$35B Capital Inflow Signals Bullish Continuation Across Crypto Market

- More than $35 billion was invested in crypto over three weeks, thanks to lower inflation and improved market feeling.

- Bitcoin reached over $104,000, with Ethereum going up 9%, creating gains in top assets.

- Meme tokens and altcoins increased in value, and short sellers shed over $239 million from liquidation.

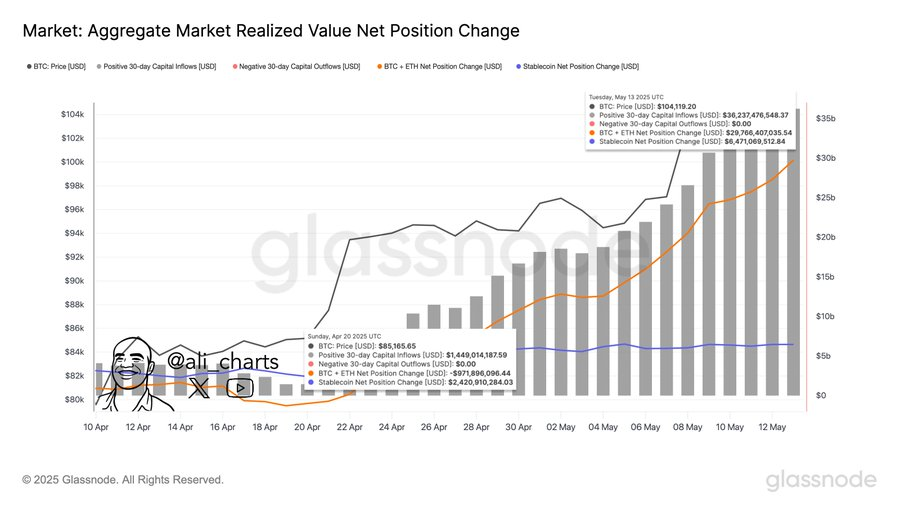

According to Glassnode’s on-chain data, over the last three weeks, more than $35 billion in capital has entered the cryptocurrency market. The influx aligns with a broader shift in investor sentiment, which has turned increasingly bullish as inflation data came in softer than expected and geopolitical trade tensions eased.

Bitcoin ($BTC) is still above the $100,000 mark on Wednesday and rose by 1.4%, while Ethereum ($ETH) gained 5%. The rise came soon after the U.S. April CPI report showed inflation up 2.3% from the previous year, missing forecasts of 2.4% and reaching its lowest level since February 2021. Lower-than-expected inflation figures motivated purchasers to buy into Bitcoin and Ethereum, resulting in their net position moving above $27.4 billion.

According to Glassnode’s chart, stablecoin holdings also grew steadily by an additional $7.4 billion over the same time frame. The persistence of stablecoin net inflows tells us that investors are getting ready to invest more in digital assets , possibly supporting broad gains.

Altcoins Rally as Ethereum Outpaces Bitcoin

Ethereum’s latest strong weekly performance, coming close to a 50% seven-day increase, has heightened talks about the arrival of an altcoin season. Although there is a lot of positivity, the altcoin season index still shows Bitcoin has the upper hand. However, Ethereum’s rise and the upswing in utility, meme, and AI tokens point to a greater interest in variety among investors.

Shiba Inu (SHIB), Dogecoin (DOGE), PEPE, and TRUMP were among the meme tokens to rise between 4% and 8% each day. AI token prices rose, too, with Fetch.ai (FET), Internet Computer (ICP), and Render (RNDR) all up between 4% and 8%.

The overall crypto market cap was above $3.5 trillion for the first time since February. Crypto assets, excluding Bitcoin, are just 6.33% away from touching a fair value gap ceiling of $1.34 trillion. According to the trend, a breakout is likely if things continue this way.

Liquidations Mount as Shorts Collapse

The price surge closed many short positions, especially on Ethereum. Over the past 24 hours, Coinglass tracked the liquidation of more than $239 million in short positions, with $109.24 million coming from Ethereum. $37 million in Bitcoin short positions were liquidated, with the biggest loss belonging to one trader on Binance for $12 million on an ETH/USDT trade.

Following Trump’s announcement about interest rate cuts at the Fed, investor sentiment has gotten even stronger. His remarks helped push up prices in both crypto and U.S. equity markets. Recently, the S&P 500 reversed earlier tariff-linked declines and is now up 0.31% for the year.

An additional bullish signal comes as Bitcoin’s spot Taker Buy/Sell Ratio has risen to 1.02 — a mark typically related to big uptrends. According to CryptoQuant statistics, two prior similar readings came before big rallies from $15,000 and after the $30,000 resistance zone.

Bitcoin Trades Near $104K as Realized Price Yield Signals Cooling Profits Amid Bullish Trend

Bitcoin ($BTC) trades near $104K as realized price yield moderates and trading volume dips, signalin...

South Korea’s Election Sparks Momentum for Bitcoin ETF Approval

Ki Young Ju confirms South Korea’s presidential candidates support Bitcoin ETFs, raising hopes for r...

Cardano Price Prediction Holds as ADA Eyes $2 and Qubetics Surpasses $17M in Presale

Cardano price prediction strengthens with ADA nearing $1, while Qubetics gains momentum as the best ...