Ripple Co-Founder Who Predicted $10,000 XRP Returns After 14 Years: Who Is Arthur Britto?

The post Ripple Co-Founder Who Predicted $10,000 XRP Returns After 14 Years: Who Is Arthur Britto? appeared first on Coinpedia Fintech News

Arthur Britto, one of the co-founders of the XRP Ledger and co-founder of Ripple, just posted on X (formerly Twitter) for the first time in 14 years. All he shared was a single emoji, but that was enough to get the XRP community buzzing.

David Schwartz, Ripple’s CTO also confirmed that Britto’s post on social media was authentic and not the result of a hack or account compromise.

The Man Behind the Ledger

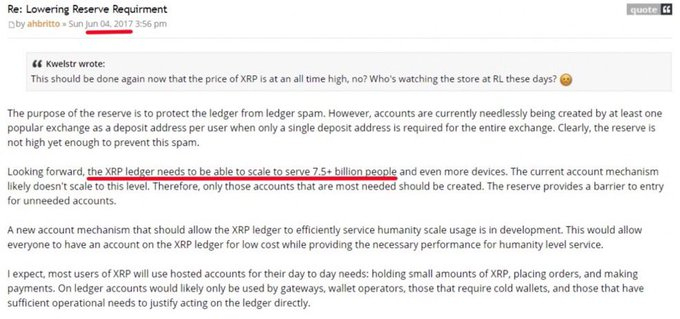

Britto is one of the three original creators of the XRP Ledger, alongside David Schwartz and Jed McCaleb. While McCaleb went on to build Stellar and Schwartz became Ripple’s CTO, Britto stayed out of the spotlight.

Britto has long been linked to the bold statement that “XRP was designed to reach $10,000.” The famous quote appears to originate from a YouTube video published in 2019, which claimed that Britto made this prediction around 2017.

He envisioned a global network that could connect everyone on the planet. To achieve that, he and the team designed the XRP Ledger to be fast, extremely cheap, and scalable enough to support billions of users.

In a 2013 internal memo, Britto had made it clear that XRP was not about hype or price speculation.“The value of XRP is probably less important than the spread. I expect most people and institutions using the ledger to ignore XRP altogether.”

While Britto stayed silent, the XRPL has evolved into a powerful network. It now supports smart contracts, CBDCs, institutional stablecoins like RLUSD, and is widely used for DeFi, NFTs, and cross-border payments.

A Surge in Activity and Key Signals

Britto’s return comes just as XRP Ledger recorded 1.5 million transactions in 24 hours — its highest in four months. At the same time, several major signals are lining up: Record on-chain activity, Ripple IPO rumors, and there are also signs of a new bull market.

The Federal Reserve also recently announced that it will no longer include “reputational risk” as a factor in how banks are examined. This clears a path for banks to engage more freely with digital assets like XRP.

This regulatory shift, the emerging catalysts, and remarks like these hint at something bigger happening behind the scenes. It could be upcoming technology upgrades, insider developments, new global liquidity partnerships, or well-timed strategic moves in response to growing institutional interest.

What XRP Users Are Talking About This Week: Latest Rumors, Predictions & Debates

The post What XRP Users Are Talking About This Week: Latest Rumors, Predictions & Debates appeared f...

Nasdaq-Listed Nano Labs Plans to Buy $1B in BNB — Aiming for 10% Supply Takeover!

The post Nasdaq-Listed Nano Labs Plans to Buy $1B in BNB — Aiming for 10% Supply Takeover! appeared ...

Bitcoin Price Holds Strong at $105K: Short Squeeze Ahead?

The post Bitcoin Price Holds Strong at $105K: Short Squeeze Ahead? appeared first on Coinpedia Fint...