XRP Still Has A Shot If It Can Hold This Level

After a near steady decline over the last week, the XRP price is now struggling as it fluctuates between bearish and bullish impulses. This correction is concerning as it is pushing the price downward toward a Fibonacci level that could spark further decline . Given this, the price must reclaim and hold the $3 level if there is to be any major recovery in the price.

What’s Wrong With XRP?

Crypto analyst CasiTrades outlined the challenges that the XRP price is currently going through and what needs to happen for the altcoin to regain bullish momentum . In the X post, she explains that the failure to rally after a brief bounce above $3 showed that there wasn’t more upward movement to be had. But rather, it was just part of the deeper corrective wave. So far, this has turned out to be the case as the bears were previously able to beat the XRP price below $3 again.

Following the first break below $3, the price had pushed to test the support at $2.75. This level is the 0.5 Fibonacci retracement level, and a sustained break below could trigger more crashes. As Casi explains, this decline was part of a larger ABC wave correction , which is inherently bearish in itself.

However, the fact that the $2.75 remains above the Wave 1 high of $2.65 leads the analyst to believe that overall, the XRP price is still bullish . Mainly, she explains that there are now bullish divergences showing up on the 15-minute chart all the way to the 40-hour chart. This suggests that $2.75 could be the low of the latest decline.

Why $3 Must Hold From Here

Given the establishment of a possible low at the $0.75 level, the next course of action is to reclaim $3 and turn this resistance into support. As the crypto analyst explains, a rise above the $3.21 level and a sustained break are what is needed for confirmation that the decline is finally over. What is expected to follow such a move is a bullish impulse.

If this trend does play out, then the expectation is that the XRP price will be headed for new all-time highs from here. The crypto analyst sees an initial target of $4, which would mean its highest point in over seven years. Then, after that, a possible surge to $4.60-$4.80 serves as the final target.

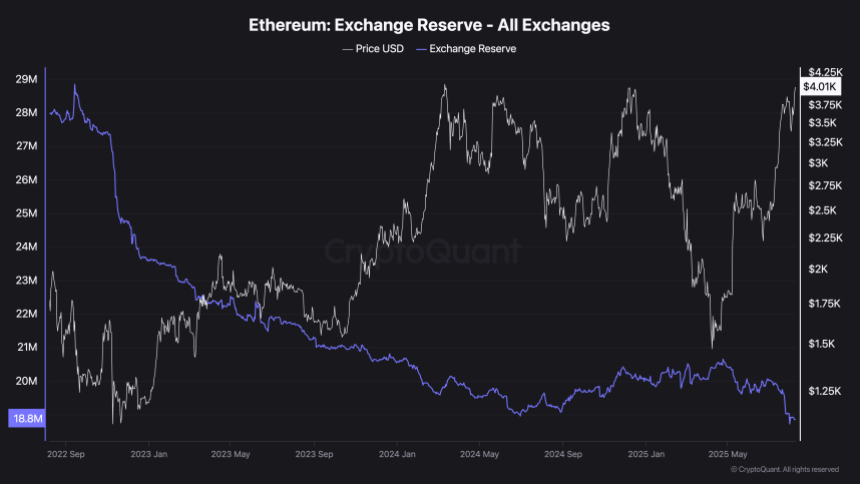

Ethereum Exchange Balances Decline To 18.8M ETH: Smart Money Drains Supply

Ethereum (ETH) has surged above the $4,000 mark for the first time since last December, signaling a ...

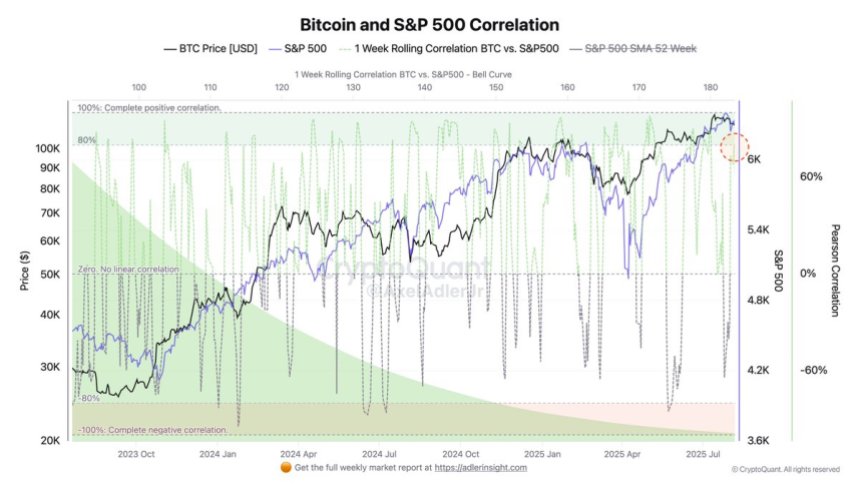

Bitcoin–S&P 500 Correlation Hits 80%, Tying Crypto To Stocks

Bitcoin is trading around key levels after reclaiming the $115,000 mark, with bulls firmly in contro...

Exit Scam? DeFi Protocol CrediX’s Team Vanishes Following $4.5 Million Exploit

The team behind the DeFi protocol CrediX is suspected of an exit scam following a recent $4.5 millio...