Ethereum Close To Local Bottom? Analyst Flags Drop In Binance Open Interest

After failing to hit a new all-time high (ATH) of $5,000 in August 2025, Ethereum (ETH) may finally be ready to breach the psychologically important price level. A decline in Binance open interest suggests that ETH is likely close to a local bottom, ready for its next leg up.

Ethereum Open Interest Declines, Is Local Bottom Close?

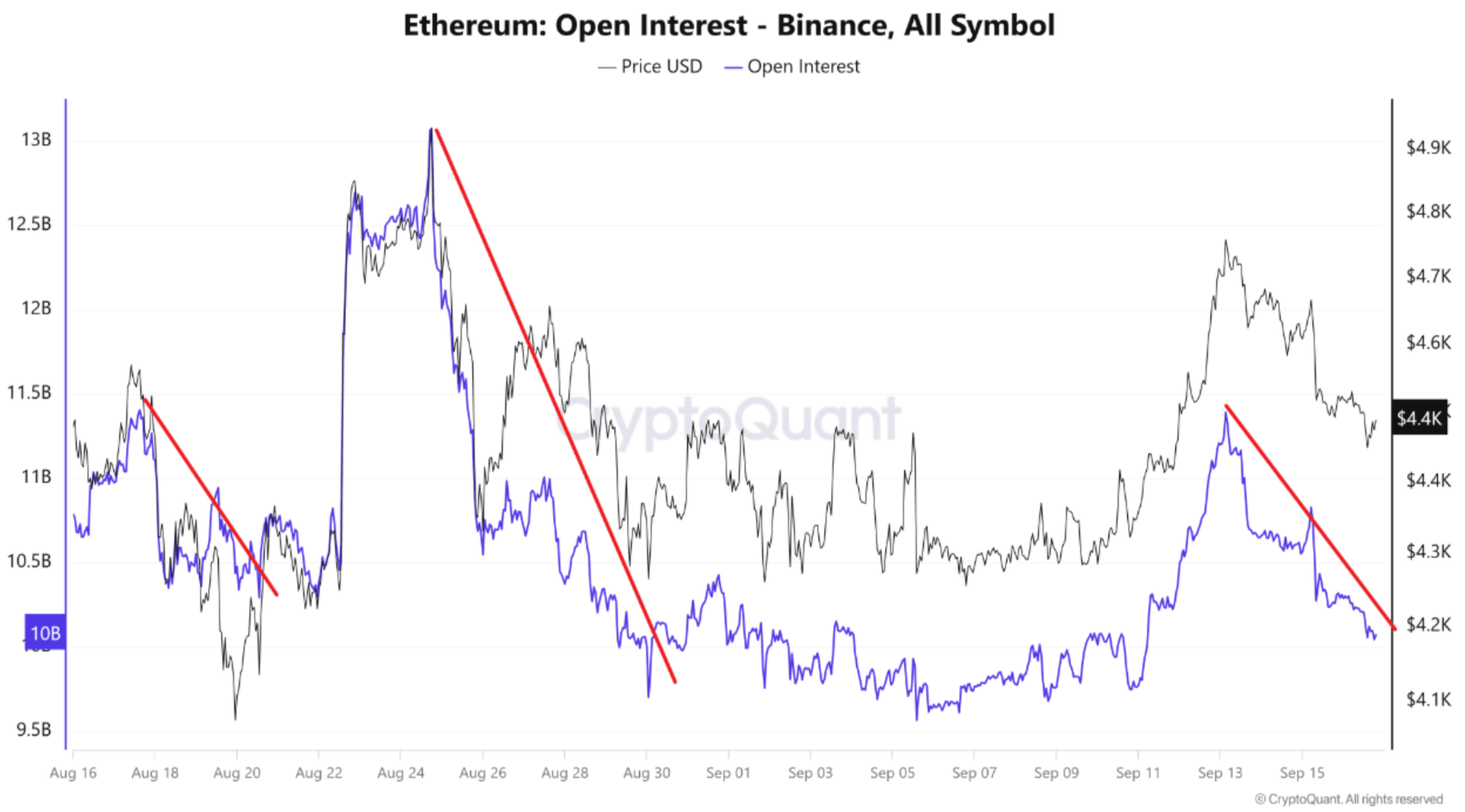

According to a CryptoQuant Quicktake post by contributor burakkesmeci, Ethereum may be nearing a local bottom. The analyst referred to the Binance ETH open interest (OI) hourly timeframe metric for their analysis.

In their analysis, burakkesmeci noted that according to the Binance ETH OI metric, local bottoms have formed with an average decline of 14.9% over the past three months. On the spot market side, these corrections have typically resulted in an average 10.7% decline.

The analyst said that drops in ETH OI have usually signaled spot price corrections ahead of time. For example, on August 17, the Binance ETH OI decreased from $11.4 billion to $10.2 billion, representing a 10.52% drop.

Similarly, on August 20, the Binance ETH OI tumbled from $13 billion to $9.7 billion, a correction of 25.38%. The latest major tumble in Binance ETH OI was observed on September 13, when it crashed from $11.39 billion to $10.4 billion. The analyst concluded:

So, we can say this: when spot price rallies are supported by the futures side, the trend progresses more healthily – just like a plane flying with two wings. In the opposite scenario, OI signals potential corrections. Binance ETH OI (measured on the highest-volume exchange, acting as a leading indicator) gives us a chance to catch local bottoms early.

The analyst added that based on the recent trends, it can be speculated that the Binance ETH OI may dwindle to $9.69 billion. It also suggests that ETH is currently in the local bottom zone. However, the ETH price may fall further before it finds its local bottom.

Is ETH Eyeing $6,800?

Meanwhile, fellow CryptoQuant analyst, PelinayPA, noted that Fund Market Premium (FMP) has remained mostly neutral or positive between July and September 2025 – indicating renewed institutional demand. Over the same period, ETH has surged from $2,500 to $4,400.

For the uninitiated, the FMP in Ethereum’s context measures the price gap between futures contracts and the spot market. Currently, with positive premiums dominating, the market is showing strong institutional support for ETH. PelinayPA added:

This environment could help Ethereum maintain stability above $4.4K and potentially sustain further upside momentum. Major target $6,8K.

In addition, ETH exchange reserves continue to deplete at a rapid pace. Recent analysis by another CryptoQuant contributor named Arab Chain forecasted ETH to touch $5,500 in September.

That said, the current pause in ETH’s rally remains a point of concern. At press time, ETH trades at $4,491, up 0.8% in the past 24 hours.

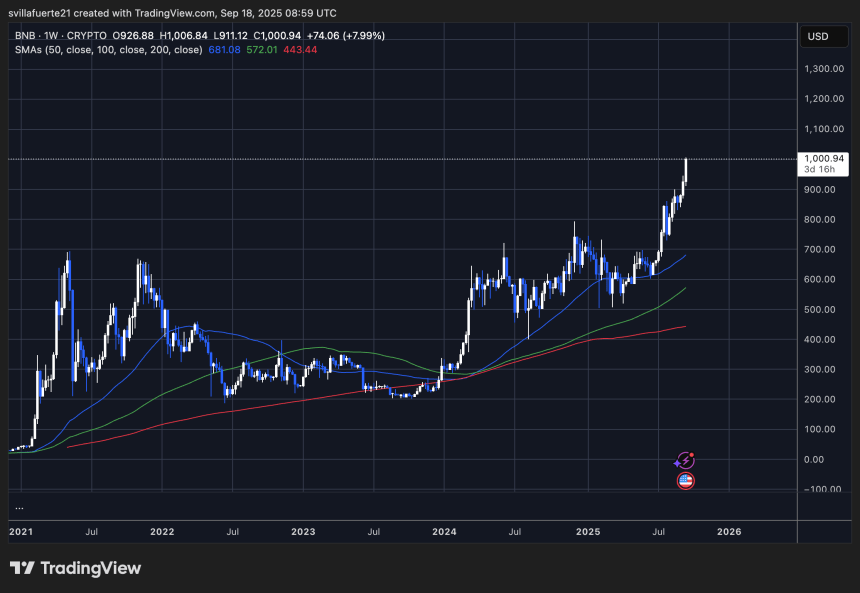

Binance Chain BNB Smashes $1,000 Milestone for the First Time Ever

Binance Chain has reached a historic milestone after its native token, BNB, broke past the $1,000 ma...

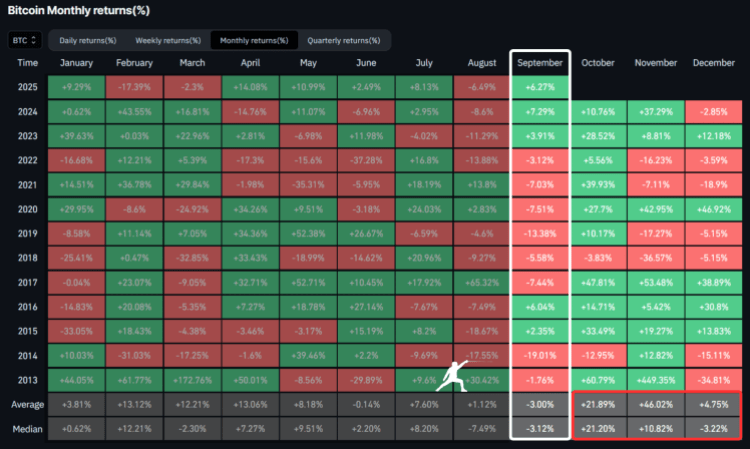

What To Expect From The Bitcoin Price Is September Closes In The Green

Over the years, different trends have emerged for the Bitcoin price depending on how the month ends,...

Powell’s Rate Cut to Fuel Bitcoin Momentum – Bitcoin Hyper Presale Skyrockets Past $16.5M

The US Federal Reserve cut the key interest rate by 0.25 points, with the change coming into effect ...