A 5% Bitcoin Drop In October? History Shows That’s Rare

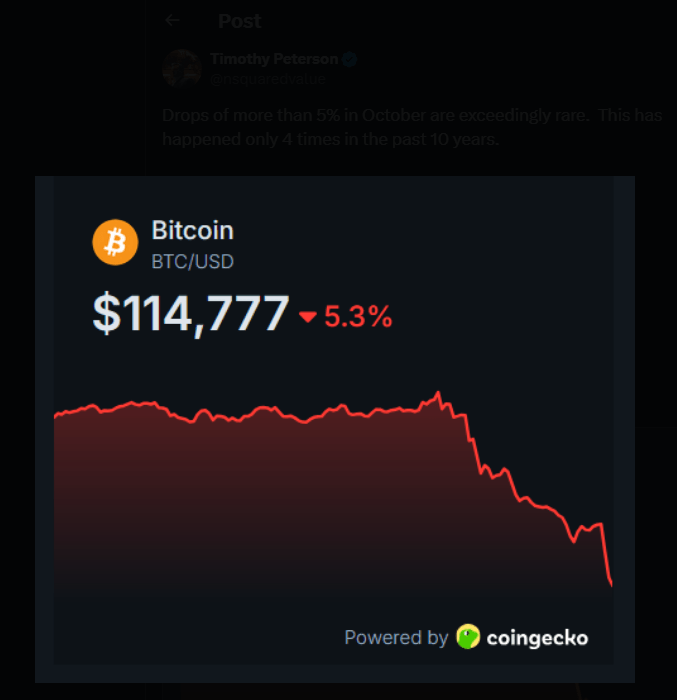

According to economist Timothy Peterson, Bitcoin’s recent slide could be a short-lived wobble if October’s history repeats itself. He pointed out that drops larger than 5% in October are rare — they have occurred just four times in the past 10 years — and when they happened, Bitcoin often bounced back quickly.

Historical October Bounces

Reports show the four October setbacks came in 2017, 2018, 2019, and 2021. In the week after each fall, recoveries ranged from modest to sharp: gains of 16% in 2017, 4% in 2018, and a big 21% in 2019, while 2021 was the lone outlier when prices slipped another 3%.

Based on those past moves, Peterson suggested a rebound of up to 21% over seven days is possible after a large October drop. CoinGlass and market outlets have long flagged October as one of Bitcoin’s strongest months historically.

Drops of more than 5% in October are exceedingly rare. This has happened only 4 times in the past 10 years.

Oct 24 2017 Oct 11 2018 Oct 23 2019 Oct 21 2021

What happened next? 7 days later bitcoin was 2017: up 16% 2018: up 4% 2019: up 21% 2021: down -3% pic.twitter.com/mbFs19RbwL

— Timothy Peterson (@nsquaredvalue) October 10, 2025

Markets moved fast this week after a tariff shock. United States President Donald Trump’s announcement of steep tariffs on China coincided with a sudden sell-off that briefly pushed Bitcoin down to about $102,000.

Prices then staged a partial recovery to roughly $112,100. Traders noted the pullback came soon after Bitcoin hit fresh highs earlier in the week, above $126,000.

Short-Term Upside Scenarios

If Bitcoin were to mirror its strongest October rebound — the 21% surge seen in 2019 — a move from the low near $102,000 would place the token just under its recent peak, around $124,000, within days.

That math is straightforward and is being quoted by analysts running many simulations. Some say there’s even a range of odds that the month could finish well above current levels.

Other market voices pushed different views. Proponents argued that the current dip is a reset during an overall uptrend; some called it the bottom of the current cycle.

Others warned that policy shocks or tariff escalations could keep selling pressure in place for longer. Social metrics and sentiment gauges moved sharply during the sell-off, and certain altcoins saw deeper losses amid the flight to safety.

Possible Triggers For A ReboundMeanwhile, traders are watching a few clear triggers . Headlines that dial down trade tensions between the US and China would likely calm markets.

Any sign the US Federal Reserve will quicken interest rate cuts could also lift risk assets, including crypto. History suggests panic sell-offs often end before a strong recovery begins, but nothing is guaranteed.

Featured image from Unsplash, chart from TradingView

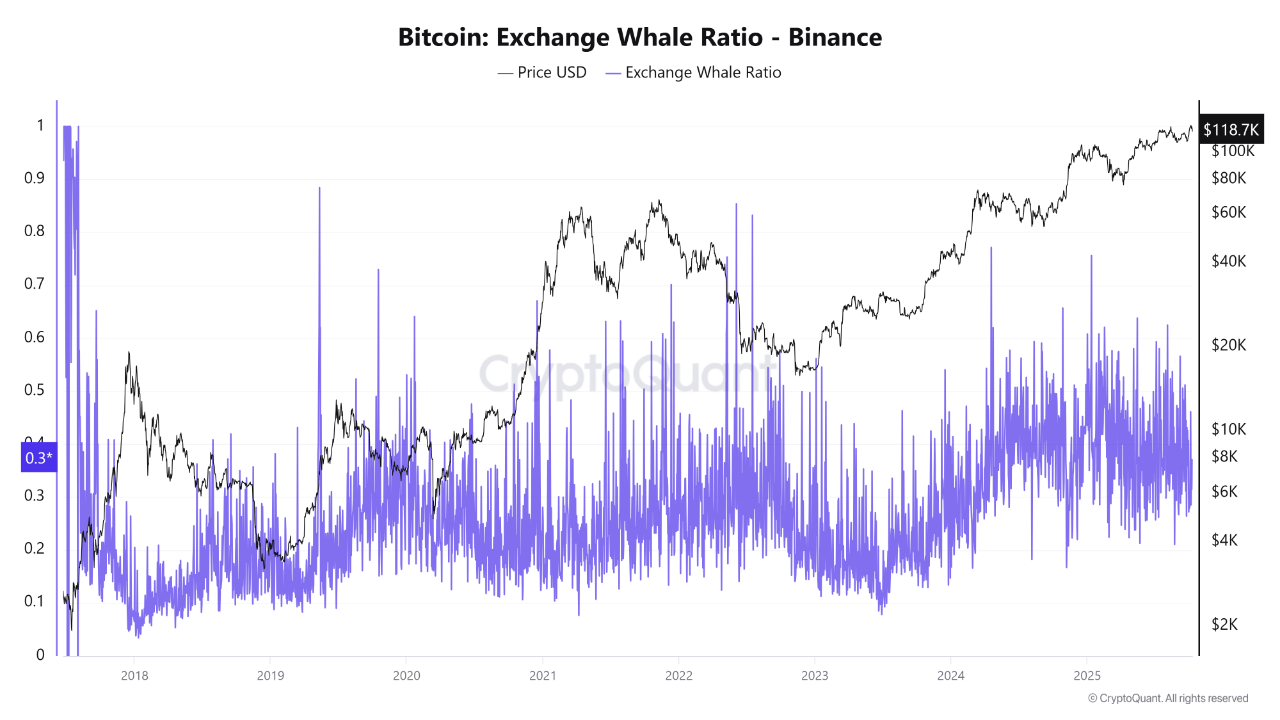

Bitcoin Whale Activity Reflects Sustained Confidence As $163K Comes In Sight — Details

Bitcoin began October on a strong bullish note, gaining by over 12% to establish a new all-time-high...

SUI Ready For $7 Price Target As Market Pressure Builds — Analyst

Amid a new wave of economic tensions between the US and China, Sui (SUI), alongside other cryptocurr...

Bitcoin Price Drops Toward $117,000: What Lies Ahead? Three Possible Scenarios

The Bitcoin price has experienced a notable decline of 6% from its all-time highs, leading to signif...