EOS Pumps 10.20% as Trump’s World Liberty Fi Accumulates 3.636 Million EOS Tokens, Fuels Rally Hopes

Today, Vaulta (A), formerly EOS (EOS), displayed signs of strength, boosted by a large whale accumulation. The transaction is significant as it has rekindled optimism for a potential rally in the EOS market.

WLF buys $2.996 million EOS tokens

According to Satoshi Club, World Liberty Financial (WLF), a crypto DeFi platform owned by President Trump, spent $2.996 million USDT to purchase 3.636 million EOS tokens at an average price of $0.824.

As reported by the news, this massive whale executed the purchase through PancakeSwap, a popular DEX running on top of the Binance Smart Chain network.

The move shows that World Liberty Financial continues to diversify into other potential assets like EOS. The decision by this large investor to buy this token shows increasing confidence in the EOS platform as an asset with growth potential.

Whale accumulation normally indicates bullish sentiment, as whales often believe the asset has potential and anticipate its growth in the near future.

Whales purchase (like this one) often trigger a stronger sense of enthusiasm in the market and lead to greater market demand and a price uptick.

EOS rebrands to Vaulta

This colossal purchase by the renewed World Liberty Financial has been felt in the EOS price. Today, the asset pumped its price by up to 10.20%, currently trading at $0.8316 – the highest gain recorded in a single day since May 7. Further, the surge pushed the asset’s market valuation to $1.3257 billion, an increase of 9.67%.

EOS has been in a correction mode over the past week, with its price remaining down 2.4% in the last seven days. Despite the consolidation, several indicators currently show signs that the asset is preparing to make impressive rebounds.

First, yesterday, May 15, 2025, EOS underwent a significant revamp that enabled it to abandon its EOS brand and rebrand its business name to Vaulta (A). This development agenda is part of the catalysts behind EOS’s upcoming price recovery as it boosts the asset’s appeal.

This transition will enable EOS holders to convert their assets to A at a 1:1 ratio. The swapping process started on May 15 and will be completed over the next four months.

Also based on this business advancement program, Vaulta is working on plans to upgrade its platform to become a Web3 bank, aimed at enabling a seamless connection between TradFi and DeFi.

The rebrand is strategic in nature as the platform plans to integrate DeFi products with traditional financial networks and provide numerous services, like wealth management, consumer payments, among others. Vaulta also plans to offer portfolio investment opportunities, where customers can engage with RWAs and DeFi investment products.

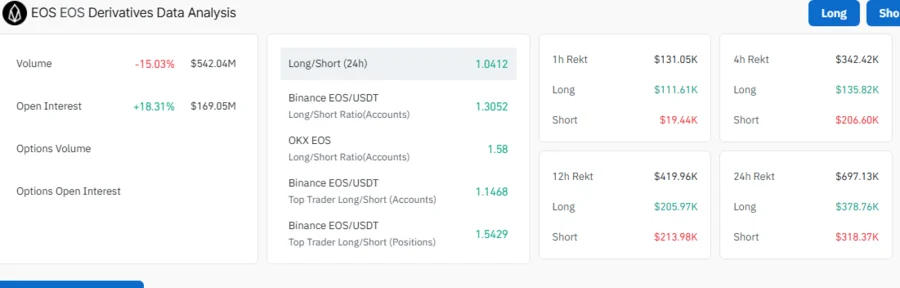

The upgrade initiative appears to have infused renewed enthusiasm in the market. According to metrics from Coinglass, EOS’s Open Interest (OI) increased by 18.31% from yesterday. Normally, a rise in Open Interest shows that derivatives traders are increasing in the market, expanding their premiums in the market. This not only signals rising confidence in the market but also shows a looming price hike.

Quack AI Teams Up with Morph for Smarter DAO Governance

Quack AI and Morph partnership targets to evolve smart governance across multichain networks and dec...

Stablecoin Market Reaches $246.5B as USDT and USDC Dominate 85% of Sector

Stablecoin market hits $246.5B with USDT and USDC holding over 85% share as smaller tokens show risi...

Today’s Top 10 Crypto Performers amid Market Consolidation: IP, EOS, HYPE, KAS, AAVE, and Others

This list highlighted insights into the top-performing crypto assets that are attracting attention. ...

Trump-backed

Trump-backed