Where’s Next Major Dogecoin Resistance? On-Chain Data Points To This

On-chain data suggests this upcoming Dogecoin level could prove to be a resistance wall based on the investor cost basis distribution.

A Large Amount Of Dogecoin Was Last Purchased At $0.36

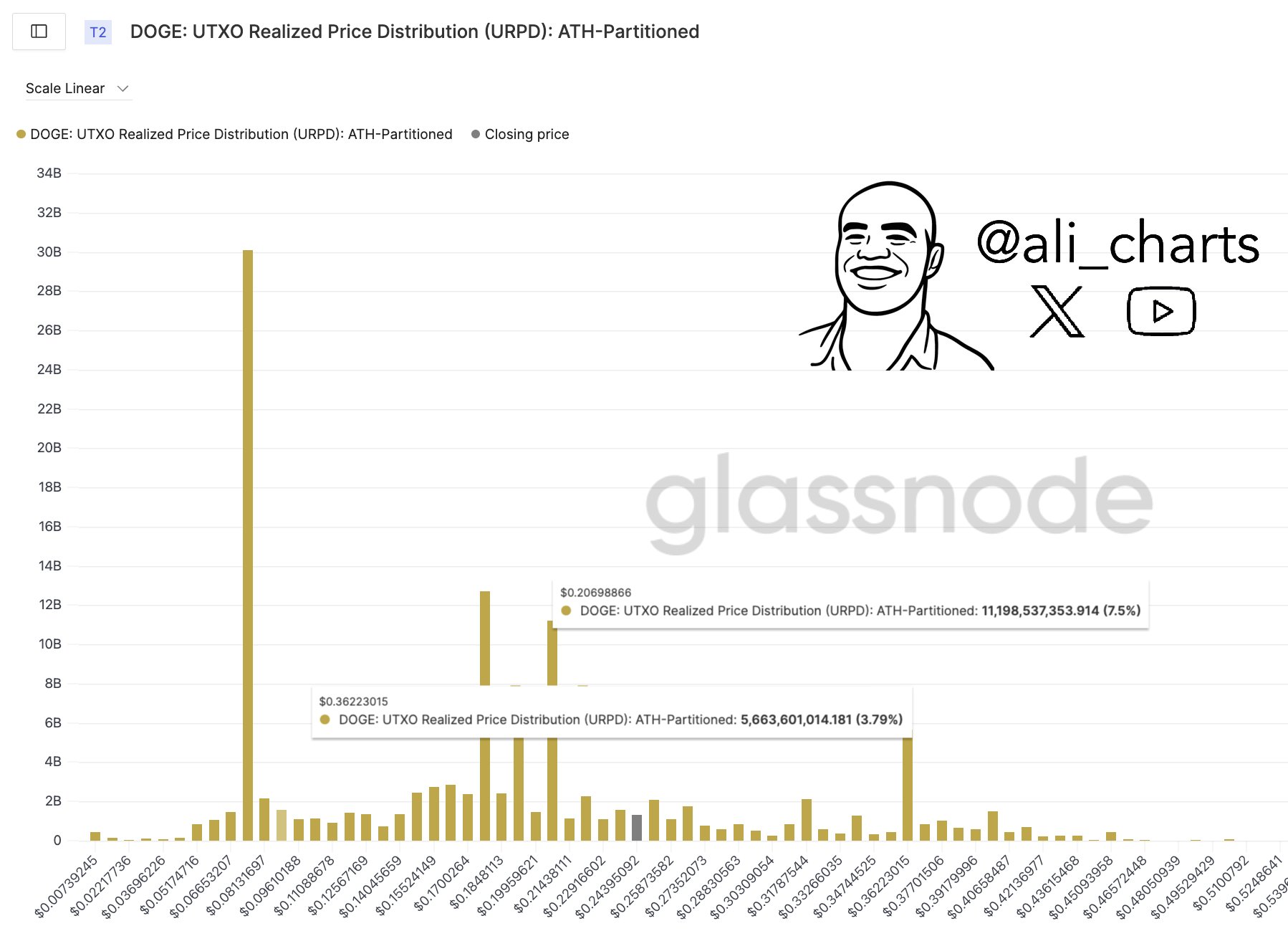

In a new post on X, analyst Ali Martinez has talked about Dogecoin levels that appear significant on the UTXO Realized Price Distribution (URPD) of the memecoin. The “ URPD ” refers to an on-chain indicator that basically tells us about how much of the asset’s supply was last purchased at which price levels. The metric determines this cost basis for each token by checking its transaction history to see its last transfer price.

Here is the chart shared by the analyst that shows the latest URPD data for Dogecoin:

As displayed in the above graph, there are no levels immediately nearby to the current Dogecoin price that hold the break-even mark of a significant portion of the supply. The closest level that stands out in the URPD is around $0.21, which hosts the acquisition point of 7.5% of the DOGE supply. For the up direction, there aren’t any notable cost basis centers until all the way to $0.36, where investors last bought about 3.8% of all tokens in existence.

Now, what’s the relevance of these levels to Dogecoin? To know the answer to that question, investor psychology needs to be understood first. To any holder, their cost basis is naturally an important level, so they can be prone to showing some kind of reaction when a retest of it happens.

Whatever this reaction be, it’s not of significant to the cryptocurrency if only a few investors are showing it. For retests of levels that host the cost basis of a large amount of holders, however, the story can be different. The aforementioned levels could be important ones from this perspective.

Generally, investors tend to react by buying if the retest is happening from above, granted the mood in the market is bullish. This is because these holders, who were in profit prior to the retest, might look at the price decline as just a ‘ dip .’

On the other hand, the holders who were in loss before the retest may decide to sell their Dogecoin, as they could fear that this might be their last opportunity to exit at their break-even for a while.

As such, major supply walls below the DOGE spot price can act as potential support zones, while those above it may prove to be resistance areas. Given that the closest two such levels are at $0.21 and $0.36 for the asset right now, they may be where the coin could be the most probable to encounter strong support and resistance, respectively.

DOGE Price

At the time of writing, Dogecoin is floating around $0.237, up more than 37% in the last seven days.

Bitcoin Exchange Stablecoins Ratio Surges—A Warning For Investors?

On-chain data shows the ‘Exchange Stablecoins Ratio’ for Bitcoin has shot up recently. Here’s what i...

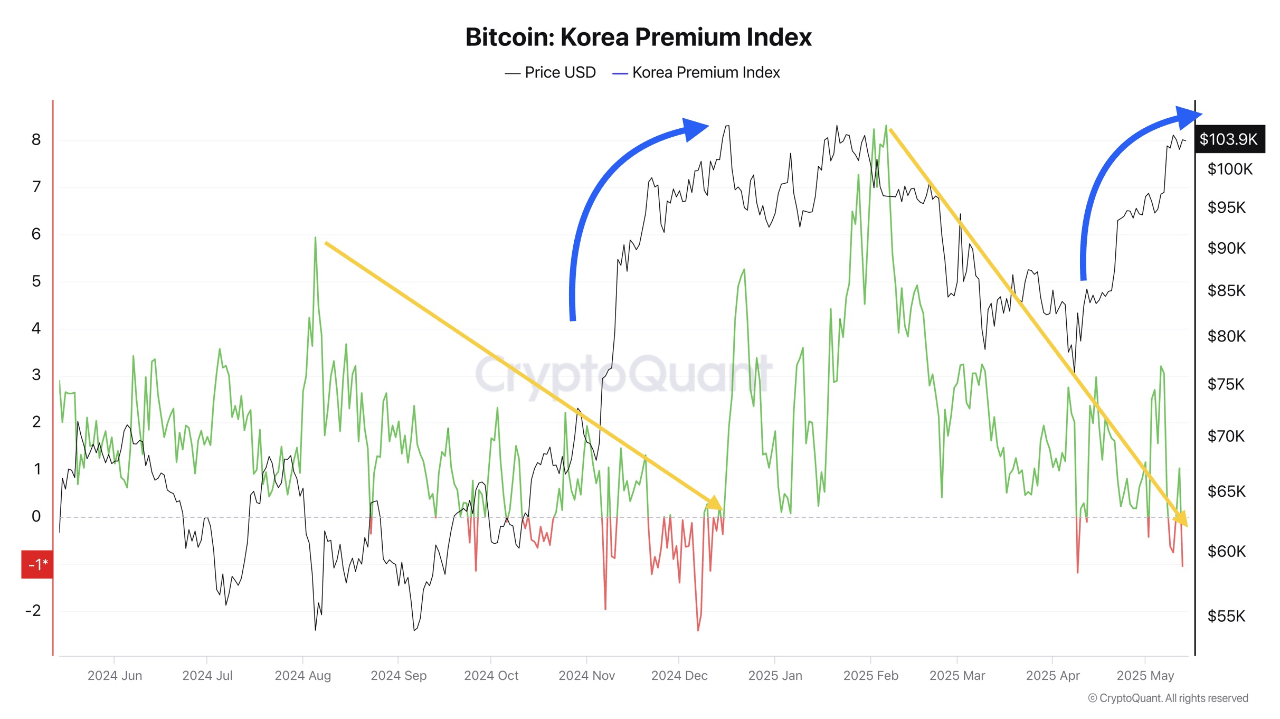

Bitcoin Tops $104K as Global Market Momentum Outpaces Korean Demand

Bitcoin has continued its steady ascent, with the asset now trading above $103,000. This marks a 0.4...

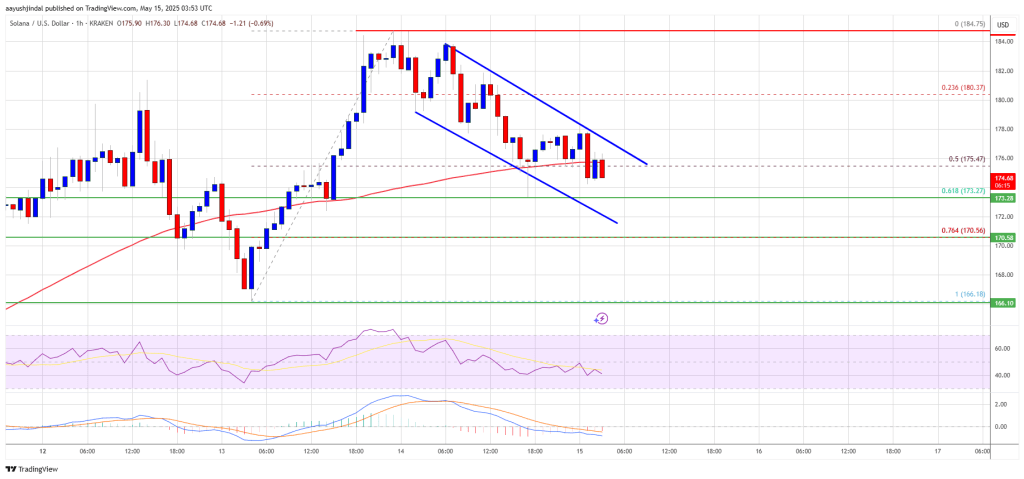

Solana (SOL) Finds Support — Rally May Be Ready to Resume

Solana started a fresh increase above the $175 zone. SOL price is now correcting gains and might fin...