Solana Price Analysis: SOL Enters Make or Break Sell Wall

The post Solana Price Analysis: SOL Enters Make or Break Sell Wall appeared first on Coinpedia Fintech News

Solana (SOL) price has entered a crucial sell wall between $170 and $203, which has resulted in multi-weeks of choppy markets since March 2024. The large-cap altcoin, with a fully diluted valuation of over $112 billion, has attempted to regain bullish momentum to mirror Ethereum (ETH) and Binance Coin (BNB).

Furthermore, the wider altcoin market has signaled bullish sentiment following the recent Bitcoin dominance drop from 66 percent to 61 percent. Additionally, the Altcoin Season Index from coinglass shows the odds of an altseason have significantly increased fueled by clear crypto regulatory frameworks and renewed demand from institutional investors.

What the On-chain Data Analysis Signals for Solana Price

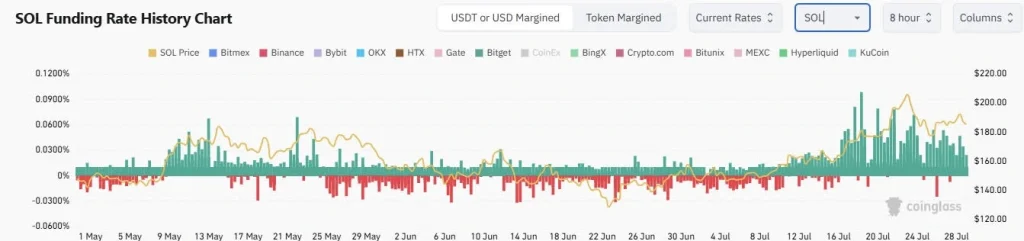

According to market data analysis from coinglass, Solana’s funding rate has remained positive for the past month. Historically, a sustained positive funding rate often signals a macro bullish outlook and vice versa.

Additionally, Solana’s Futures Open Interest (OI) has slithered to an all-time high of above $10 billion. The rising OI suggests an increase in speculative trading, amid the wider bull market.

Closer Look at SOL Chart

Solana price in the weekly timeframe has entered a pivotal range, which could either lead to a parabolic rally or choppy markets in the midterm. Notably, the SOL price has formed a potential macro head and shoulders pattern (H&S) coupled with a bearish divergence of the weekly Relative Strength Index (RSI).

However, the weekly MACD indicator has signaled bullish sentiment in the near term. Moreover, the MACD and signal lines recently crossed above the zero line amid growing bullish histograms.

In the four-hour time frame, the SOL price must hold above the support level of $170 to rally above $200 towards the midterm target of $254.

Renewed Demand From Institutional Investors Signals Bullish Sentiment

The Solana network has enjoyed a renewed demand from institutional investors seeking to diversify from Bitcoin and Ethereum. For example, Upexi, a company focused on Solana treasury, entered into a $500 million line of credit agreement to fund additional SOL token purchases.

Meanwhile, on-chain data shows whale investors have been aggressively accumulating SOL from the various cryptocurrency exchanges.

What Are JCOIN & JOYCOIN? Jd.com Moves Ahead of Hong Kong’s New Stablecoin Rules

The post What Are JCOIN & JOYCOIN? Jd.com Moves Ahead of Hong Kong’s New Stablecoin Rules appeared f...

Corporate Ethereum Treasuries Could Hit 10% of Supply, Says Standard Chartered

The post Corporate Ethereum Treasuries Could Hit 10% of Supply, Says Standard Chartered appeared fir...

Solana (SOL) Set to Hit $400 in 25 Days, While Viral Crypto Below $1 Could Flip $420 into $24,000 Before Cycle Top

The post Solana (SOL) Set to Hit $400 in 25 Days, While Viral Crypto Below $1 Could Flip $420 into $...