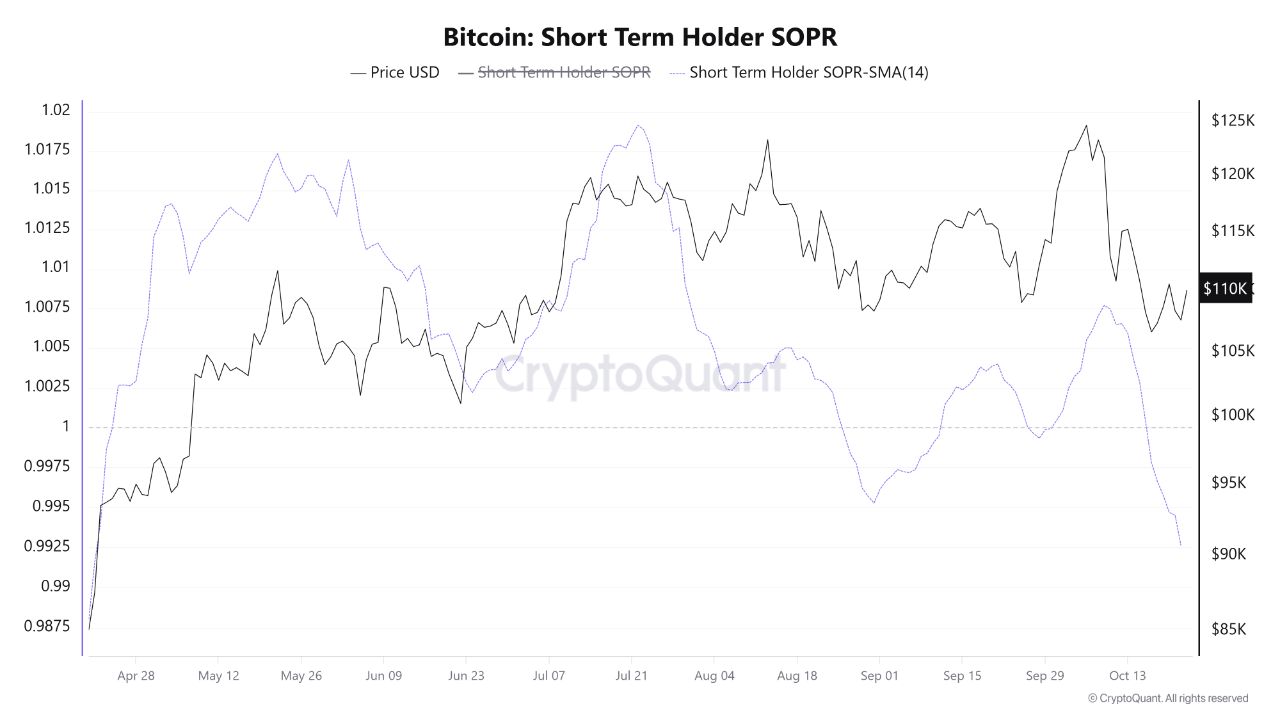

Bitcoin STH-SOPR Falls Below 1.0 for the First Time Since April – What This Means

Bitcoin is showing signs of renewed weakness as short-term investors begin to fold under selling pre...

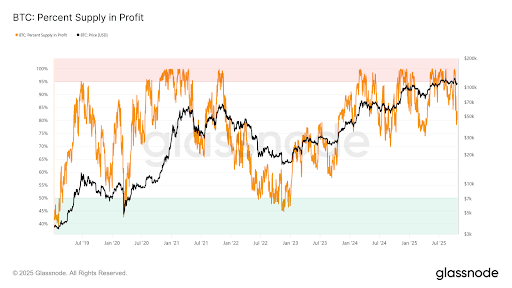

Bitcoin Supply In Profit Sees Sharp Decline With Market Crash – Here Are The Numbers

The Bitcoin supply in profit has seen a sharp decline amid the latest crypto market crash. This has ...

Chris Larsen Cashes Out: $764M In XRP Profits Since 2018

XRP continues to struggle for bullish momentum as market sentiment remains heavily bearish. After we...