Arthur Hayes Just Killed Bitcoin’s Four-Year Cycle Giving Bitcoin Hyper 10x Momentum

What to Know:

- Arthur Hayes predicts Bitcoin’s traditional four-year cycle is officially over

- Fed rate cuts and global liquidity expansion create unprecedented bullish conditions

- Bitcoin Hyper presale surges past $22.9M as investors position for new market paradigm

Arthur Hayes, the crypto billionaire who was pardoned by President Trump and somehow always manages to be both controversial and correct, just dropped a manifesto declaring Bitcoin’s sacred four-year cycle officially deceased. RIP to the most reliable pattern in crypto, apparently.

In his latest Substack post , dramatically titled Long Live the King , the former BitMEX boss argues that everything we thought we knew about Bitcoin’s cyclical behavior is about to be thrown out the window. The macroeconomic tea he’s spilling actually makes sense this time.

When the Fed prints money like it’s going out of style and China joins the global liquidity party, Bitcoin thrives.

With Trump literally screaming at Jerome Powell to slash interest rates faster, which he actually did in September 2025 , and China deciding to stop being the fun police on monetary expansion, we’re entering what Hayes calls an era where ‘money shall be cheaper and more plentiful.’

Traditional cycle watchers are expecting Bitcoin to hit its peak soon and then nosedive 70% to 80%, like it’s done for the past decade.

But the institutional money that doesn’t panic sell during dips (because, well, institutions have actual risk-management strategies) can literally change this religious yearly ritual, just as Hayes says.

Suppose Hayes is right. His track record, despite his self-deprecating humor about his predictions being pretty bad, is actually pretty solid. In that case, we’re looking at a structural shift in how Bitcoin behaves in response to monetary policy.

This is precisely why the Bitcoin Hyper ($HYPER) presale momentum is absolutely exploding right now.Having recently hit $22.9M, $HYPER is positioning itself to ride the $BTC wave with a utility-first approach – a Bitcoin Layer-2 – that actually makes sense in this new liquidity-driven environment.

Bitcoin Hyper’s presale is essentially offering a discounted entry point into this macro thesis before the mainstream catches on.

Bitcoin Hyper: Where Solana Speed Meets $BTC Security

When Hayes talks about Bitcoin benefiting from increased liquidity, he’s talking about infrastructure that can actually handle that liquidity without fees going parabolic or transactions taking 45 minutes. Bitcoin Hyper ($HYPER) is building exactly that infrastructure.

So, what separates Bitcoin Hyper from the casino of shitcoins flooding your X feed?

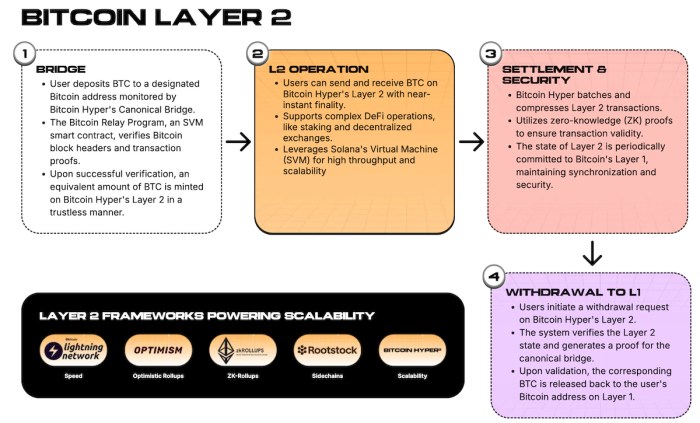

The project is building an actual Layer-2 (L2) solution that will bring Solana’s legendary speed to Bitcoin’s unmatched security.Bitcoin Hyper will integrate the Solana Virtual Machine as a Layer-2 on Bitcoin , connected via a Canonical Bridge, basically taking Bitcoin’s Fort Knox-level security and giving it a Ferrari engine.

The Canonical Bridge will enable asset transfers between Bitcoin’s main chain and Bitcoin Hyper’s L2, meaning you get to keep Bitcoin’s battle-tested decentralization while executing transactions at Solana-level speeds.

No more choosing between security and scalability, because Bitcoin Hyper will give you both, which is precisely what institutional money needs as it floods into crypto. So Hayes’ thesis is coming full circle.Developers will be able to deploy Solana-style dApps on Bitcoin’s ecosystem, tapping into Bitcoin’s liquidity while maintaining the transaction throughput that actually makes DeFi usable.

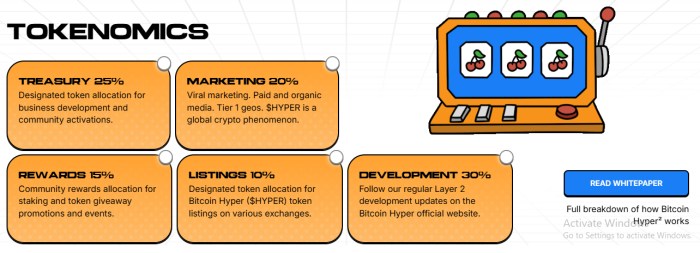

The tokenomics are designed for sustainability; not a quick rug pull. The team has allocated significant portions to staking rewards and ecosystem development, which means they’re playing the long game, precisely the game you want to play if Hayes’ post-cycle thesis is correct.

But when a billionaire who’s been in Bitcoin since before it was cool starts talking about structural market changes backed by actual Fed policy and global liquidity data, maybe it’s worth paying attention.

And when a presale like Bitcoin Hyper positions itself specifically to capitalize on this exact macro environment, with actual utility and legitimate staking yields, that’s strategic positioning.

The four-year cycle might be dead, but opportunities like this are very much alive. And Bitcoin Hyper’s $22.9M+ presale is testament to that. Even whales are sitting up and taking notice, with hefty buys of $379.9K and $274K coming in, among many others.Right now you can buy $HYPER for just $0.013095 per token, and stake it for 51% APY. $HYPER price predictions , by the way, forecast a potential $0.253 by the end of 2030.

Do with that information what you will. Just don’t complain in six months when the token is trading at 10x and you were too busy arguing about cycle tops on X.

Join the Bitcoin Hyper presale now.

Authored by Elena Bistreanu, NewsBTC – https://www.newsbtc.com/news/arthur-hayes-bitcoin-price-prediction-amps-up-bitcoin-hyper-presale

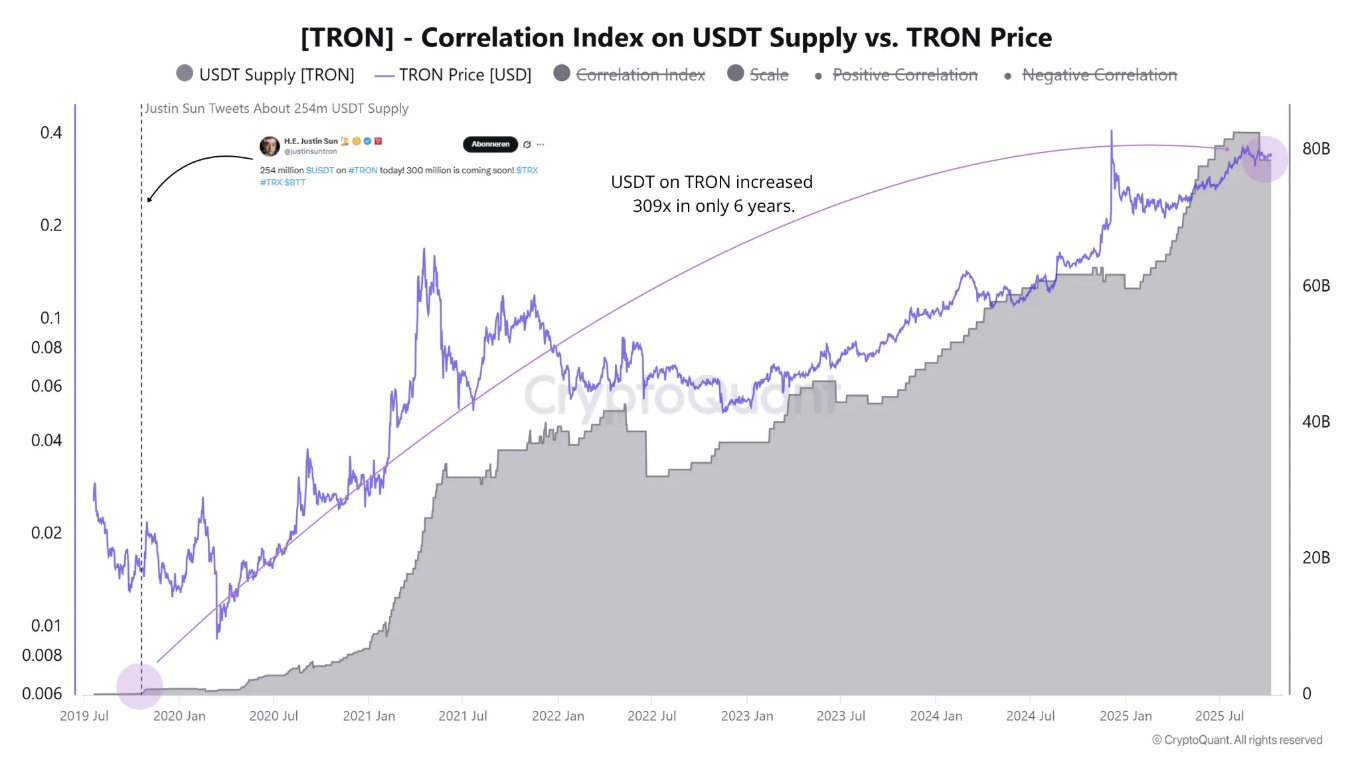

From $254M To $78.5B: Tron USDT Growth Drives Network Valuation

Tron (TRX) is at a decisive moment after retracing to key demand levels that could determine its nex...

Crypto Analyst Says Dogecoin Price Is ‘Parabolic Coded’ To $1, Here’s What It Means

Crypto analyst EtherNasyonaL has predicted that the Dogecoin price is well-primed for a parabolic ra...

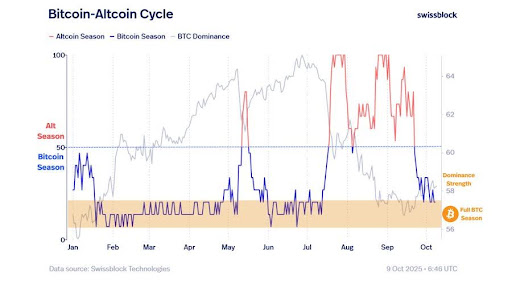

Bitcoin Dominance Dilemma – Why Capital Flows Back To BTC Before Fuelling Altcoin Rally

The cryptocurrency market, a landscape famed for its volatility and rapid innovation, operates on a ...