"Buy the Dip" Traders Rush Into Bitcoin

Markets cheered progress toward ending the US government shutdown, with Bitcoin recouping above $106,000 on Monday after a brief dip below $99,000 last week, during one of its most turbulent periods since June.

After a weekend of fear, sell-offs, and major leveraged losses, market participants jumped at the chance to buy at lower prices, sparking the recovery.

Crypto markets, which had a total value fall of more than $400 billion during the current selloff, are now somewhat stable thanks to the latest leg up.

The recent surge in Bitcoin aligns with a general sense of optimism in risk assets following a significant move by the US Senate to resolve the government shutdown, which had halted the release of economic data for several weeks.

Ether Leads

After hitting a low of $3,000 on Thursday, Ethereum surged nearly 20% to rise beyond $3,600 on Monday.

The recent uptick in ETH is driven by a resurgence of confidence regarding institutional investments in spot Ethereum ETFs, particularly in light of the significant outflows observed last week.

Historically, lower market cap altcoins have shown a tendency to recover more swiftly following significant declines — yet, just as rapidly as they ascend, they can also falter.

Bitcoin Eyes $112K

Buyers focused on selling liquidity. Market participants anticipated a swift resolution to the US government shutdown, which would enhance risk appetite.

As the weekend drew to a close, the market rebounded when President Trump declared that most Americans would receive a $2,000 "dividend" paid for by tariff income.

Shutdown Odds Waver

Reports indicate that the US Senate has successfully brokered a bipartisan agreement to end the longest government shutdown in American history, which has now extended for 40 days.

This bodes well for the predicted recovery, which is expected to continue this week.

The outcome of the prediction markets changed dramatically as a result of this news; for example, Polymarket bettors now have an 85% chance that the government shutdown will end between November 12 and November 15.

Traders had previously pegged the likelihood that the shutdown would extend into November 16 and into Thanksgiving at 63%.

Following a record 44 days of government shutdown, the probabilities on Kalshi, a rival platform, appear quite similar, indicating a 90% likelihood that the shutdown will conclude by Friday.

The end of the US government shutdown will lead to an influx of market liquidity, positively impacting risk assets such as Bitcoin by releasing billions of dollars in Treasury funds.

The previous government shutdown in the United States took place from late December 2018 to late January 2019 during Trump's first term.

Following its end on January 25, 2019, Bitcoin experienced a remarkable increase of over 265%, climbing from $3,550 to $13,000 within the subsequent five months.

As ask bids exceed $112,000, numerous traders are predicting a potential upward liquidity grab.

The latest data from the monitoring resource CoinGlass indicates that most of the interest was focused above $112,000, while the price was gradually depleting liquidity near $106,000.

The $111,500–$15,000 area contains the majority of the liquidity bids.

If $115,000 is broken, it would cause short sellers to sell their positions, which would push prices up to $117,000, where there will be a large concentration of liquidity.

Cointelegraph reports that the probability of Bitcoin's price reaching $112,000 or higher has increased due to the cryptocurrency's strong weekly closing above the 50-week SMA.

What About the Whales?

While many eyes track price milestones, another critical area is the behavior of large holders. The latest surge of Bitcoin past $107,000 has generated a wave of optimism throughout the cryptocurrency market.

However, it appears that a number of Bitcoin's initial investors are discreetly liquidating substantial amounts of BTC on exchanges. Recently, a prominent figure in the cryptocurrency space has transferred his remaining 11,000 BTC, valued at over $1.1 billion, to exchanges.

This development prompts a significant inquiry: are the early Bitcoin investors beginning to liquidate their holdings?

Following a prolonged period of inactivity, veteran Bitcoin holder Owen Gunden, recognized as one of the early pioneers in the field, has recently moved a substantial quantity of Bitcoin.

Recent data from Lookonchain indicates that Gunden has moved 3,549 BTC, valued at approximately $361 million, to new wallets. Notably, 600 BTC has already been transferred to the Kraken exchange, suggesting that a sale may be on the horizon.

He is not the only one; numerous early Bitcoin wallets from the Satoshi era, which have remained dormant for over ten years, have recently shown signs of activity once more.

Bitcoin OG Owen Gunden keeps dumping $BTC !

— Lookonchain (@lookonchain) November 8, 2025

Today, he moved 3,600.55 $BTC ($372M) — with 500 $BTC ($51.68M) already deposited to #Kraken , and the remaining 3,100.55 $BTC ($320.46M) likely heading there in the coming days. https://t.co/sGMrheaZl9 https://t.co/lGpGzZiXmE pic.twitter.com/dsZzCKyvc5

Initially, these significant fluctuations may appear concerning.

However, experts contend that this should not be interpreted as a negative indicator; rather, it reflects the maturation of Bitcoin.

The whales are not abandoning their confidence in Bitcoin; they are merely adjusting their wealth management strategies.

Markets Surge

Optimism surrounding a potential resolution to the US government shutdown bolstered risk appetite at the beginning of the week. Global stock markets experienced an upward movement alongside U.S. futures.

The Democrats successfully garnered the necessary backing to overcome the stalemate and pass a resolution in the Senate on Sunday, representing a crucial advancement in the effort to conclude the unprecedented shutdown; however, there remain several procedural challenges that must be addressed.

On Sunday night, President Trump informed reporters that the government shutdown appeared to be coming to a close. "The information will be provided to you shortly."

With a weekly close above $104,500, Bitcoin has given investors reason to be optimistic.

However, a surge near $107,000 might quickly reverse, according to several market participants, who expressed a great deal of concern.

As discussions surrounding the imminent end to the US government shutdown intensify, inflation metrics are once again taking center stage for the Federal Reserve and those engaged in risk assets.

Delving deeper, market participants highlight three interconnected factors: a sudden change in the Federal Reserve's balance-sheet direction, increasing likelihood of a swift resolution to Washington's shutdown situation accompanied by a subsequent drawdown from the Treasury General Account (TGA), and a new surge of policy discussions—from 50-year mortgages to possible relief checks—that reignites the conversation around the "liquidity impulse."

The biggest change is the way the Fed now talks about reserves and the balance sheet.

Not to stimulate the economy, but to keep the money markets running smoothly when the Fed ends quantitative tightening on December 1 and begins to fully reinvest maturing Treasuries, New York Fed President John Williams hinted last week that the central bank might soon have to resume asset purchases.

X is passionately distilling the liquidity narrative into concise humor and historical analogies.

“Positive weekly close,” stated Charles Edwards (@caprioleio), founder of Capriole Investments, encapsulating the day's optimistic outlook.

The central bank systematically lowered interest rates by 1% across an 18-month timeframe.

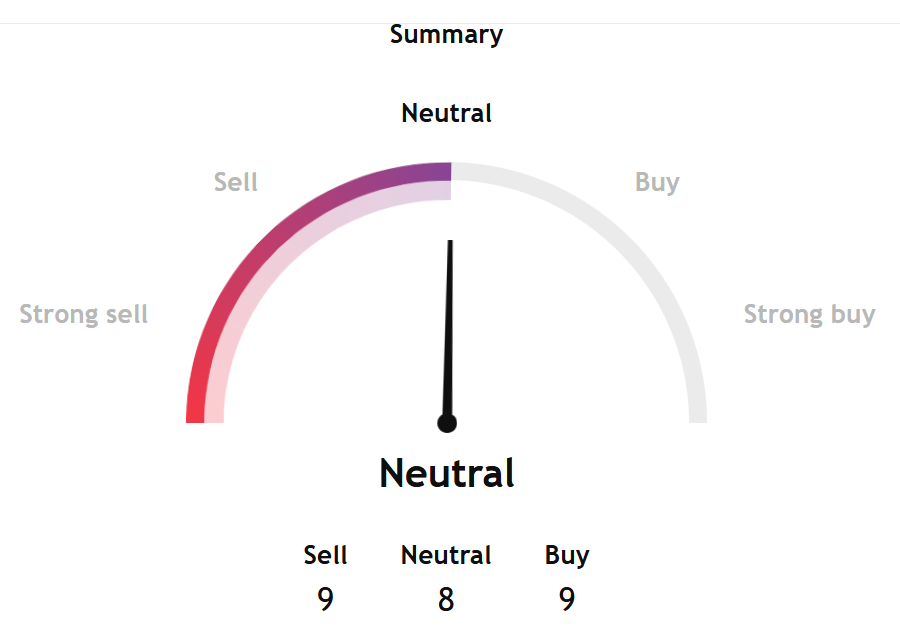

What Do Technicals Show?

To round out the analysis, technical signals offer additional perspective on recent price action.

TradingView's Bitcoin analysis gauge, based on the most popular technical indicators, such as moving averages, oscillators, and pivots, showed a neutral stance for the token in the week ahead.

A further breakdown of short and long-term gauges also pointed to a neutral reading, suggesting a more measured technical reading.

According to TradingView's 1-week rating, the neutral trend is prevailing, and the 1-month rating shows a buy signal.

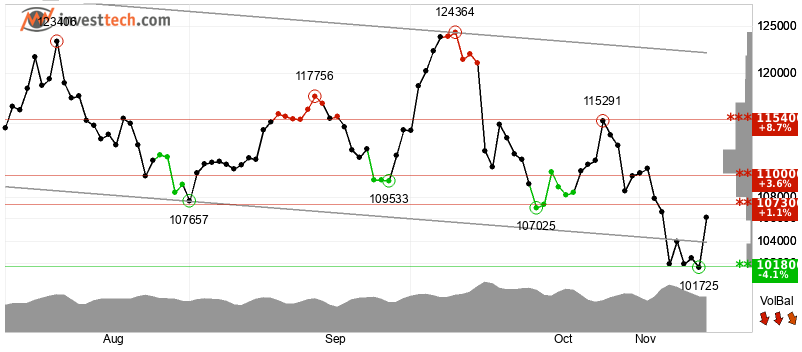

Separately, InvestTech's overall algorithmic analysis still gives a negative score.

The analysis gives a negative recommendation for one to six weeks.

Investech said, "Bitcoin is within an approximate horizontal trend channel in the short term, which indicates further development in the same direction. The token is approaching resistance at $107,300 points, which may give a negative reaction. However, a break upwards through $107,300 point will be a positive signal."

The analysis added, "Negative volume balance shows that volume is higher on days with falling prices than days with rising prices. This indicates decreasing optimism among investors. The RSI curve shows a falling trend, which is an early signal of a possible trend reversal downwards for the price as well. The token is overall assessed as technically negative for the short term."

Elsewhere

We're a media partner for the upcoming Singapore Fintech Festival! Use the promo code SFFSMPBH for 20% off all delegate passes at this link !

Blockhead is a media partner for Consensus Hong Kong 2026. Readers can save 20% on tickets using exclusive code BLOCKDESK at this link .

Ledger Eyes New York IPO as Crypto Hardware Wallet Demand Surges Amid Record Hacks

Paris-based security device maker reports best year yet with revenues in triple-digit millions as $2...

Singapore's First Retail Tokenized Fund Goes Live Through DBS-Franklin Partnership

Money market fund approved by MAS will offer retail access in Q1 2026, bringing blockchain-based inv...

Crypto Rallies as Washington Strikes a Deal: Bitcoin Jumps Back Above $106K

Your daily access to the backroom...