ADA at $0.36: Patience Costs More in a Thin Market

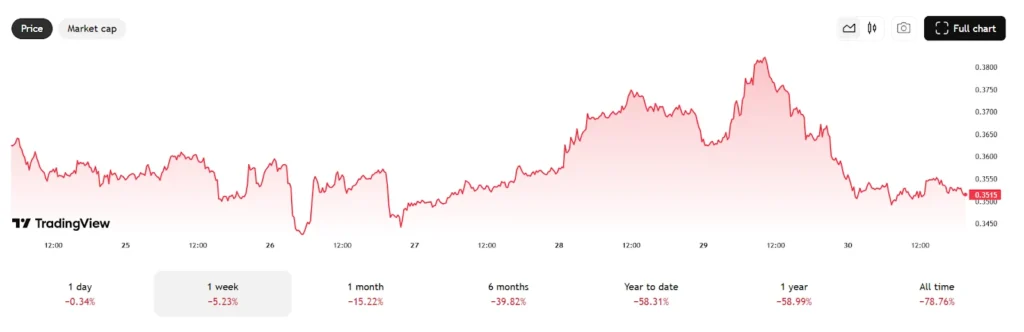

Cardano has a reputation for doing things the slow, careful way. That mindset built a loyal base of long-term holders who value research, stability, and strong infrastructure. In late December 2025, ADA was trading around $0.36, moving within a narrow $0.35–$0.36 range, down around 3% in the past 24 hours, with a market cap near $12.7 billion and 24-hour volume around $629 million.

That price level is not proof that Cardano failed. It is a signal of something simpler: market conditions punish timelines. In a period marked by lower liquidity and cautious risk-taking, capital tends to drift toward ideas that feel closer to completion, easier to measure, and quicker to use, often reshaping how investors think about the best altcoins to buy now during slow market phases. This is where Digitap ($TAP) keeps showing up in conversations around working value versus waiting value.

Cardano remains a major network with a strong brand. The shift happening now is less about ideology and more about math: time, downside, and what an asset actually helps accomplish during a slow market.

Cardano’s ADA remains range-bound near $0.35–$0.36, highlighting the opportunity cost of parked capital during low-momentum phases. (Source: TradingView )

The Quiet Reason Cardano Holders Rotate

Cardano veterans tend to value fundamentals, not noise, which often mirrors how crypto for beginners eventually learn to prioritize usability and downside protection over short-term excitement. That makes the current rotation especially telling, because it does not look like a stampede. It looks like a controlled adjustment.

In bear markets, priorities change. The typical hold-and-wait strategy becomes harder when day-to-day moves feel unproductive, and the broader market lacks momentum. Long-cycle holders often start looking for positions that provide at least one of the following: usable tools, cash-like stability, or a clearer path between growth and real demand.

Cardano’s foundation is built on a research-first approach, including a proof-of-stake design called Ouroboros , which Cardano describes as peer-reviewed and research-based. That kind of rigor attracts patient builders and patient investors. The problem is that markets do not always reward rigor on a schedule. Price can lag even when the technology improves.

This is where a second position begins to make sense: keeping long-term beliefs intact while reassessing what the best cryptocurrency to invest in right now looks like under bear-market conditions, where practical utility and defensive mechanics matter more than distant potential.

Why Digitap ($TAP) Fits the Capital Working Mindset

Digitap’s appeal in this comparison is not better tech. The appeal is a different job.

Cardano is often treated as a long-term network bet. Digitap is framed as a working system built around everyday finance. Digitap presents itself as a crypto-to-fiat (crypto-to-cash) banking product with the $TAP token tied to ecosystem benefits like rewards and reduced fees. That framing matters in a bear market, because utility can be explained without asking anyone to believe in a future that may take years.

Digitap’s bear-market story leans on defensive ideas:

- Stable settlement logic, designed to move incoming crypto through fiat rails and into spendable balances more efficiently,

- System value rather than chart value, and

- Token mechanics are designed to reduce dilution pressure over time.

That defensiveness is reinforced by Digitap’s underlying mechanics. The platform operates with a fixed 2 billion token supply, uses app-generated revenue to fund buy-backs and token burns, and supports stable settlement options that allow incoming crypto to be converted into spendable cash. In a falling market, those features are designed to limit dilution and reduce exposure to sudden price swings.

Digitap also offers tiered KYC, allowing users to choose between a no-KYC wallet setup or verified tiers that unlock higher limits and access to offshore banking features through regulated partners, depending on their needs.

Digitap’s campaign materials describe a presale price ladder with a large gap between current stages and a planned listing price, framing the difference as an equity buffer for early participants. Those same materials commonly cite numbers such as $0.0399 as a current presale price, a next step near $0.0411, and a planned listing price of $0.14, alongside progress like Round 3 nearly sold and $3.2 millions raised.

ADA vs. $TAP: A Cleaner Comparison Than “Old vs New”

The comparison works best when it stays fair.

Cardano’s strengths are clear: a recognized network, a large community, and an identity built around research and careful execution. Ouroboros and the proof-of-stake design are part of that long-term trust-building. For long-horizon investors, that still matters.

The friction is that ADA’s market reality today reflects a slower reward cycle. With ADA around $0.355, market cap near $12.7B, and heavy volume still flowing, the asset remains widely traded. But widely traded is not the same thing as actively compounding value. During low-momentum periods, large-cap coins can feel like parked capital.

Digitap and $TAP are framed differently. The pitch is not “replace Cardano.” The pitch is “add exposure to a system designed to function in the meantime.” Utility-led positioning is meant to reduce reliance on hype cycles. Presale mechanics are meant to create a predictable ladder rather than a purely reactive market price.

During the holiday period, Digitap has also introduced a limited-time rewards campaign tied to its presale, adding extra incentives while the broader market remains cautious.

Digitap as the Next Chapter for ADA Holders Who Want Motion

Cardano veterans tend to think in cycles. That experience often produces a practical instinct: protect downside, stay rational, and look for asymmetric setups when the broader market is tired.

ADA at around $0.35–$0.36 reflects a market that is still cautious. Some holders respond by waiting longer. Others respond by rotating part of their attention toward systems that emphasize utility, defensiveness, and clearer “why now” timing.

Digitap fits that second path because the story is built around working finance, not just a future narrative. A live product claim, ecosystem benefits tied to $TAP, and presale-style ladder framing combine into something that looks less like a lottery ticket and more like a structured early-stage bet.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app Website: https://digitap.app Social: https://linktr.ee/digitap.app Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

This article is not intended as financial advice. Educational purposes only.