Aster DEX Surges Past Hyperliquid as CZ Confirms Ex-Binance Team Behind Project

Decentralized perpetual exchange Aster recorded over $46 billion in trading volume on Friday, briefly surpassing established competitor Hyperliquid in daily activity as its native token ASTER surged over 2,000% since launching September 17.

The explosive growth comes amid confirmation from Binance founder Changpeng "CZ" Zhao that former Binance employees built the platform, which has attracted both significant trader interest and concerns about extreme token concentration among a small number of wallets.

Zhao clarified his role in the project this week, stating he serves only as an advisor focused on product and technology rather than as a team member, addressing speculation about his direct involvement following an endorsement tweet that sparked the initial price surge.

The Binance founder confirmed that his venture capital firm YZi Labs holds a minority stake in Aster through a private fund managing over $10 billion on behalf of early Binance executives. He described the project as independent despite the Binance connections, calling it "a very strong project" advancing on its own.

Rapid Market Share Gains

Aster emerged from a 2025 merger between Astherus, a multiasset liquidity protocol, and APX Finance, a decentralized perpetuals platform. The combined entity offers perpetual futures trading with up to 1001x leverage across multiple blockchains including BNB Chain, Solana, Ethereum, and Arbitrum.

The platform's trading volume has challenged Hyperliquid's dominance in the perpetual DEX sector. On September 24, Aster logged $24.7 billion in daily volume compared to Hyperliquid's $10 billion, with cumulative volume exceeding $514 billion since March. Daily revenue peaked at $7.2 million on September 23.

The $ASTER token launched at $0.08439 and reached an all-time high of $2.42 on September 24 before settling around $1.94 as of publication time, representing an over 2,o00% increase from the token generation event price. The surge pushed market capitalization above $3 billion.

Zhao's September 18 tweet praising Aster's "Binance-like" liquidity and privacy features triggered the initial price acceleration. The endorsement from crypto's most influential figures sparked speculation about deeper involvement, though Zhao has limited his public role to advisory support.

Whale Concentration Raises Questions

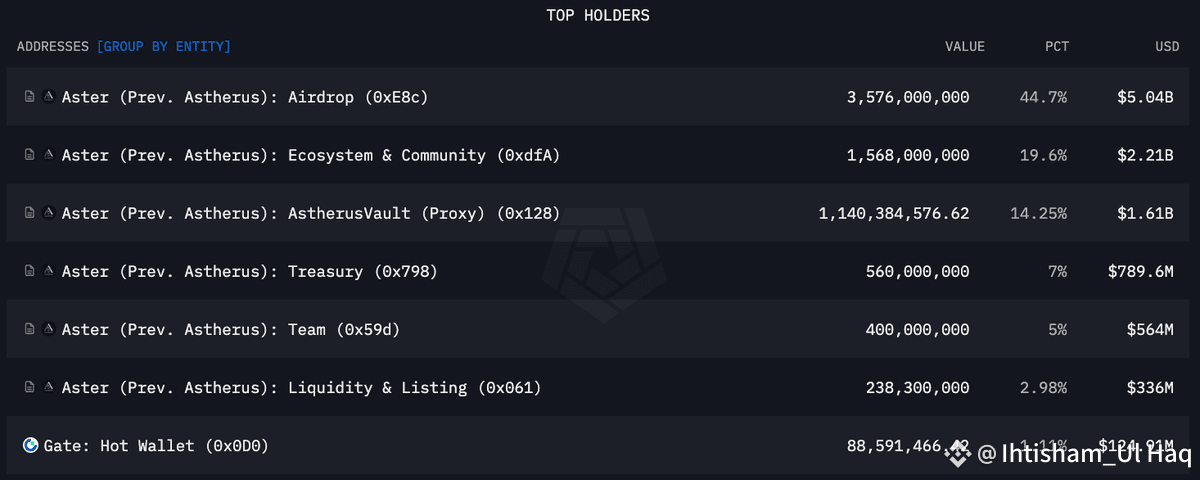

Onchain analysis reveals significant token concentration that has drawn scrutiny from crypto researchers. Six wallets control approximately 96% of ASTER's 8 billion total supply, with the largest single wallet holding 44.7% or roughly 3.58 billion tokens.

The concentration stems partly from the token distribution model, which allocated 53.5% to airdrops and 30% to ecosystem development. However, blockchain analytics firms including Arkham and Bubblemaps have flagged the extreme centralization as a potential manipulation risk.

One major wallet moved 168 million tokens within a 24-hour period, demonstrating the capacity for large holders to influence price action. Exchange holdings represent just 3.29% of supply, approximately 25 times less than the top wallet addresses.

The distribution pattern reflects common practices in DeFi token launches but at a scale that exceeds typical concentration levels. The remaining airdrop allocation of 3.6 billion tokens unlocks over 80 months, while ecosystem tokens vest over 20 months.

Platform Differentiation

Aster distinguishes itself through several features designed to attract both retail and institutional traders. The platform offers "hidden orders" that remain invisible on public order books until execution, addressing front-running concerns that Zhao himself highlighted in June 2025 advocacy for privacy-focused DEX infrastructure.

Given recent events, I think now might be a good time for someone to launch a dark pool perp DEX.

— CZ ? BNB (@cz_binance) June 1, 2025

I have always been puzzled with the fact that everyone can see your orders in real-time on a DEX. The problem is worse on a perp DEX where there are liquidations.

Even with a CEX…

The exchange enables use of yield-bearing collateral including asBNB liquid staking tokens and USDF stablecoin, allowing traders to earn passive income on margin while actively trading. This "Trade & Earn" model addresses capital efficiency limitations on competing platforms where collateral sits idle.

Aster also provides perpetual contracts on traditional stocks including Apple and Tesla, bridging decentralized finance with traditional asset exposure. The platform operates dual trading modes: a simplified interface with one-click execution for retail users and a professional order book interface with advanced tools for sophisticated traders.

Competitive Landscape

The rapid growth has shifted perpetual DEX market dynamics. Hyperliquid's market share declined from 71% in May to 38% currently, though the platform maintains larger total value locked at $3.5 billion compared to Aster's $2 billion.

Hyperliquid has responded by listing ASTER for leveraged trading on its own platform, acknowledging the competitive threat while attempting to capture trading activity around the token. The platform continues expanding its user base, which grew 78% in the first half of 2025 to 518,000 users.

Aster has gained listings on centralized exchanges including Bybit, KuCoin, Gate.io, and MEXC, providing additional liquidity channels..

Strategic Positioning

Zhao characterized Aster's success as beneficial to the broader BNB Chain ecosystem despite competing with Binance's own perpetual trading offerings.

Few understand this.

— CZ ? BNB (@cz_binance) September 28, 2025

Aster competes with @Binance , but helps #BNB . https://t.co/CmTSvVKUGR

YZi Labs' backing provides Aster with credibility, technical resources, and access to BNB Chain's user base. The strategic investment follows the venture arm's November 2024 investment in Astherus, predating the merger that created Aster.

The platform's roadmap includes launch of Aster Chain, a purpose-built Layer 1 blockchain designed for high-performance derivatives trading with zero-knowledge proof integration for private transactions. A testnet launch is expected in coming months.

Aster has accumulated over 2 million users since launch, demonstrating rapid adoption despite concentration concerns and market volatility. Whether the platform can sustain growth beyond initial hype cycles will determine its position in the evolving perpetual DEX landscape.

TeraWulf Plans $3B Debt Raise as Google Doubles Down on Crypto Miner's AI Pivot

Bitcoin mining company targets high-yield or leveraged loan markets as Google backstop grows to $3.2...

Kraken Seeks New Funding at $20B Valuation After $500M Raise

Crypto exchange in advanced talks for strategic investment as IPO timeline shifts to 2026....

Blockchain Association Singapore's Flagship Event Tackles Digital Asset Investment Landscape

Senior executives from traditional finance and blockchain firms to examine institutional adoption tr...