The recent selling pressure in Bitcoin has placed considerable strain on Michael Saylor's approach, leading to a notable drop in Strategy's (MSTR) stock value and drawing heightened attention from analysts.

Saylor, in response to the uncertain market, has downplayed those worries.

I Won’t ₿ack Down

— Michael Saylor (@saylor) November 23, 2025

The downturn in the cryptocurrency market has dashed the aspirations of both institutional and retail investors involved in digital assets, and even Strategy has not been immune to the turmoil.

The impact on Strategy has been severe so far, with Bitcoin's over 36% crash from its all-time high of above $126,000.

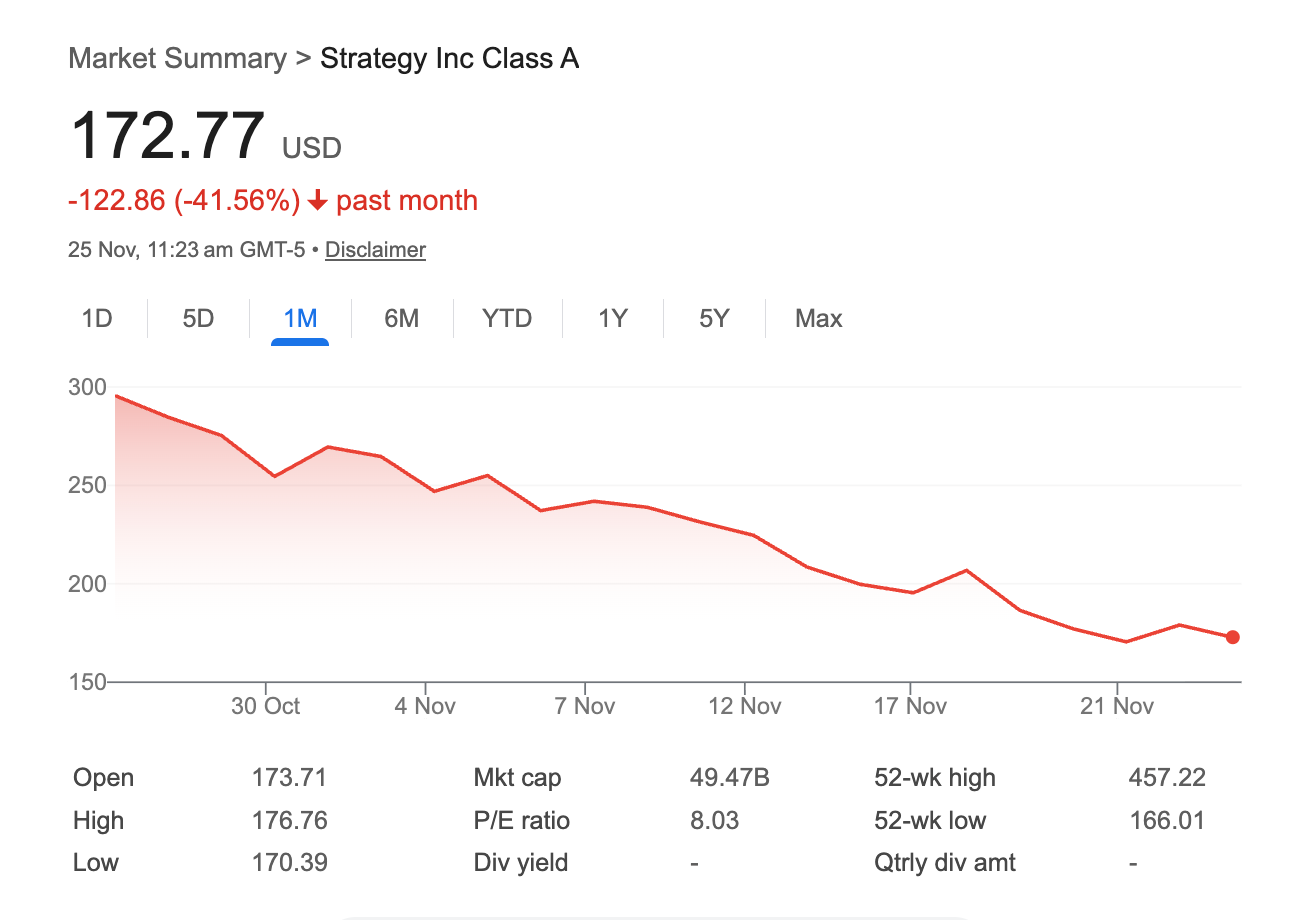

Outpacing the top token's slide, Strategy's stock has fallen more than 67% from its 2025 top and more than 40% over the past week.

Strategy often acts as a magnified reflection of Bitcoin's performance. A drop in MSTR's price may adversely affect overall sentiment in the broader crypto market, potentially initiating a harmful cycle.

Further complicating the picture, Strategy unexpectedly paused its regular Bitcoin buying campaign this week, a break from the steady accumulation cadence it has maintained for months. The firm, which normally announces fresh purchases at the start of each week, offered no update this time — a silence that stood out as its share price traded near a 14-month low. According to TD Cowen’s Lance Vitanza, Strategy didn’t issue new shares through its at-the-market programs and didn’t add to its Bitcoin reserves, marking its first notable pause in several weeks.

The halt comes amid a steep 38% slide in the stock over the past month, reflecting both weaker market demand and limited room for the company to expand its holdings through equity issuance under current conditions.

The average acquisition cost of the 649,870 BTC held by the company is around $74,433. Since Bitcoin's price dropped to $83,000 not long ago, the gap between its present value and the threshold of break-even is rapidly closing.

In the event that Bitcoin's value drops by another 20%, Strategy's holdings are likely to go into unrealized losses.

The sharp decline in Strategy's stock price and increased volatility have put the company in danger of delisting from major indexes, including the Nasdaq 100 and MSCI USA. Passive funds may be forced to sell their holdings due to this predicament. This might result in massive withdrawals of billions of dollars and further drive down the stock price.

As the multiple-to-net-asset-value (mNAV) of MSTR fell, famous short-seller Jim Chanos began to voice his extreme disapproval of the firm and signal his intention to liquidate his short positions.

As we have gotten some inquiries, I can confirm that we have unwound our $MSTR /Bitcoin hedged trade as of yesterday’s open. pic.twitter.com/lgrWNy35H8

— James Chanos (@RealJimChanos) November 8, 2025

This premium takes into consideration the Strategy's debt and preferred equity levels, and it measures the correlation between the stock price and the value of the Strategy's Bitcoin assets per share.

The mNAV (market net asset value) has decreased from 2.5x in December last year to 1.16x currently. Chanos indicated that he anticipated the metric would decrease over time and ultimately reach 1.0x.

He also suggested that the company's shares will be appraised at a value directly corresponding to its Bitcoin assets.

A significant Wall Street player, JP Morgan, has warned that Strategy might be delisted from important equity indices, including the MSCI USA Index. The latest Bitcoin crisis is secondary to the larger issue of the digital asset treasury model put out by industry heavyweights.

If a company's total assets are more than 50% digital assets, MSCI will consider including it in its traditional stock indexes.

Wall Street continues to regard Strategy in the same light as it did prior to the assertions made by founder and executive chairman Saylor, who contended that index classification has no bearing on the company's operations or self-perception, while also reaffirming its commitment to Bitcoin for the long haul.

Response to MSCI Index Matter

— Michael Saylor (@saylor) November 21, 2025

Strategy is not a fund, not a trust, and not a holding company. We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.

This year alone, we’ve completed…

Economist Peter Schiff is one of several who believe that the strategy and debt structure may lead to significant challenges for the business. Several professionals have pointed out that Saylor's latest purchases were executed at a premium, placing some of their assets in a vulnerable state.

Saylor, on the other hand, is very bullish on the long run, claiming that the business can weather an 80% to 90% drop in Bitcoin's value with ease and that it needs just a small annual growth of 1.25% in Bitcoin to pay its bills.

As Bitcoin hovers around $85k, @saylor says, "Volatility is Satoshi’s gift to the faithful."

— CoinDesk (@CoinDesk) November 21, 2025

If BTC just went up 2% a month forever with zero volatility, "Warren Buffett would own all of it." pic.twitter.com/dmu9p9v6V0

The fact that the company has continued to buy more Bitcoin even as the market has dropped shows how committed it is to the approach.

In the depths of the 2022 crypto winter, our average cost basis was $30K while $BTC traded nearly 50% below it at $16K. What did we do? We bought more.

— Strategy (@Strategy) November 21, 2025

Also, according to Saylor, issuing digital credit is the most promising possibility for a Bitcoin treasury organization.

But Chanos debunked that message.

“Give me your money and I will buy Bitcoin with it.” Killer app, for sure. $MSTR https://t.co/9HriTQwK0O

— James Chanos (@RealJimChanos) November 21, 2025

Still, in summary, although the market value of Strategy's approach has been greatly impacted by the downturn and is encountering notable short-term challenges, Saylor continues to hold a strong conviction in Bitcoin and the company's capacity to endure the fluctuations.

Elsewhere

Blockcast

Kaia's Path to Mass Adoption: Blockchain in Everyday Apps

This week, Takatoshi Shibayama hosts Dr Sangmin "Sam" Seo and John Cho from the Kaia DLT Foundation . They discuss the merger of Kakao and Line to create the Kaia blockchain, the integration of stablecoins and DeFi into their messaging apps, and the strategies for attracting Web2 users to Web3. The conversation also covers the potential of stablecoins in cross-border remittance and the user journey from fiat to digital assets.

Thanks for tuning in! If you enjoyed this episode, please like and subscribe to Blockcast on your favorite podcast platforms like Spotify and Apple .

Blockhead is a media partner for Consensus Hong Kong 2026. Readers can save 20% on tickets using exclusive code BLOCKDESK at this link .