XRP On-Chain Activity Down 80% In 5 Months, Experts Argue Bullish/Bearish Implications

XRP’s on-chain metrics are reportedly painting a foreboding picture for its price outlook, as data shows a steep 80% decline in new wallet creation over the past five months. This drop in network activity has sparked divided opinions between two expert analysts, with one casting doubts on XRP’s ability to reclaim the $3 mark, and the other rejecting such bearish predictions .

XRP Price Surge To $3 Stalled

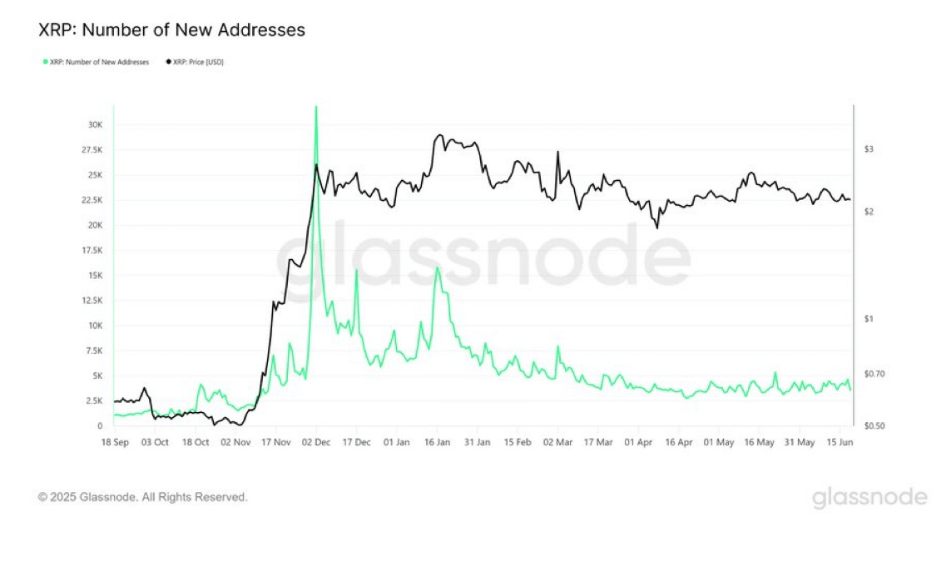

In a recent X (formerly Twitter) post , crypto analyst the ‘Coin Bureau’ highlights that XRP’s momentum appears to be fading fast as new on-chain data from Glassnode reveals a staggering 80% drop in wallet creation since January 2025. This sharp decline in network activity and growth has led the analyst to claim that the XRP price is unlikely to revisit the $3 level anytime soon.

At the height of XRP’s 2024 rally , both its price and user activity surged in tandem. During that time, new wallet addresses soared to nearly 30,000 per day in November, coinciding with a sharp rally that sent the token’s price surging close to $3 . However, the explosive rally proved short-lived, as momentum faded and prices have since reversed.

As of mid-June 2025, Glassnode chart shows that new wallet creation has fallen drastically to around 2,000-5,000 per day, while daily active addresses plunged from 577,000 to just 34,000. XRP’s price, meanwhile, has settled just above $2 and has remained largely range-bound, failing to show signs of a sustained breakout.

According to Coin Bureau, this significant drop in on-chain engagement indicates that interest in XRP may have dried up, removing one of the key drivers behind its previous rally. Without new users entering the ecosystem or existing ones increasing XRP’s on-chain activity, the analyst warns that the conditions necessary for an immediate $3 price reclaim aren’t present.

Analyst Debunks Bearish Forecast

While Coin Bureau’s data paints a picture of declining interest and slow price growth , one crypto expert, known as Moon Lambo on X, has pushed back against the bearish narrative. He argues that XRP’s network activity actually reflects growing strength and long-term confidence.

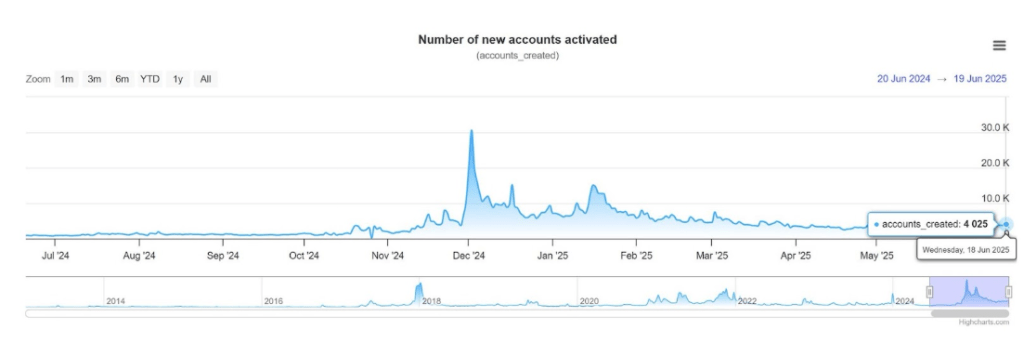

The chart presented by the analyst, covering wallet creation data from June 2024 to June 2025, shows an undeniable spike in network activity between November and early January—a surge that peaked during a period of heightened market enthusiasm following the US elections . As the post-election euphoria faded and investor sentiment cooled off, XRP’s on-chain metrics, like daily new account creations, naturally returned to lower levels.

Moon Lambo indicates that this drop does not reflect weakness in the XRP ecosystem, as Coin Bureau claimed. The analyst argues that the decline in activity was a healthy correction that occurred right after an abnormal spike in activity driven by macro excitement, and not a reflection of any breakdown in XRP’s fundamentals.

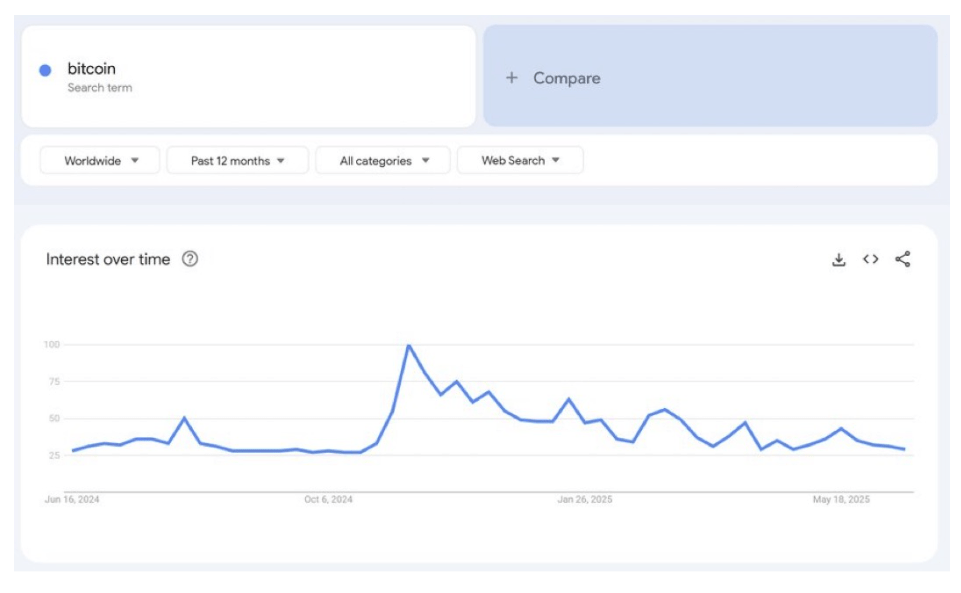

To further support the bullish thesis, Moon Lambo pointed out that Google Trends shows that search interest in Bitcoin has declined significantly, confirming that the lull in on-chain activity is not exclusive to just XRP but reflective of a broader market cool-off.

Rather than declining interest, as Coin Bureau suggests, Moon Lambo indicates that XRP is maintaining relevance and attracting steady new engagement even during quieter market conditions.

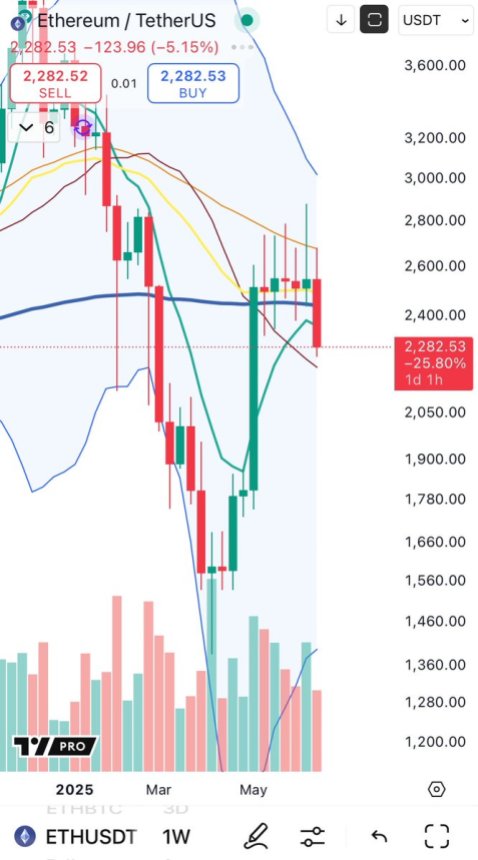

Featured image from Unsplash, chart from TradingView

Solana Cracks Below Key Structure – Head And Shoulders Breakdown Points To $106

Solana has broken down decisively, losing a critical support level following news that the United St...

Ethereum Weekly Chart Nears Tower Top Formation As US Launches Attack On Iran – Details

Ethereum has officially broken below the long-standing range it had maintained since early May, losi...

Pump.fun’s Big Launch Put On Ice Over Legal Drama

Pump.fun’s latest delay has rattled its backers. The Solana‐based memecoin launchpad was set to rais...