Bitcoin Gold Rush 2.0? Treasuries Swell With 60 New Players

Companies around the globe made 60 Bitcoin announcements in five days, signaling a surge in corporate interest. Between June 9 and 13, companies added thousands of BTC to their balance sheets and revealed plans for billions more. This week’s activity shows that more businesses are treating Bitcoin like any other financial asset.

Six New Bitcoin Treasuries Open Doors

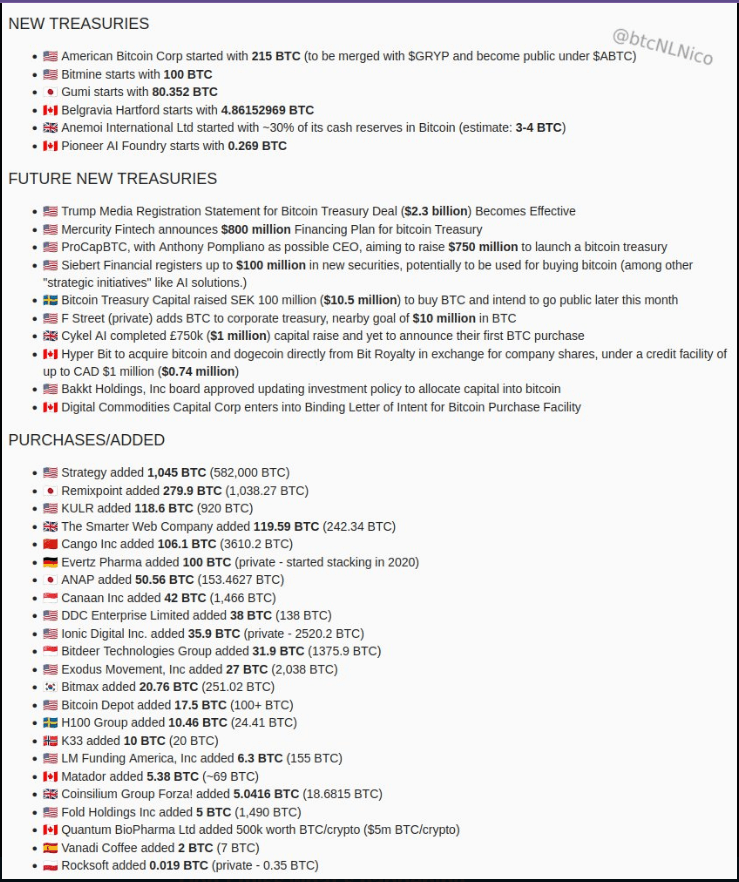

According to data shared by @btcNLNico on X, six firms created fresh Bitcoin treasuries and together added 404 BTC in just one week. American Bitcoin Corp led the pack with an initial purchase of 215 BTC as it moves toward a public merger under the ABTC ticker.

Week 24 – #Bitcoin Treasury Strategy Updates

June 9-13 saw a massive 60 announcements!

– 6 new treasuries launched with 404 BTC – 10 future treasuries announcements – 23 companies added bitcoin, totaling 2,188 BTC – 9 plans to buy more bitcoin, up to ~$1.83 billion… pic.twitter.com/HM9FiZWMvb

— NLNico (@btcNLNico) June 14, 2025

Bitmine and Gumi also made their debut in the corporate Bitcoin club. On top of that, 10 companies—including Mercury Fintech, which unveiled an $800 million financing plan—have filed paperwork or announced intentions to set up their own Bitcoin reserves. Trump Media, owned by US President Donald Trump, even registered for a $2.3 billion Bitcoin Treasury deal.

Existing Holders Expand Their Stakes

Twenty‑three firms bolstered existing Bitcoin piles with 2,188 BTC of new buys. Strategy was the busiest, scooping up 1,045 BTC and closing a $979.7 million IPO on June 10. Remxpoint added 279.9 BTC, KULR took on 118.6 BTC, and Cipher Mining snapped up 111 BTC. Smaller players like Vanadi Coffee and Rocksoft chipped in with between 1 and 10 BTC each.

Based on reports, this wave of buying echoes the rush into Bitcoin ETFs—BlackRock’s IBIT fund alone approached $1 billion in inflows over the same stretch.

Plans Point To $1.83 Billion In Future Buys

Plans Point To $1.83 Billion In Future Buys

Nine companies have spelled out intentions to buy more Bitcoin, potentially fueling $1.83 billion of fresh demand. ANAP has raised funds earmarked for a 585 BTC purchase. Mélioz brought in $32.5 million and set up warrants that could translate into another $69.48 million in Bitcoin. GameStop announced a $2.25 billion convertible note issue, with proceeds tagged for crypto investments.

Asset Tokenization And Capital Raises Take ShapeBased on reports, some firms are going beyond simple purchases. DDC Enterprise and H100 Group plan to tokenize real‑world assets and use Bitcoin as collateral. The Blockchain Group in France kicked off a €300 million capital program and won shareholder backing to raise up to 10 billion euros.

Featured image from Unsplash, chart from TradingView

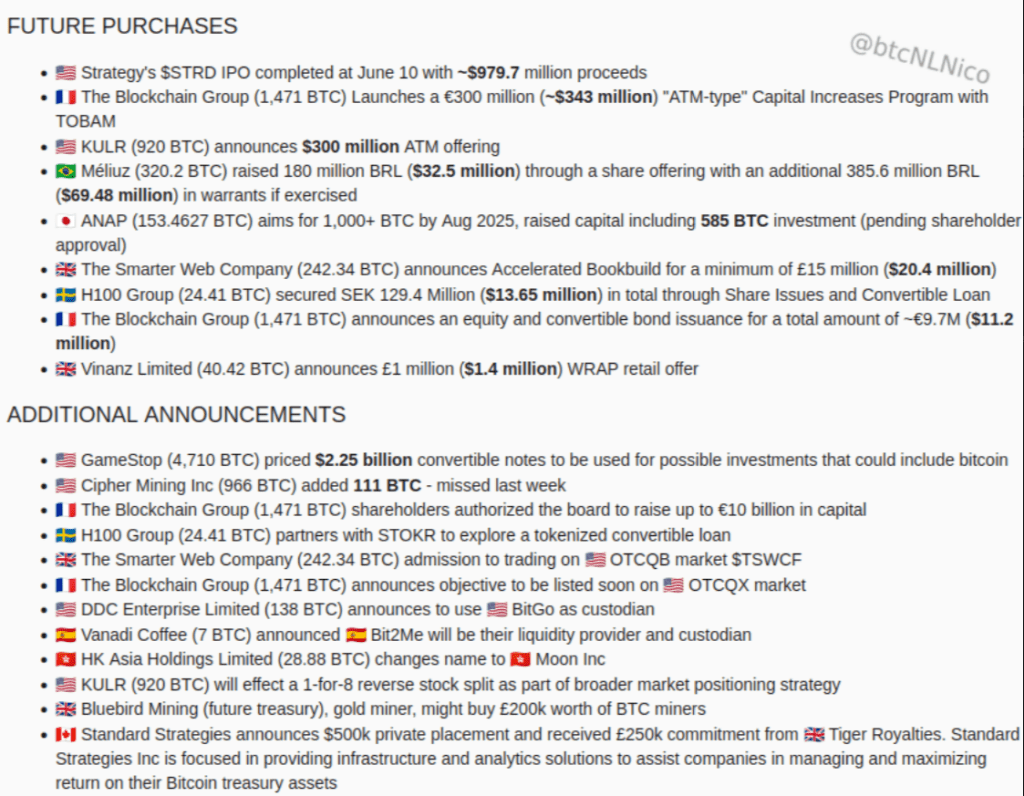

XRP Price Climbs Higher — Is It Finally Turning Attractive to Bulls?

XRP price started a fresh increase above the $2.20 zone. The price is now correcting gains and might...

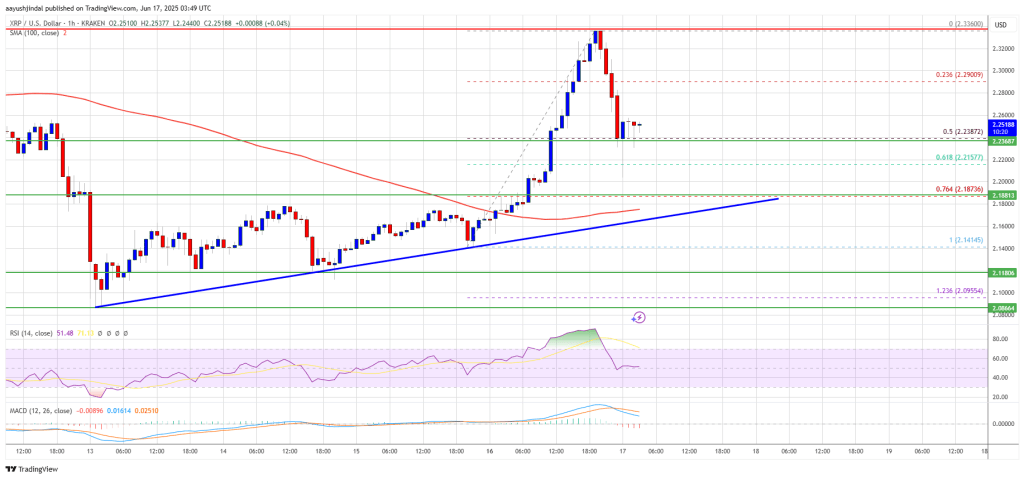

Crypto Funds Hit With Record Outflows, But Altcoin Buyers Smell Opportunity

Crypto asset investment products experienced another challenging week as capital outflows continued ...

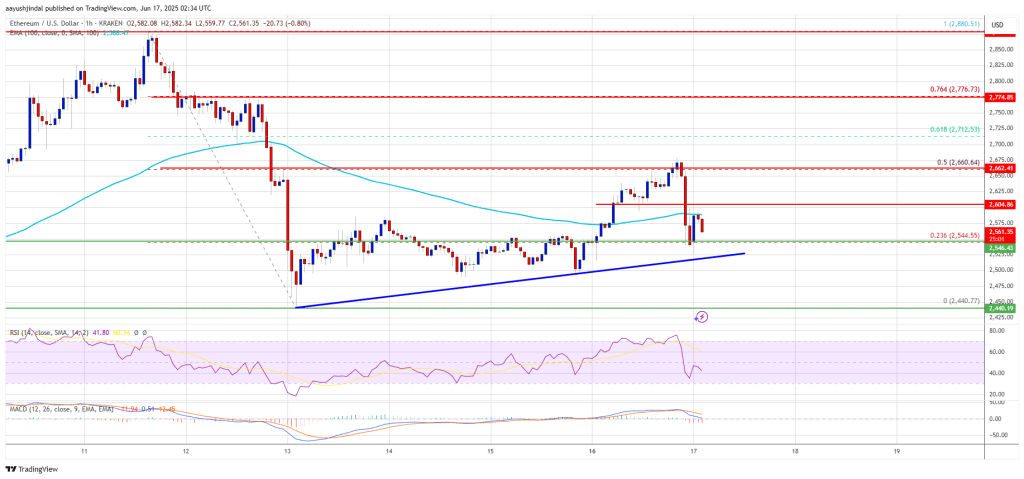

Ethereum Price Shows Weakness, Eyes Key Support as Bears Loom

Ethereum price attempted a fresh increase above $2,600. ETH is now trimming gains and might struggle...