After getting off to a strong start this year, the price of Bitcoin cooled on Monday, as little has changed for the market leader.

Following a pullback from its late-2025 peaks, the top token has been oscillating in recent trading sessions between the mid-$80,000s and low-$90,000s.

Buyers have been actively entering the market on dips, while sellers are firmly holding the resistance level.

After failing to hold its $91,500 level, the price of Bitcoin has started to decline. Bitcoin has entered short-term negative territory after falling below $92,000 and $91,200.

The token was last trading around the $90,500 mark.

According to TradingView analysis, the value even fell below $90,500 and approached $90,000. The price has established a low at $89,225 and is currently making efforts to initiate a new upward movement.

The price has surpassed $90,500 and has risen above the 23.6% Fibonacci retracement level following the recent drop from the $93,770 peak to the $89,225 trough.

Bitcoin & the Threat to the Fed

After new legal developments involving Federal Reserve Chair Jerome Powell, Bitcoin soared beyond the $92,000 barrier late Sunday.

Powell made a decisive move when he decided to publicly address the subpoenas from the DOJ and the criminal investigation, which he characterized as political interference pertaining to the administration's interest rate preferences.

"The possibility for criminal charges stems from the Fed making decisions on rates based on our best judgment of what serves the public, rather than appealing to the President's preferences," Powell said in a video posted on Sunday evening, addressing US President Donald Trump directly."

BREAKING: Fed Chair Powell responds after Federal prosecutors open a criminal investigation into him:

— The Kobeissi Letter (@KobeissiLetter) January 12, 2026

“The threat of criminal charges is a consequence of the Fed setting rates based on our best assessment of what will serve the public, rather than following the preferences of… pic.twitter.com/y1dRdoQ1fm

However, speaking to reporters, Trump denied any knowledge of the grand jury investigation.

A sharp upswing occurred in the price of Bitcoin and the crypto sector as a whole in response.

Timing is crucial for those involved in crypto trading: the Fed is approaching its meeting on January 28, with the market showing a growing expectation for a pause in rate cuts, heightening awareness of any indications that monetary policy may be influenced by political disputes.

The renewed attention on Bitcoin as a non-sovereign risk asset could be advantageous, especially in light of the ongoing criminal investigation involving the Chair of the US Federal Reserve, Jerome Powell.

Federal prosecutors have initiated a criminal inquiry regarding Powell's testimony before a Senate committee concerning the renovations of the Fed's buildings.

A price chart showing Bitcoin's recent run beyond $92,000 supports this story, but the same legal and political factors that lend credence to the idea of "neutral money" may also increase volatility.

The hourly chart of the BTC/USD pair indicates a breakout above a downward trend line, facing resistance at $90,750.

Should the price hold steady above $90,500, there may be an opportunity for a new upward movement.

Current resistance is close to the $92,000 mark and aligns with the 50% Fibonacci retracement level from the recent drop, which started at the $93,770 peak and fell to the $89,225 trough.

The initial significant barrier is around the $92,650 mark.

On the other side, the first major support is near the $90,500 barrier.

Around the $90,000 mark is the next support level. If prices keep falling, they are likely to reach the $89,250 support level soon. The main level of support is at $88,000; a quicker fall in the short term is possible if BTC falls below this level.

The grand jury inquiry presents immediate political challenges for all risk assets, especially US stocks.

Nonetheless, a significant adjustment in the stock market could lead to increased interest in Bitcoin's unique characteristics that are independent of government influence.

In the meantime, analysts indicate a steady enhancement in the outlook of crypto investors, suggesting a higher likelihood of a rebound in the crypto market.

Breakout Anytime Soon?

Notably, the current technical reading mirrors the pattern Bitcoin established prior to its previous surge that ultimately drove its price to a lifetime high of above $126,000.

A detailed analysis by TradingView of the daily candlestick chart of BTC price fluctuations demonstrates that the leading token is exhibiting behavior similar to what was seen from March to May 2025.

In the beginning, Bitcoin was very stagnant, spending weeks in a range of about $76,000 to $86,000 without ever managing to break beyond that level.

During that time, Bitcoin's price stuck above support levels and made lower lows inside the range on a regular basis, indicating that there wasn't much room for quick increases.

The range-bound trading ultimately demonstrated itself as a foundation.

Once Bitcoin surpassed the upper limit of that range at $86,000, the sentiment shifted rapidly, setting the stage for a significant upward movement that ultimately propelled Bitcoin.

The existing framework exhibits similar traits, merely elevated to a greater level.

The current price of Bitcoin is fluctuating between roughly $84,000 and $94,000, showing a compression pattern reminiscent of early 2025.

It now appears that the $94,000 level is the critical zone impacting Bitcoin's continuous higher price trend.

The price of Bitcoin came close to this area during its early January rise; on January 5, it briefly reached $94,500 before meeting resistance and retracing into a slump.

Now that we have overcome the last rejection, we can turn our attention to what Bitcoin could do after it breaks past this level of barrier.

The past performance serves as a valuable benchmark for anticipating potential outcomes following a confirmed breakout.

Following Bitcoin's breakthrough past $86,000 during last year's consolidation phase, it experienced a significant upward trajectory over several months, ultimately achieving a peak price of about $126,080.

The action resulted in an increase of approximately 46% from the breakout point.

While each price movement is unique, the parallels between the current situation and last year's framework indicate that Bitcoin might be accumulating momentum beneath resistance levels once more.

If Bitcoin experiences a similar growth trajectory after surpassing $94,000, the anticipated upside targets could reach slightly beyond $126,000, potentially resulting in a new all-time high.

Other Technical Readings

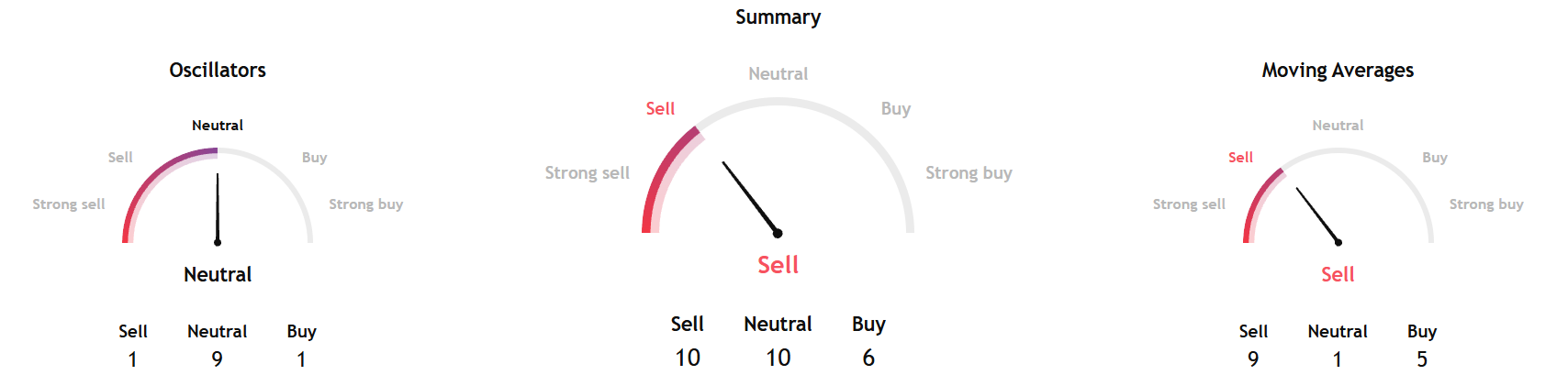

TradingView's technical analysis overview based on key data from moving averages, oscillators, and pivots, pointed to a sell stance for the weekahead.

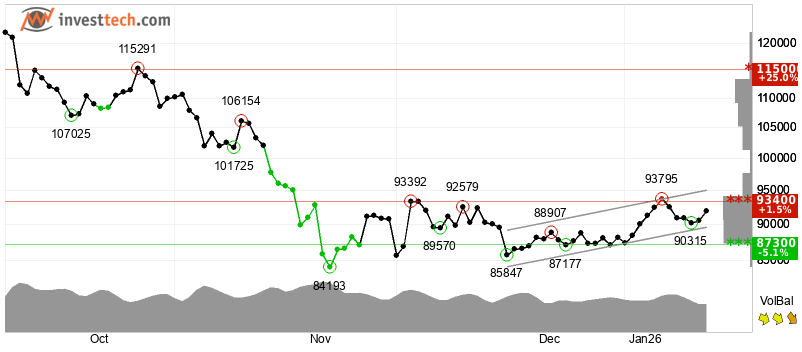

Separately, InvestTech's algorithmic overall analysis pointed to a weak negative.

The firm said, "Bitcoin shows strong development within a rising trend channel in the short term. This signals increasing optimism among investors and indicates a continued rise. The token is approaching resistance at $93,400, which may give a negative reaction."

InvestTech added, "However, a break upwards through $934,00 will be a positive signal. The RSI curve shows a rising trend, which supports the positive trend. The token is overall assessed as technically neutral for the short term."

Overall recommendation in the one to six weeks points to a hold stance.