Bitcoin's Record-Setting Rally vs. Other Cryptos

At first glance, 2025 appears to be a remarkable year for cryptocurrency: Bitcoin hits unprecedented heights, a pro-industry US president with family ties dives into the market, and significant legislation is anticipated to be approved by Congress, which is likely to have lighter-touch regulations.

But the story has taken an unexpected turn. Even with an optimistic forecast for cryptocurrency in 2025, many altcoins, which refers to a digital currency other than Bitcoin, faced significant downturns earlier this year, resulting in a loss of over $300 billion in market capitalization. Now, however, altcoins are staging a dramatic comeback, with Ethereum leading the charge above $3,000 and investors asking the same critical questions: what's driving this surge, and how long can it last?

Bitcoin continues to be a highly desirable asset within the cryptocurrency market, holding the largest share and proving its resilience as the most recognized and widely accepted asset. However, the recent surge in altcoins is challenging this dominance, with Ethereum breaking decisively above the $3,000 threshold and posting gains of nearly 3% while Bitcoin remains flat or slightly down.

The altcoin rally extends far beyond Ethereum. Optimism (OP), an Ethereum ecosystem token, AAVE, and Polkadot are leading daily gains, buoyed by an all-around positive sentiment in the tech sector — the only sector posting gains on the day. Veteran altcoins are showing impressive weekly performance: Stellar (XLM) has surged 82%, ADA nearly 30%, Ripple (XRP) 29%, and Dogecoin (DOGE) 18%.

On the other hand, altcoins present a variety of projects and innovations, each establishing its unique position within the market landscape — and for the first time in over a year, many are gaining ground against Bitcoin.

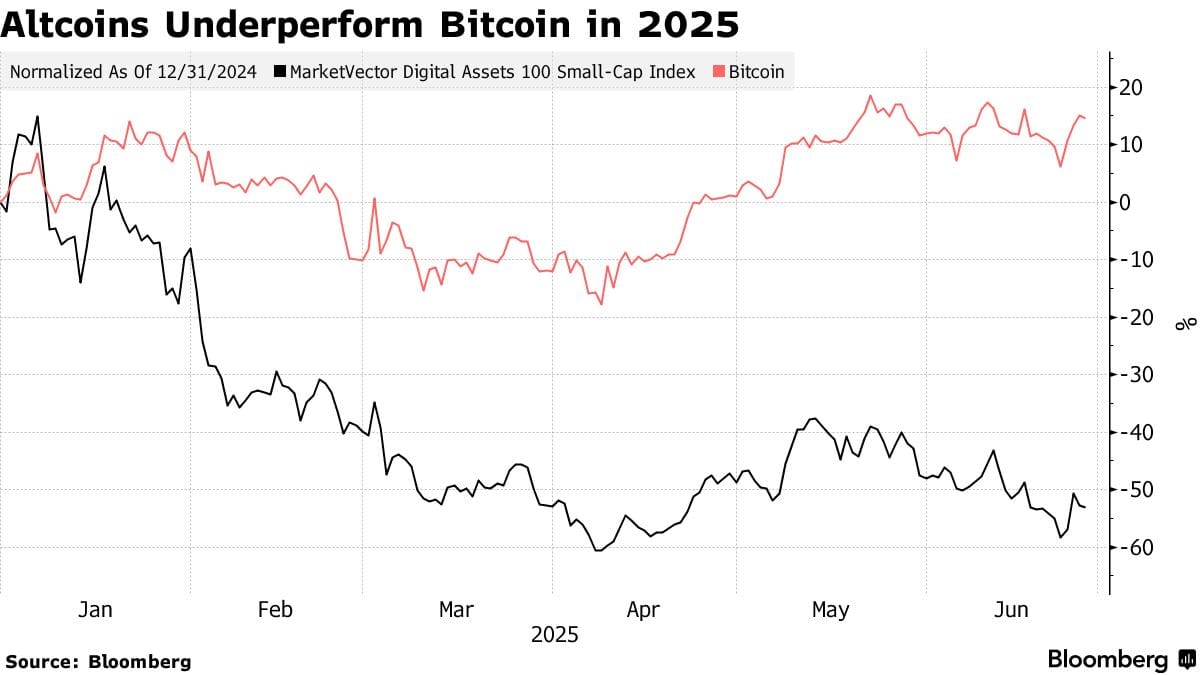

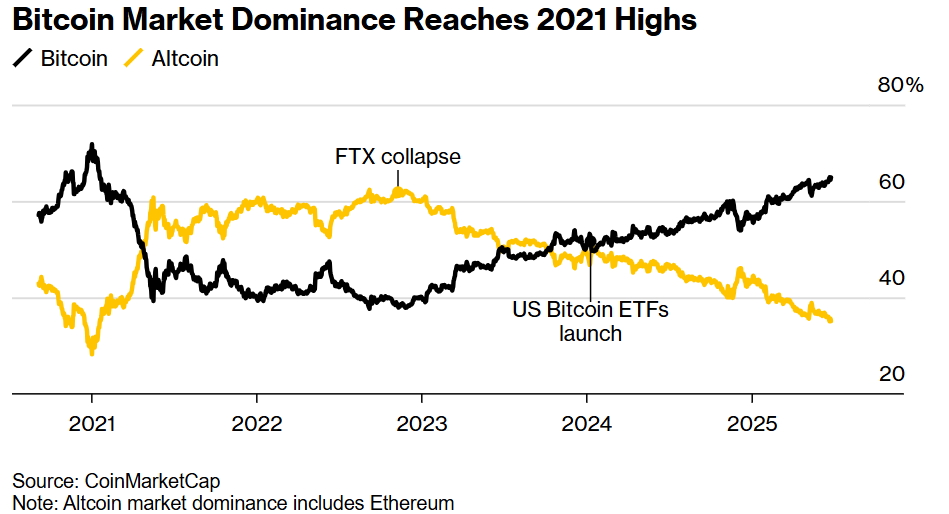

The increasing dominance of Bitcoin within the crypto industry was evident earlier this year, as its portion of the overall market value had risen to 64% — the highest level for Bitcoin since January 2021. However, recent market dynamics suggest this dominance may be waning as capital rotates into altcoins.

For the first time in over a year, the ETH/BTC pair has risen above its 200-day moving average — a rare bullish crossover typically seen during major rallies. The altcoin season index stands at 32/100, still far from the 75-point threshold that would confirm a full altcoin season, but the index has recently shown a positive upward trend, suggesting that early signs of rotation are emerging.

Altcoins Stage a Comeback

While earlier this year many predicted that altcoins may "die" or fade into obscurity, the current market dynamics tell a different story. The shift in capital from Bitcoin to altcoins indicates that the market may be entering an altcoin season, where alternative cryptocurrencies outperform Bitcoin.

Following Donald Trump's election triumph on November 5, a MarketVector index tracking the bottom half of the top 100 digital assets witnessed a substantial surge. However, by earlier this year, it had retraced all those gains and was down about 50%. Now, the collective strength of veteran altcoins is being interpreted as an early signal of retail funds possibly flowing back into the market.

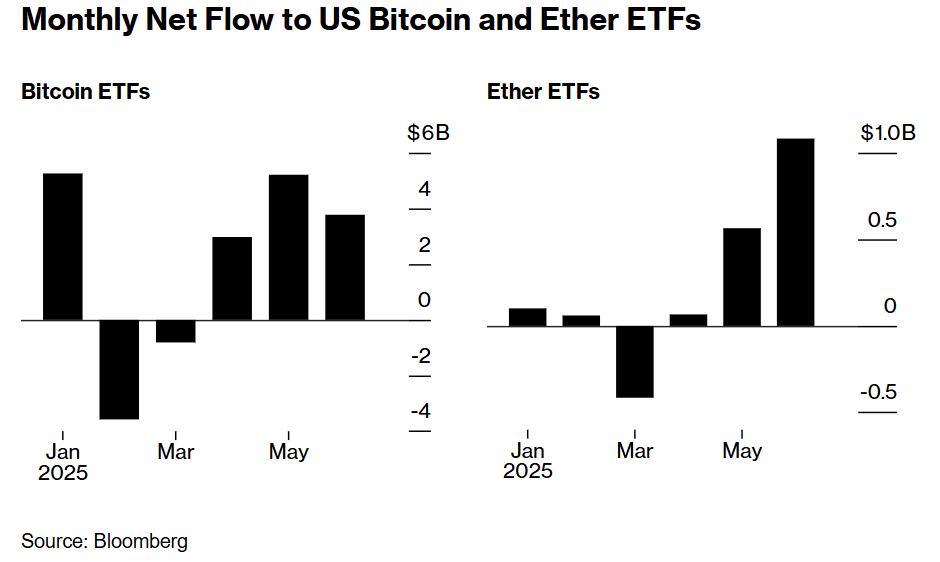

This comes as the crypto sector continues evolving into a more regulated and institution-focused environment, where stablecoins are becoming increasingly popular. However, the recent altcoin surge suggests that alternative coin projects may be successfully demonstrating utility and attracting a broader range of investors.

While earlier forecasts suggested that significant portions of the industry may devolve into a digital wasteland, the current altcoin resurgence challenges this narrative. The recent surge suggests that rather than being a speculative frenzy, altcoin growth may be driven by fundamentals and institutional funding for more sustainable growth.

The launch of spot ETFs, advances in Layer 2 solutions, the combination of artificial intelligence and blockchain, the development of real-world asset tokenization, and improvements in blockchain gaming infrastructure have all brought new value narratives and application prospects to altcoins.

However, not every altcoin was struggling during the downturn. Assets such as Maker and Hyperliquid, associated with successful decentralized finance protocols, achieved significant growth even during the difficult period. Now, with the broader altcoin rally underway, the question becomes whether this momentum can be sustained.

While it remains early to assume a definitive breakout, the strength of the ongoing ETH/BTC rally may lead to significant upside in Ethereum and, consequently, other altcoins. The market dynamics suggest a potential bifurcation: Bitcoin maintaining its long-term uptrend while altcoins capture short-term momentum.

Still, with Bitcoin's long-term trajectory remaining bullish despite recent pullbacks from its $123,000 peak, the sustainability of altcoin outperformance remains uncertain. The divergence between Bitcoin and altcoins may narrow again if the current rally loses steam.

Elsewhere

Crypto's New Bold Plan: Blockchain-Led Stock Market

Major crypto players like Coinbase, Kraken, and Robinhood are launching tokenized stock trading plat...

Talos Acquires Coin Metrics for Over $100M in Major Crypto M&A Deal

Digital asset trading infrastructure firm creates comprehensive institutional platform through strat...

Ethereum Surges as Legislation Advances – How We're Positioning Ahead of an Altseason

Your daily access to the backroom....