Bitcoin Exchange Supply Ratio Declines After Fed Cut, Setting Stage For $120,000 Test

Earlier this week, the US Federal Reserve (Fed) cut interest rates by 25 basis points, providing the much-required impetus to the economy after a cycle of raising interest rates to keep inflation under check. A cut in interest rates is likely to benefit risk-on assets, including Bitcoin (BTC).

Fed Cuts Interest Rate, Bitcoin Supply Ratio Falls

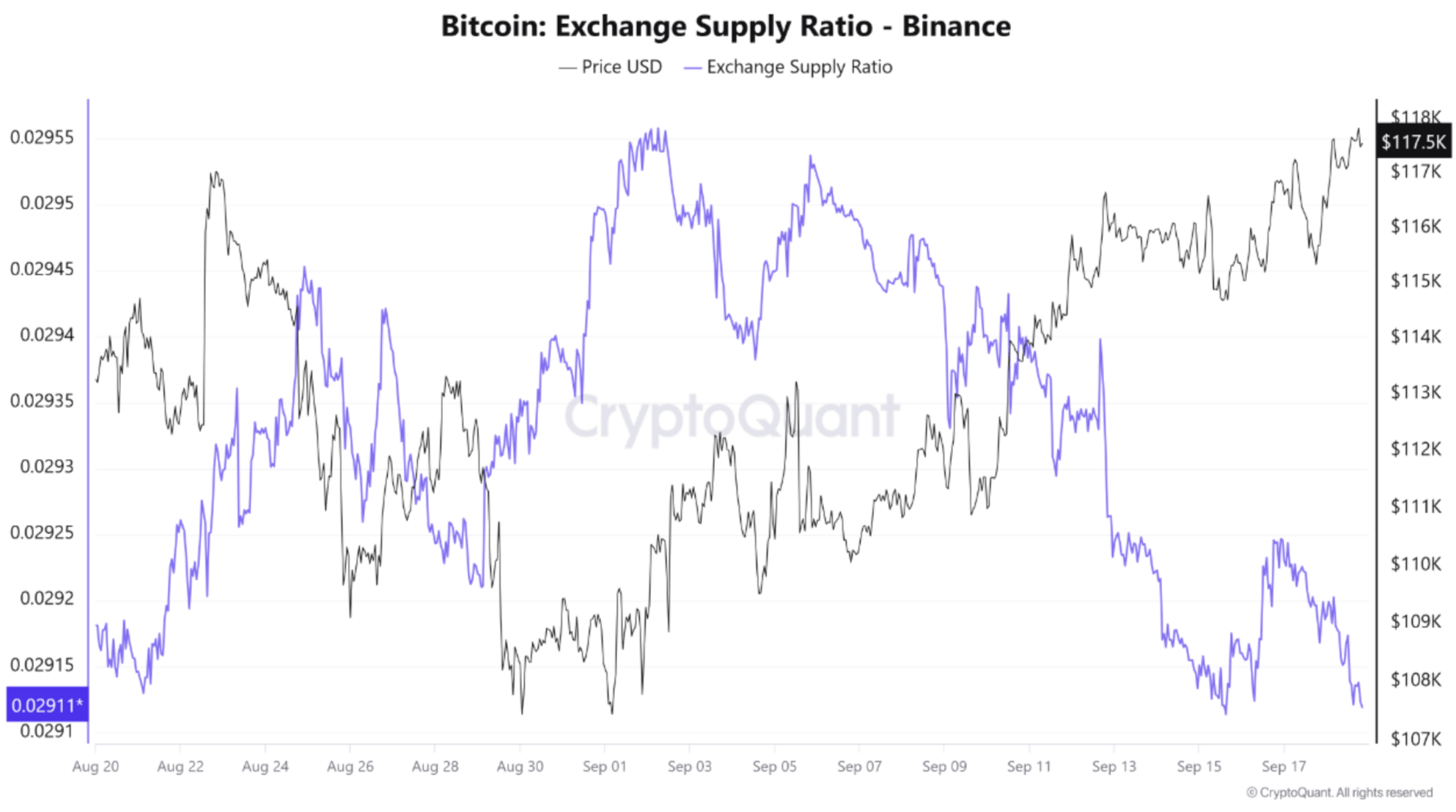

According to a CryptoQuant Quicktake post by contributor Arab Chain, the latest data from Binance shows that the interest rate cut has rekindled investors’ interest in BTC. Notably, the exchange supply ratio has declined to 0.0291, hinting that investors are choosing to withdraw their BTC from exchanges and hold it for the long-term instead of selling it.

To support their analysis, Arab Chain shared the following chart, which shows a tumbling exchange supply ratio while the BTC price continues to shoot up. The analyst noted that the interest rate cut has increased risk appetite and improved liquidity in the market.

This behavior shows that the Fed’s monetary policy will remain dovish for the near term, which could mitigate selling pressure on BTC for the time being. Low exchange supply is creating relative buying pressure, as Bitcoin’s stability above $115,000 further supports this trend.

The analyst remarked that if BTC outflows from crypto exchanges continue at the current pace, then the digital asset may target the $120,000 resistance level. However, liquidity must continue to flow into digital assets, driven by the Fed’s decision. Arab Chain added:

The continued decline in the Exchange Supply Ratio for Bitcoin, coupled with a rising price, reinforces the bullish scenario, especially if traditional markets stabilize after the Fed’s decision. Conversely, if the Exchange Supply Ratio turns upward again (if Bitcoin reenters exchanges), it could signal that investors are preparing to take profits at levels near 118K–120K.

Meanwhile, crypto analyst Titan of Crypto had similar thoughts. In an X post, the analyst shared the following chart, saying that BTC is currently stuck under the bearish fair value gap. A daily close above this gap – highlighted in red – could pave the way for a new high for BTC.

Is BTC Facing A Supply Crunch?

A declining exchange supply ratio further suggests that BTC may be approaching a bullish ‘supply crunch’ that could lead to significant price appreciation for the digital asset in the near term.

Recently, the Bitcoin Scarcity Index recorded its first spike since June 2025, indicating potential upward price pressure on BTC. Meanwhile, BTC outflows from Binance continue at a rapid pace, further reducing the digital asset’s active circulating supply.

That said, some concerns still linger, specifically due to the lack of participation of whales in recent BTC price action. At press time, BTC trades at $116,374, down 1.3% in the past 24 hours.

Analyst Says XRP Price Not Reaching $10+ Due To Market Cap Is Irrelevant

The arguments for the XRP being able to reach $10+ or not have ranged from how high the market cap w...

ADA Holds $0.90 Support As Hoskinson Says Cardano Will ‘Break The Internet’

Charles Hoskinson has affirmed that Cardano (ADA) will steal the crypto spotlight as the altcoin att...

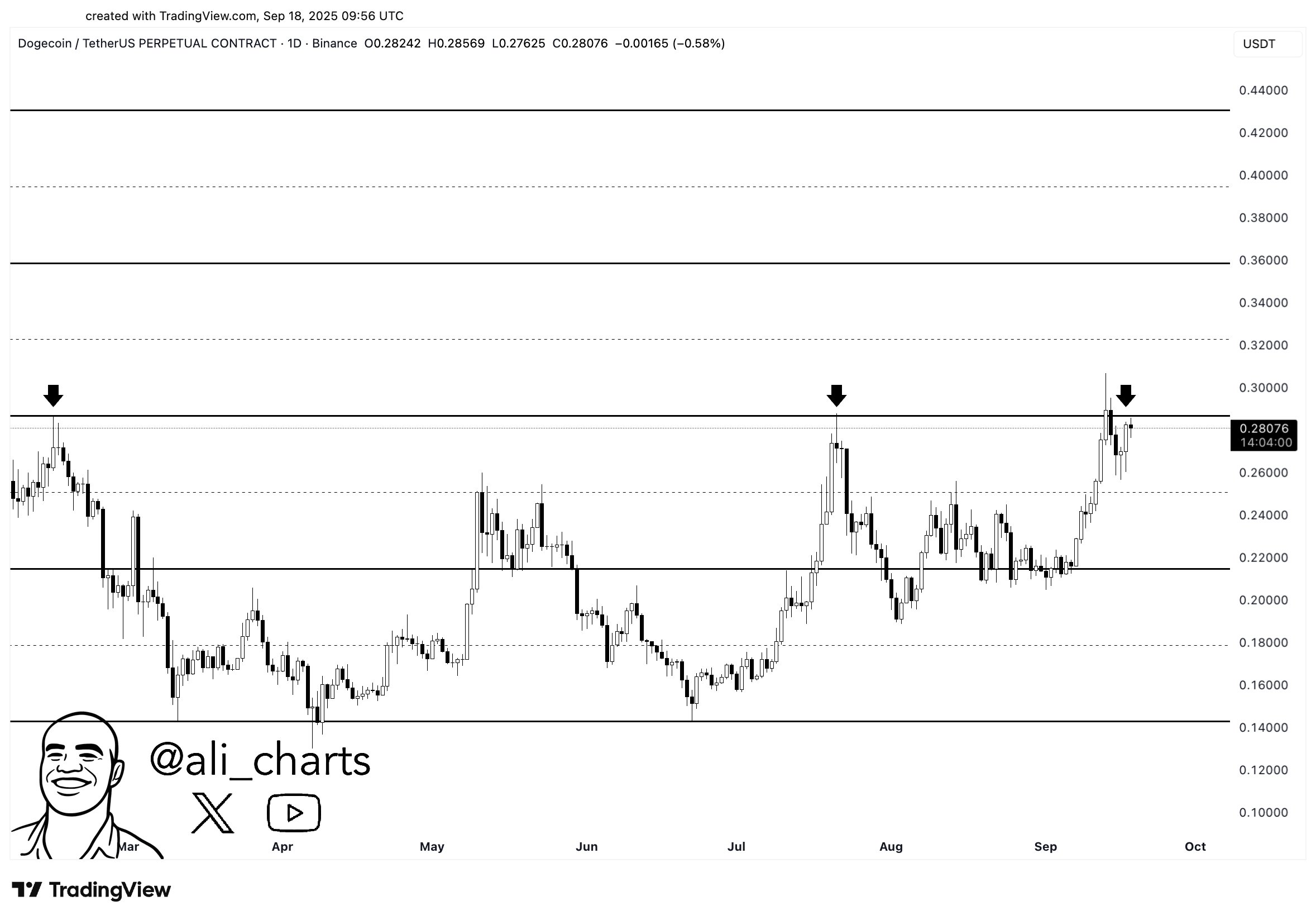

Dogecoin Ready To Bark Again? Analyst Sees Path To $0.45

An analyst has pointed out how Dogecoin could see a rally to $0.36 or even $0.45 if its price can ma...