Stablecoin Giants Battle for Control of Hyperliquid's USDH Ticker in Unprecedented Vote

A fierce competition has erupted among major stablecoin issuers seeking control of the USDH ticker on Hyperliquid, with the decentralized exchange's validators set to determine which entity will issue what could become a multi-billion dollar digital currency.

Ten major players have submitted proposals for the USDH stablecoin contract, including Ethena Labs, Paxos, Frax Finance, Sky Ecosystem, Curve Finance, Native Markets, Bastion Platform, and Agora . The winner will gain access to an estimated $220 million in annual revenue from what analysts project could become a significant stablecoin within the rapidly growing Hyperliquid ecosystem.

The competition represents an unprecedented democratization of stablecoin selection, with Hyperliquid validators directly voting on which issuer receives the lucrative contract.

Hyperliquid's motivation centers on reducing dependence on external stablecoins like USDC while capturing treasury yields and liquidity incentives within its own ecosystem. The platform currently relies heavily on Coinbase-issued USDC, with leadership viewing the native stablecoin as essential for long-term independence and value retention.

Ethena Labs pledged to return 95% of reserve revenue to the Hyperliquid community while covering migration costs from USDC to USDH and committing at least $75 million in ecosystem incentives. Paxos emphasized enterprise infrastructure and regulatory compliance, offering 95% of interest returns toward HYPE token buybacks.

Sky Ecosystem proposed a multicollateral approach similar to USDS with instant redemption capabilities for 2.2 billion USDC, directing approximately 4.85% returns on Hyperliquid-held USDH toward HYPE buybacks. Frax Finance offered zero take rates with on-chain Treasury bill yields flowing to Hyperliquid.

The proposals vary significantly in structure, from fiat-backed solutions to decentralized collateralized debt positions. Native Markets proposed an issuer-agnostic approach through Bridge technology, while Curve Finance suggested a decentralized CDP model alongside regulated options. Each contender emphasizes compliance, day-one liquidity commitments, and revenue-sharing arrangements designed to benefit the Hyperliquid ecosystem.

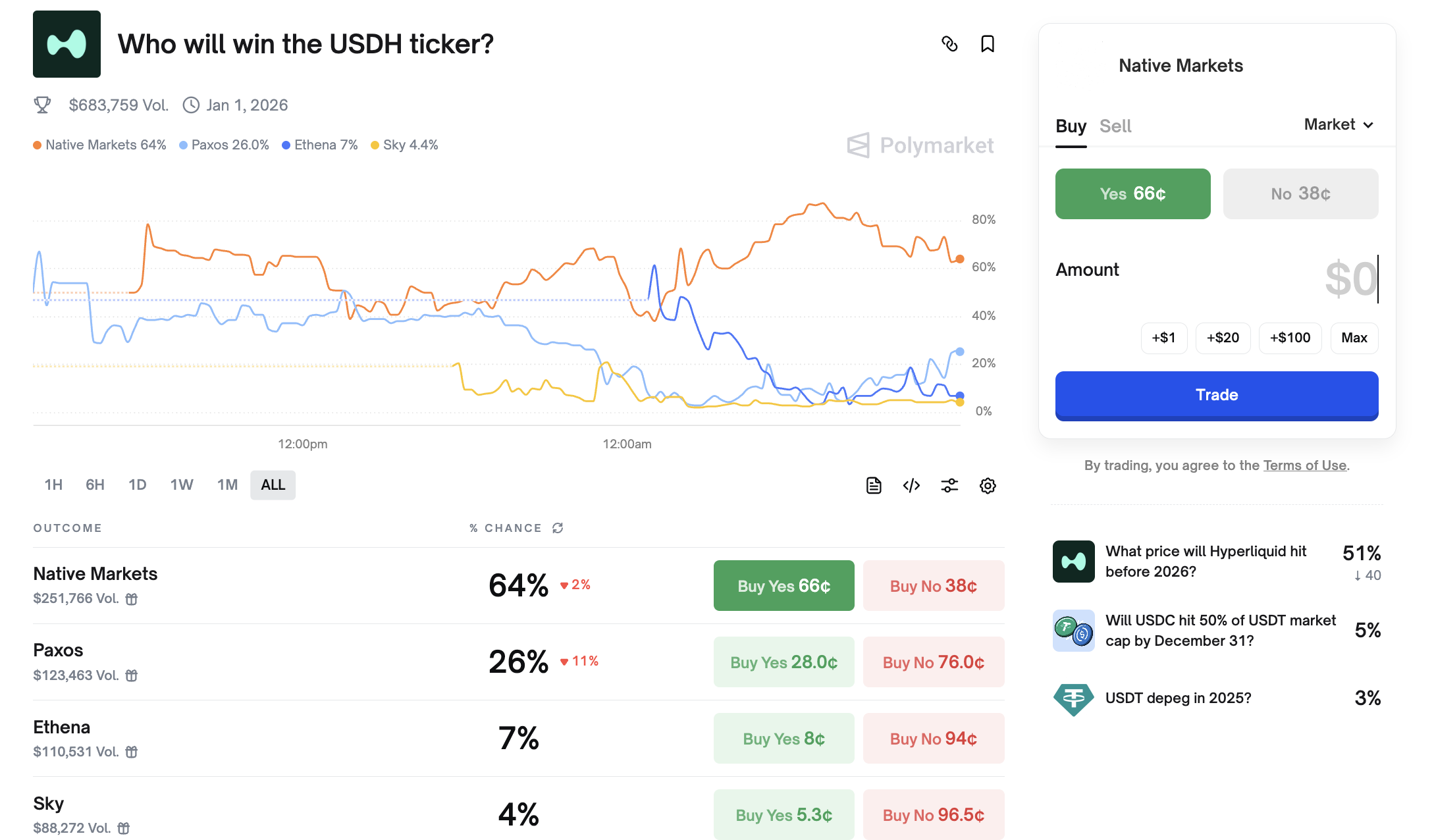

The competition has attracted attention from prediction markets, with Polymarket launching betting pools on the outcome, with Native Markets currently holding a commanding lead and Paxos coming in second.

The stakes extend beyond immediate revenue to questions about stablecoin governance and control. Observers view the competition as a test case for whether traditional financial institutions or native DeFi teams will dominate next-generation stablecoin infrastructure.

The submission window for proposals closes on 10 September, at 10:00 UTC.

Corporates Embracing Bitcoin: Strategic Gains, Hidden Risks

As public companies and traditional banks increasingly embrace Bitcoin, the cryptocurrency is becomi...

SharpLink Gaming Executes First Share Buyback Under $1.5B Program

Ethereum treasury company repurchases nearly 1 million shares amid claims stock trades below asset v...

Metaplanet Raises $1.45 Billion in Share Offering to Expand Bitcoin Holdings

Tokyo-listed company plans to purchase additional Bitcoin and expand options trading operations amid...