Changelly Review 2025: Safe, Reliable, and Definitely Not a Scam

OUR FINAL RATING: 4.3/5

Today, we will be reviewing Changelly, a name many crypto users have probably already heard: this crypto exchange has been operating for 10 years, since 2015. In terms of its basic features, it enables users to swap, buy and sell a wide range of digital assets quickly without holding funds on the platform, and also provides API tools for wallets and businesses.

This review draws on publicly available data, independent tests, and user feedback to help you decide whether Changelly is a scam or worth using.

Pros and Cons

To provide an informed and balanced assessment of the Changelly cryptocurrency exchange, we examined the platform from multiple angles. We explored both the web version of Changelly and its app to fully understand its features, usability, and overall performance first-hand. We also studied feedback from existing users to see how our observations compared with the wider community’s experience. All insights shared here are based on this combined research and on publicly available information from Changelly’s official website, app stores, and other review platforms.

| Pros | Cons |

| 0.25% service fee on crypto swaps—low compared to many competitors. | Doesn’t support all fiat currencies (though non-supported currencies can still be used via conversion to USD/EUR). |

| Easy-to-use interface, available on both web and mobile. | All fiat transactions are processed by third-party providers, which often ask you to create an account. |

| 1,000+ coins are available for swaps and 350+ for direct purchase. Operates in 170+ countries. | Certain countries and regions are restricted, like the US and UK. (For the full list, see Changelly’s Terms of Use .) |

| No mandatory account registration is required for basic swaps, with flexible limits supporting small amounts. | Rates for fiat purchases can be higher due to provider fees. |

| 24/7 live human support (not bots or AI). | Not a full trading platform with order books—geared more to simple swaps/purchases. |

| Easy to use, even for complete beginners. | No clear public info about licensing. Changelly’s own Terms of Use indicate that all swaps and purchases are executed via third-party providers, with the platform acting as an intermediary/aggregator ( ToU, 2.2 ). |

| Various integrations, including ones with top crypto wallets. | KYC/AML checks can be triggered for larger or flagged transactions, which some users find inconvenient. |

| Fast processing: average transaction completion time is under 10 minutes. |

Key Features: An Overview

Even if you’re completely new to crypto, you’ve probably come across Changelly. It powers swaps inside top wallets like Ledger and Trezor, and, as the company itself claims, now has 600+ partners worldwide. You can try out swaps, purchases, and other features Changelly offers directly on their official website or app.

Rather than acting as a trading terminal, Changelly functions as an aggregator. That means it sources offers from multiple liquidity providers in one interface so users can view rates side by side and select their preferred option. The service is available on Changelly’s website and mobile app. Here are its key features:

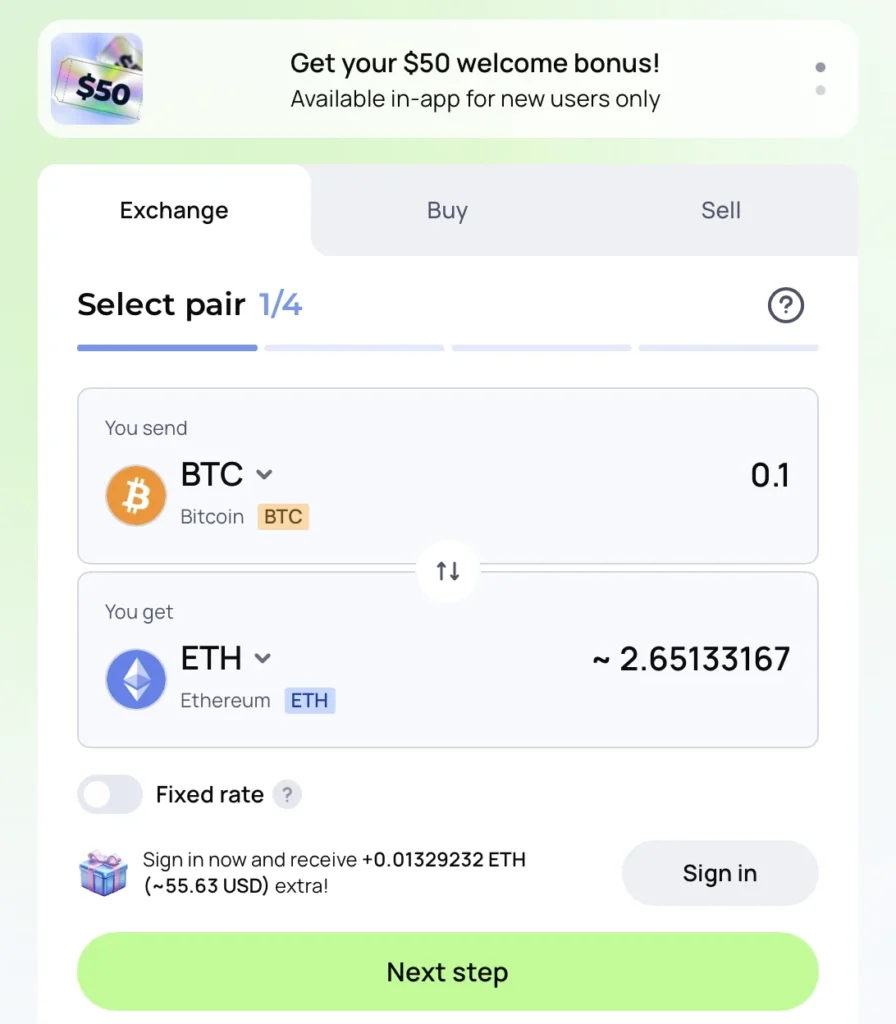

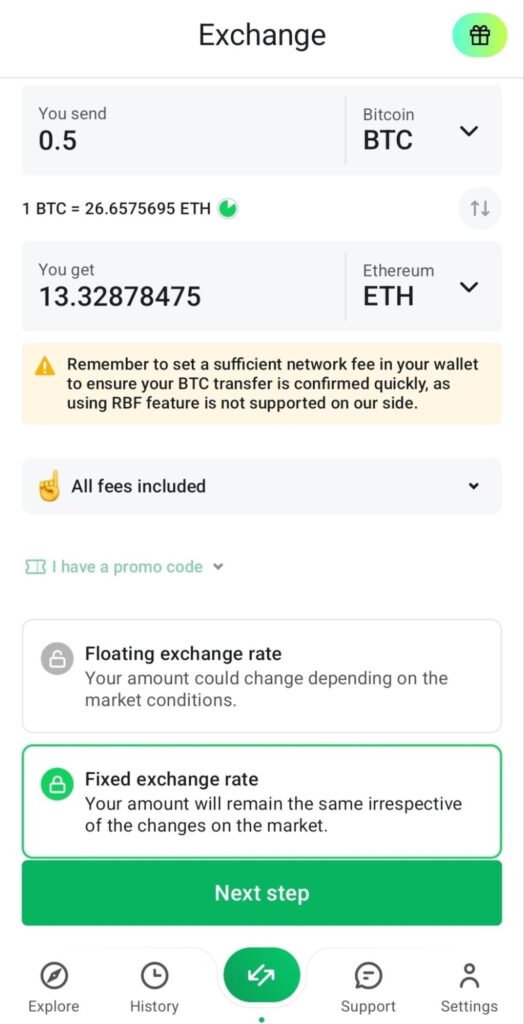

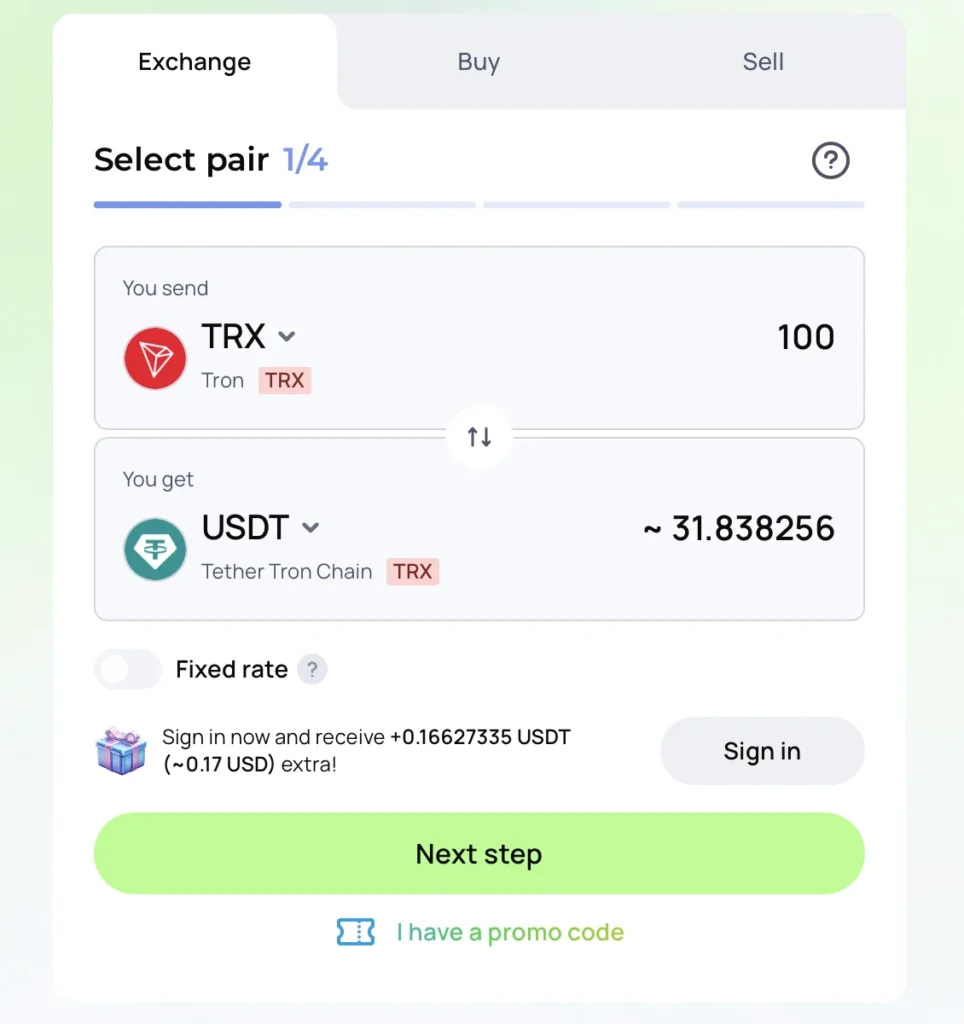

- Swaps: 1,000+ coins across 185 blockchains. Floating and fixed rates available.

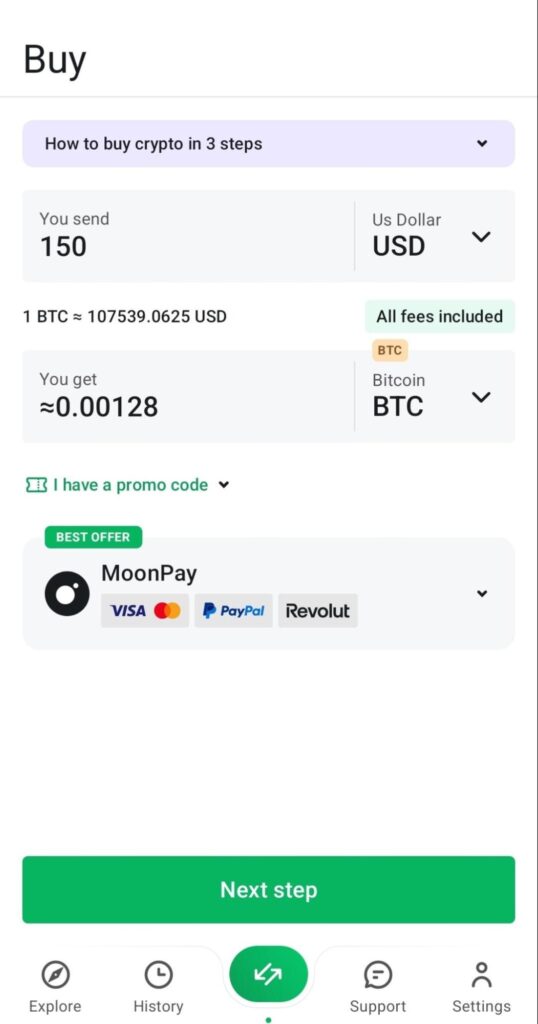

- Purchases: 350+ coins, 100+ fiat currencies, 20 payment methods, 14 fiat providers, and support for 170+ countries.

- Transaction limits: From $5 to $30,000 for crypto purchases.

- Pricing: Flat 0.25% service fee for crypto-to-crypto swaps. Fiat purchases include extra provider fees that vary by payment method and other factors. Users can compare rates from different providers.

- Security: Non-custodial model with 2FA for accounts and active transaction monitoring. (Don’t worry, we’ll look at Changelly’s KYC/AML policy in more detail later.)

- Localization: Changelly is available in multiple languages, and its support team is multi-lingual, too.

Changelly’s Background

Changelly was founded by Konstantin Gladych back in 2015. However, his name isn’t mentioned anywhere in official sources. The platform’s official website lists the names of its key team members, and Konstantin is not among them. All current team members have links to active social media accounts and, from what we’ve gathered after a bit of research, fairly recent mentions in reputable sources.

Currently, Changelly is officially registered in St. Vincent andthe Grenadines, operating within the legal framework of this jurisdiction. Key figures include:

- 10+ million users worldwide (in April 2025)

- 10 years on the crypto market

- 600+ API partners

User Experience

So, what’s it like to actually use Changelly? From our experience, it’s not too different from the average instant exchange platform of its type. What sets it apart is that you don’t need to create an account on Changelly itself—you can just go ahead and start swapping (or buying) without any delay.

During our testing, we’ve had no issues navigating through Changelly’s website or its app. Out of curiosity, we did create an account: it only took a few minutes, a completely standard procedure. Having an account gives you access to a transaction history, with no other hidden perks or benefits.

Swapping crypto on Changelly is just as straightforward. You enter the amounts, enter your wallet address, and confirm. Quotes for floating or fixed rates appear instantly and our swaps went through without any hiccups. Small crypto-to-crypto exchanges were almost immediate, and even larger ones settled in under ten minutes on average.

We also poked at customer support to see how responsive it really is. Opening a live chat from the app connected us to a real person within a couple of seconds, and their answers were clear and helpful.

Safety and Trustworthiness: A Look at Changelly’s KYC & AML Policy

Changelly states that user funds are never stored on their platform. This design reduces the impact of a potential security breach, and to date, the service reports no history of hacks. In terms of user reception, it holds high ratings in both the Apple App Store and Google Play Store.

Since users don’t need to store any funds or personal details on the platform, the risk of any breaches is non-existent. However, if you do create an account, your info will be protected with 2FA.

KYC & AML

According to an FAQ on their official subreddit (the most recent source we could find), Changelly itself does not manually request verification. Instead, an automated risk-scoring system flags certain transactions and triggers KYC only when activity looks suspicious: for example, if it detects coins linked to hacks, unusual patterns or destinations, or very large amounts.

Basic verification is handled by SumSub and is said to typically take about five minutes once documents are submitted. From what we’ve seen in user reviews, enhanced due diligence cases can take longer than that.

According to Changelly, this policy is intended to limit money laundering and to help recover stolen assets—but it also means that legitimate users can be asked for documents unexpectedly. Some negative reviews online come from people whose transactions were frozen during these checks (with many of them, however, later amended as their cases were resolved and they got their money back).

In contrast, some dissatisfied users have turned out to be scammers engaging in money laundering. For example, while researching, we found this case , where one such user was exposed by a well-known crypto vigilante. While claiming to be a victim, it turned out he was moving stolen funds. We’ve encountered similar cases while reviewing other platforms in the past, and are now suspicious in general when we see people claiming to have lost large sums without providing any transaction IDs.

Overall, Changelly’s AML/KYC framework is consistent with international and industry standards. It adds a layer of friction but also strengthens safety for compliant users.

So, Is Changelly Actually a Scam? Our Final Verdict

No, Changelly is not a scam. It has been operating for over ten years, partners with major wallets and payment providers, and, unlike centralized exchanges, does not hold user funds. The platform has never reported a breach and maintains consistently high ratings in major app stores.

Changelly is best suited for users who want quick, one-off swaps or fiat purchases without opening a full exchange account, and for businesses or wallets looking to embed crypto swaps via API. It’s less ideal for active traders who need order books, advanced tools or consistently low fiat on-ramp fees.

Final score: 4.3/5. A long-standing aggregator with wide asset coverage and responsive support, but with occasional KYC friction and third-party fiat fees.

How to Use Changelly to Exchange Crypto: A Brief Guide

Step 1. Set up your exchange by selecting the crypto pair and entering the amount you want to swap.

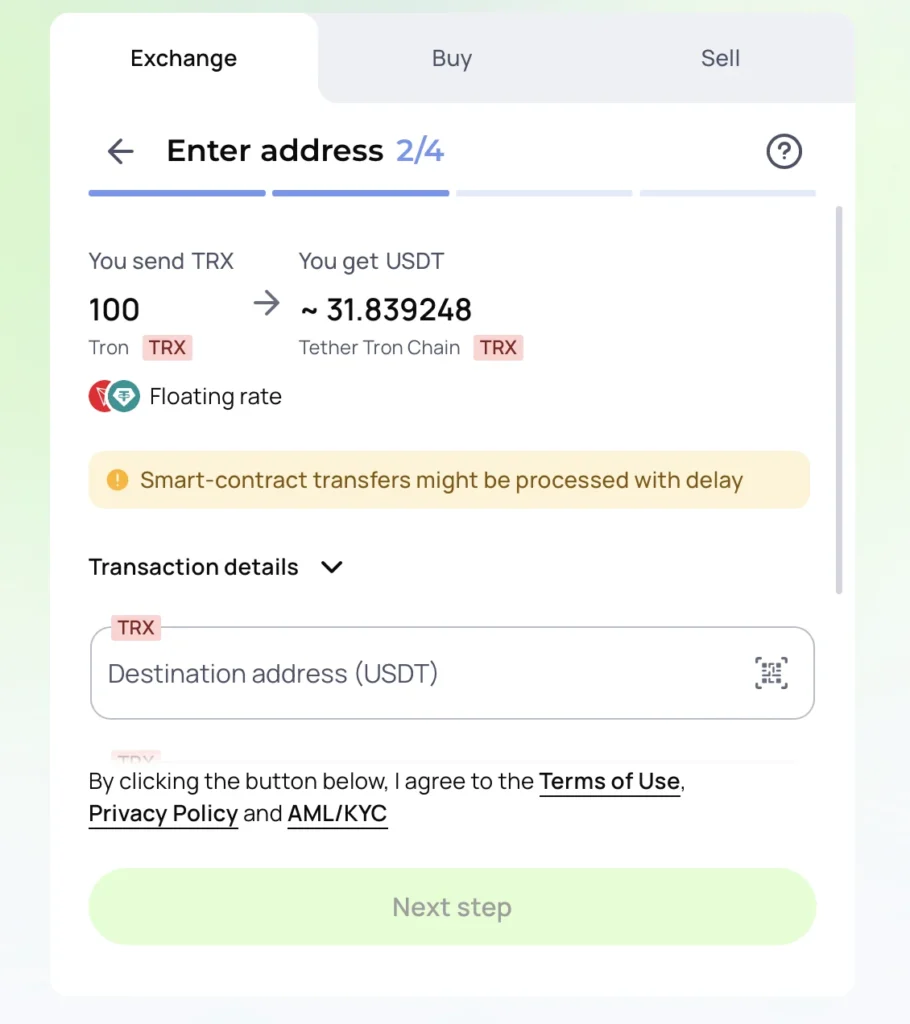

Step 2. Enter your crypto wallet address. Then, review your transaction details and proceed to payment.

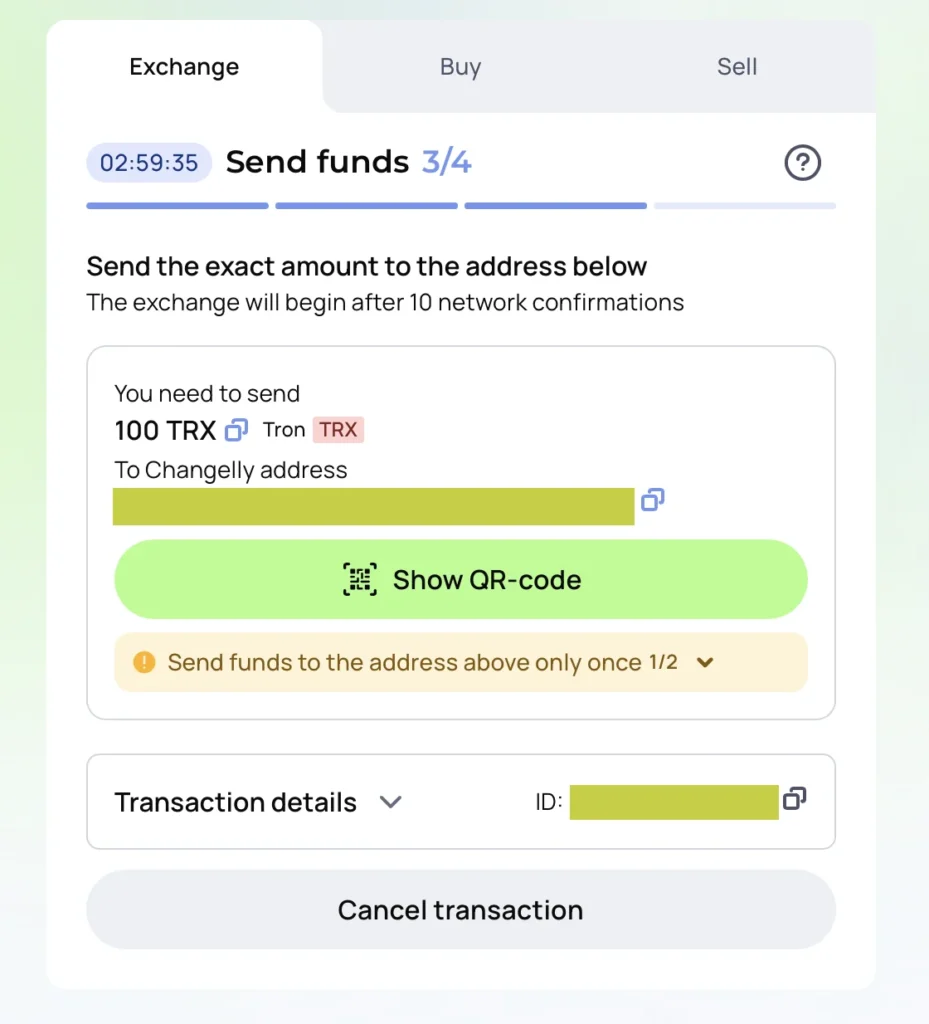

Step 3. Send the correct amount of crypto to the provided crypto wallet address. Make sure to send out the crypto ASAP, as these exchange wallet addresses can expire.

Bonus: Tips For Staying Safe When Using Crypto Exchanges

- Break up large transfers. If possible, avoid moving very large amounts of crypto in a single transaction. Send a small test transfer first to confirm the address and network.

- Enable 2FA everywhere. Turn on two-factor authentication on your exchange accounts and your email.

- Use your own wallet. Keep long-term holdings in a wallet you control rather than leaving them with any service.

- Double-check URLs and providers. Only access exchanges through official links or apps to avoid phishing.

- Understand KYC triggers. Large or unusual transactions may require verification. Be prepared with up-to-date documents.

Our Methodology

We use a clear, structured approach to review cryptocurrency exchanges. Each platform is assessed across several weighted categories, combining first-hand testing with independent research.

Security & Trustworthiness (35%)

Security is our top priority when evaluating any exchange. We examine how platforms protect user data and transactions, whether they hold customer funds, and what safeguards are in place to prevent hacks or fraud. We also research any past breaches, regulatory actions, or unresolved complaints.

Supported Assets, Payment Options & Tools (30%)

Breadth and depth matter. We look at how many cryptocurrencies and blockchains are supported, what fiat currencies and payment methods are available, and what built-in tools or integrations are offered (such as analytics, alerts, API access, or wallet connections). We also test how these features work in real scenarios.

Pricing & Fees (20%)

We evaluate service fees, spreads, and charges from third-party providers, comparing quoted rates with the rates actually executed in test transactions to ensure transparency and competitiveness.

Reputation, User Experience & Feedback (15%)

Finally, we combine usability testing with community sentiment. We assess how intuitive the platform is on both web and mobile, how responsive its support is, and what recurring themes appear in reviews on Reddit, Trustpilot, app stores, and other channels. This helps us validate our findings against real-world user experiences.

Bitcoin Accumulation Gradually Wanes, Trend Score Declines

As per Glassnode data, Bitcoin’s Accumulation Trend Score is declining to a great extent, indicating...

New Meme Coin PEPENODE Nears $1.5M Raised at Presale – Is This the Next 50x Crypto?

PEPENODE raises $1.4M in presale with a deflationary Mine-to-Earn model, token burns, and scarcity-d...

Binance Taps Aave Protocol for On-Chain Yields on Plasma USDT

Binance launches the Aave-Plasma USDT Locked Product on Sept 25, offering up to 7% APR with daily US...