Bitcoin Poised For Rally As Geopolitical Tensions Ease And Inflation Expectations Fall

Leading crypto exchange Binance witnessed a significant outflow of Bitcoin (BTC) and Ethereum (ETH) on June 23, with investors pulling out over 4,000 BTC and 61,000 ETH in a single day. This shift comes amid easing geopolitical tensions and declining inflation, fuelling speculation about a renewed rally.

Bitcoin Likely To Rally As Global Tensions Simmer

According to a recent CryptoQuant Quicktake post by contributor Amr Taha, Bitcoin is likely to resume its upward trajectory, bolstered by a series of recent macroeconomic and geopolitical developments. The analyst highlighted multiple positive signals that could propel the top digital asset closer to its all-time high (ATH).

One of the key developments was an announcement by US President Donald Trump, who stated that a ceasefire agreement had been reached between Israel and Iran. This deal removes the immediate threat of Iran closing the Strait of Hormuz, a vital chokepoint for global oil supply.

The ceasefire had an immediate and positive effect on global equity markets, with the S&P 500 index surpassing 6,000 for the first time since February 2025. This recovery signals growing investor confidence as geopolitical risks subside.

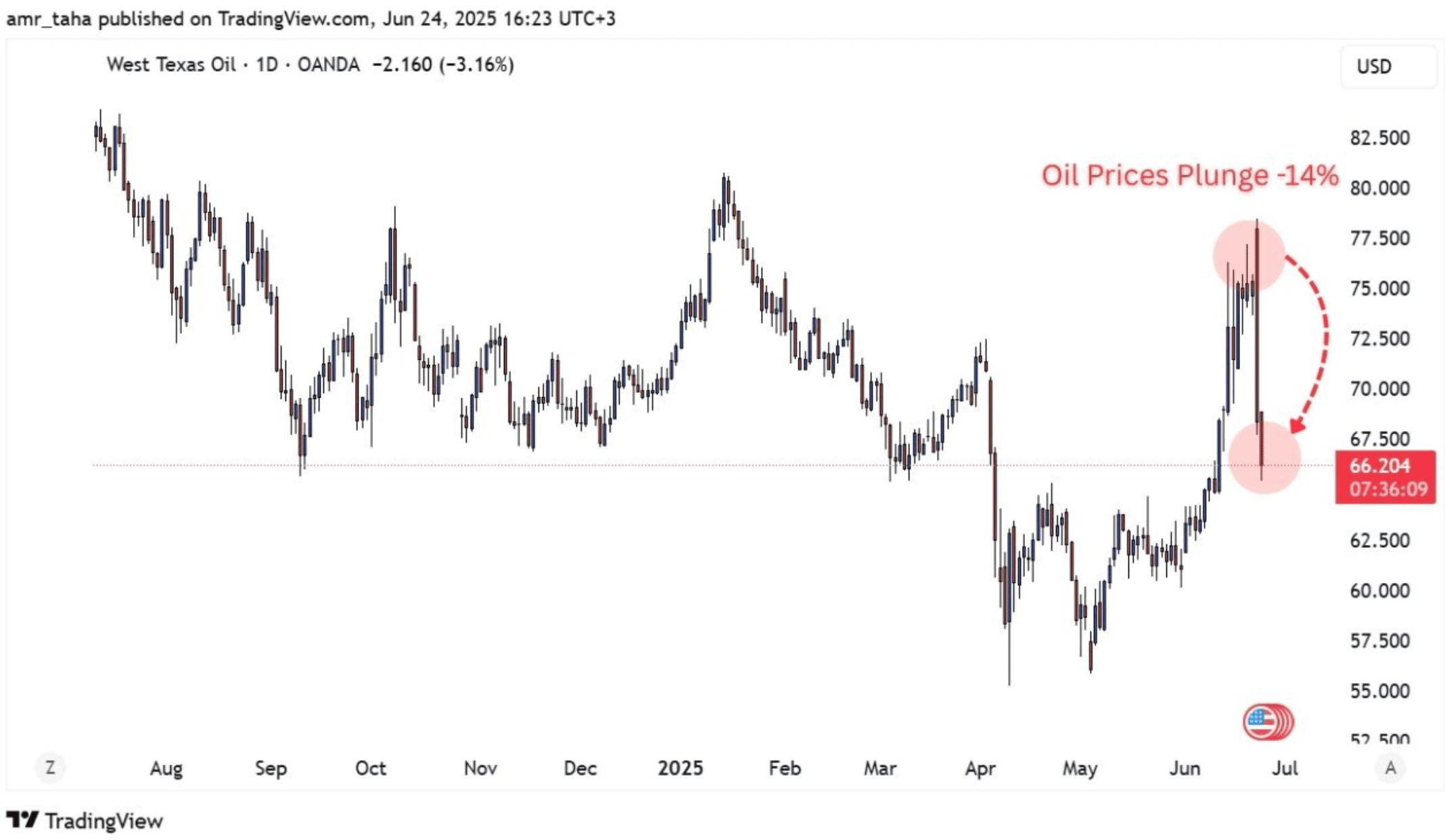

In addition, crude oil prices dropped by 14%, adding to the disinflationary narrative. Lower energy costs help reduce production and transportation expenses, thereby supporting a broader decline in inflationary pressures. Taha concluded:

The convergence of significant crypto outflows from Binance, falling oil prices, a bullish breakout in US equities, and the reduction of Middle Eastern tensions presents a striking scenario. With the geopolitical overhang removed, inflation easing, and macro markets stabilizing, Bitcoin is now well-positioned to resume its upward trajectory.

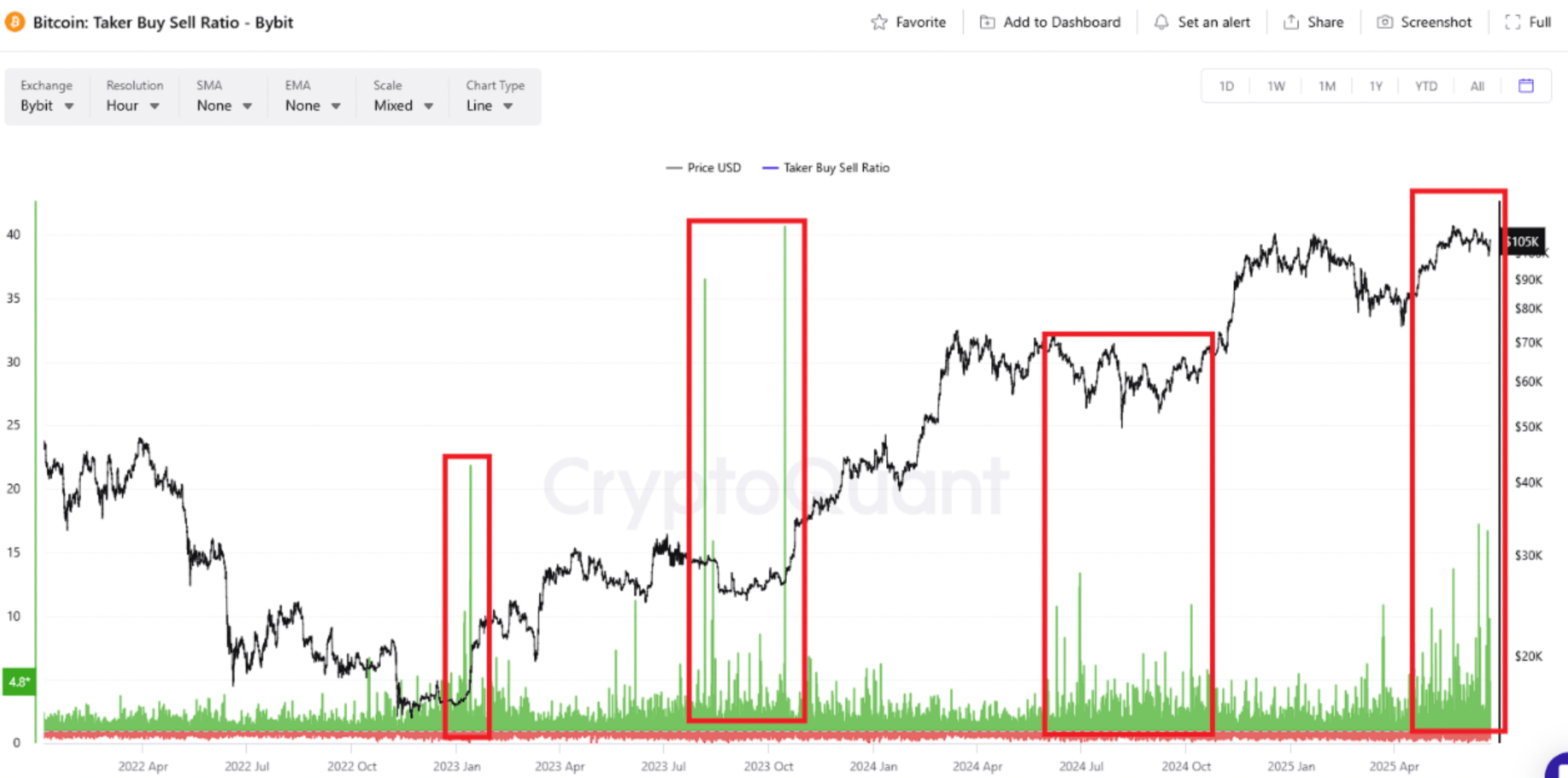

Meanwhile, Bitcoin whales – wallets holding large amounts of BTC – appear to be quietly accumulating in anticipation of a breakout. In another CryptoQuant post, contributor Mignolet noted that whale accumulation has been rising steadily since BTC bottomed in April.

Mignolet pointed out that whale activity typically increases during periods of low market attention or heightened fear, often foreshadowing bullish reversals. Historical data supports this trend, showing that increased accumulation often precedes significant price surges.

Bullish Quarter For BTC

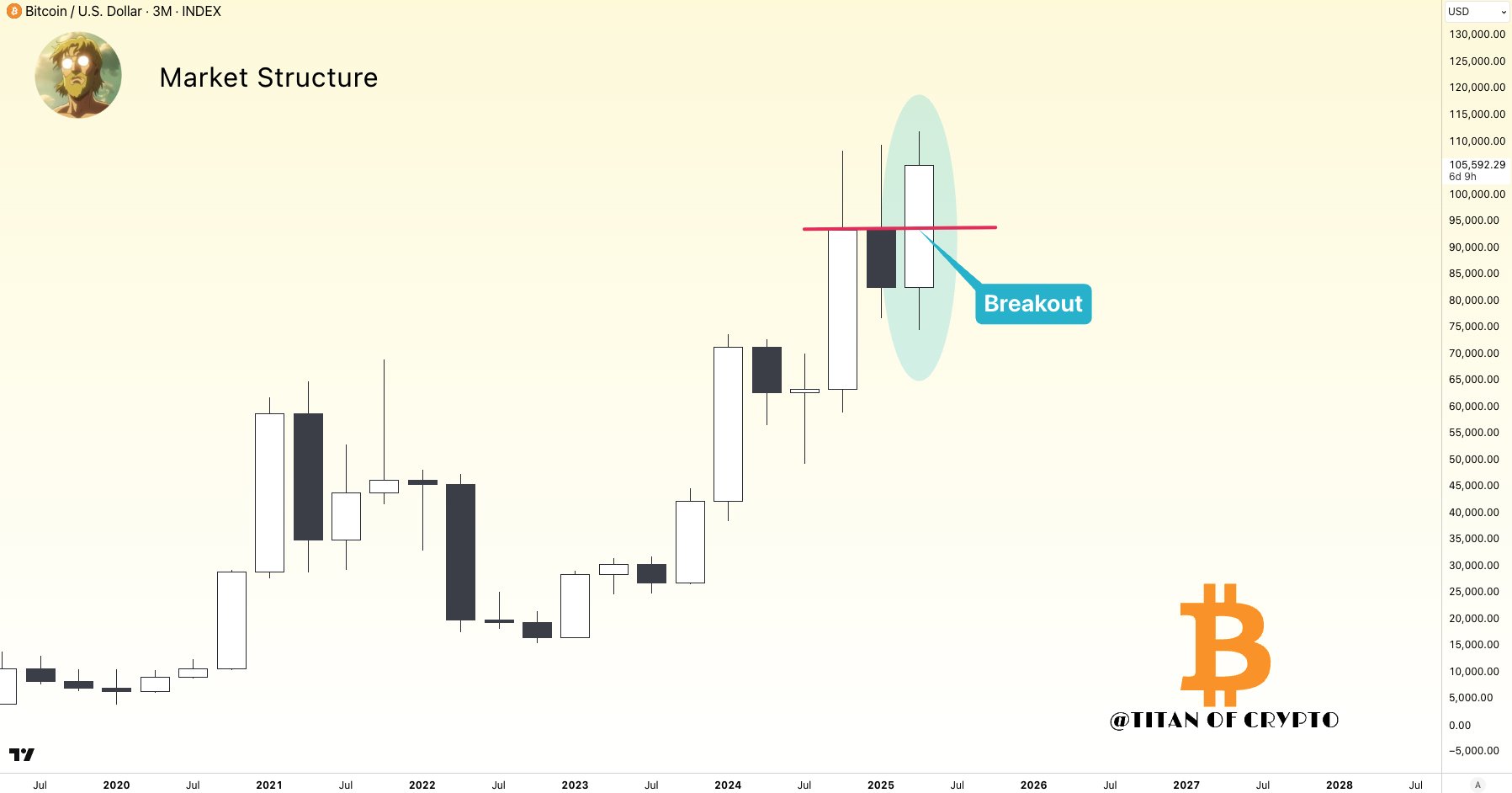

In an X post published today, seasoned crypto analyst Titan of Crypto stated that BTC is set to close a bullish monthly candle, reinforcing the long-term uptrend for the flagship cryptocurrency.

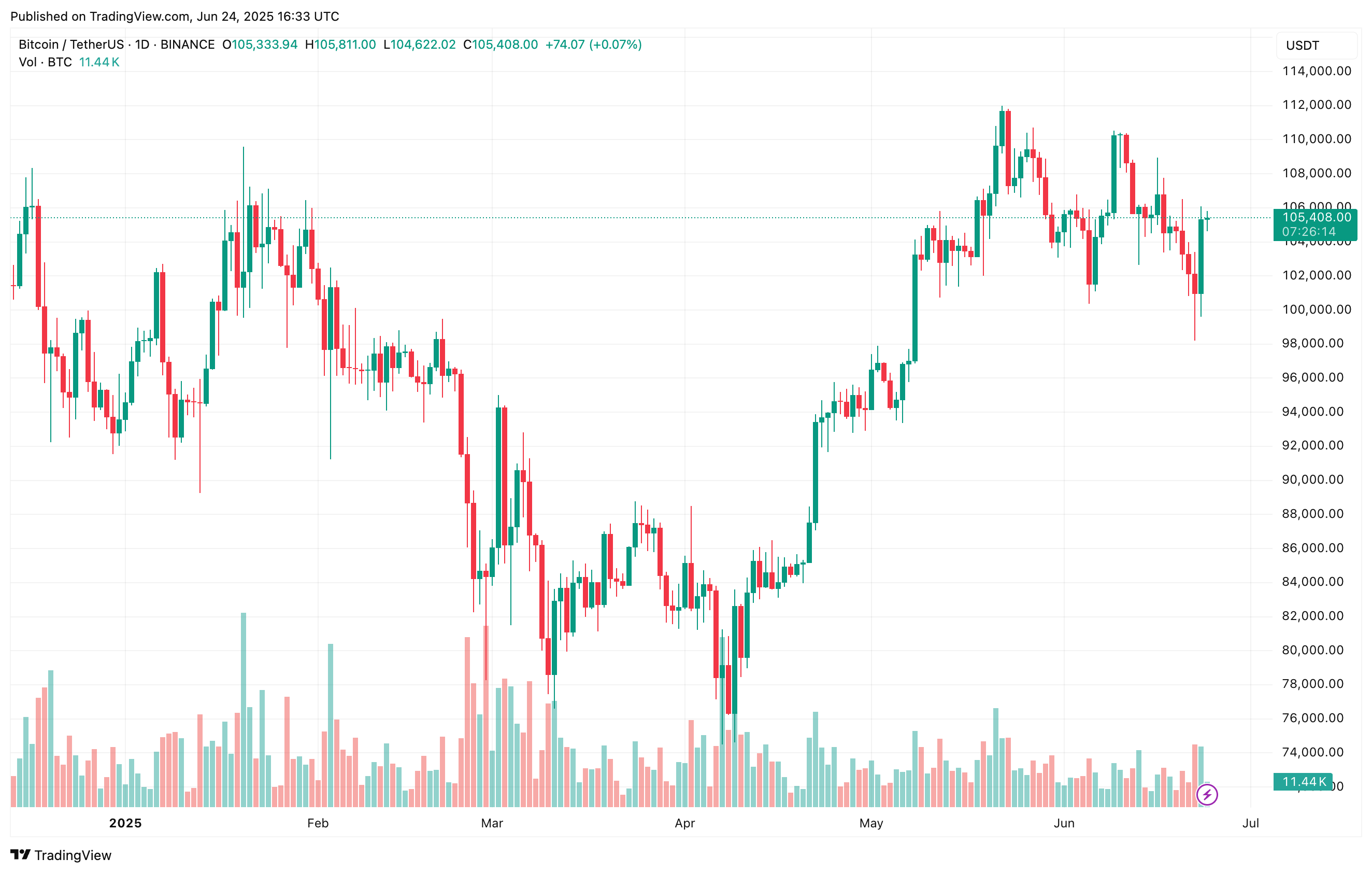

Several other on-chain and technical indicators also suggest further upside potential. For example, Bitcoin Binary CDD shows that long-term holders are continuing to hold rather than sell, indicating strong conviction in BTC’s long-term value.

At the same time, the number of short positions is climbing as BTC consolidates between $100,000 and $110,000. This dynamic raises the probability of a short squeeze, potentially propelling Bitcoin to a new ATH. At press time, BTC trades at $105,408, up 5.2% in the past 24 hours.

GoldenMining Investors Earn Average Profit of $9,800 on Bitcoin Surge Day Stable Daily Income Model Attracts Thousands to Join Global Cloud Mining Platform

As geopolitical developments continue to impact global markets, the cryptocurrency space remains hig...

Dogecoin Price Closes Daily Candle With A Doji, What This Means

The Dogecoin price is in focus, having closed the daily candle with a Doji. Crypto analyst Trader Ta...

Best Crypto to Buy as Polymarket Nears $1B Valuation & BitGo Hits $100B in Crypto Custody

In a sign of crypto’s accelerating maturation, two major developments reinforce how institutional ad...