Trump Media Takes $55M Hit As Bitcoin Holdings Surge In Value

Trump Media & Technology Group (TMTG) posted a net loss of about $54.8 million for the quarter, and that shortfall was driven in part by write-downs tied to its digital-asset holdings. According to company disclosures , the firm holds a sizable bitcoin stash that has swung in value and helped turn trading swings into headline losses.

Bitcoin Strategy And The Loss

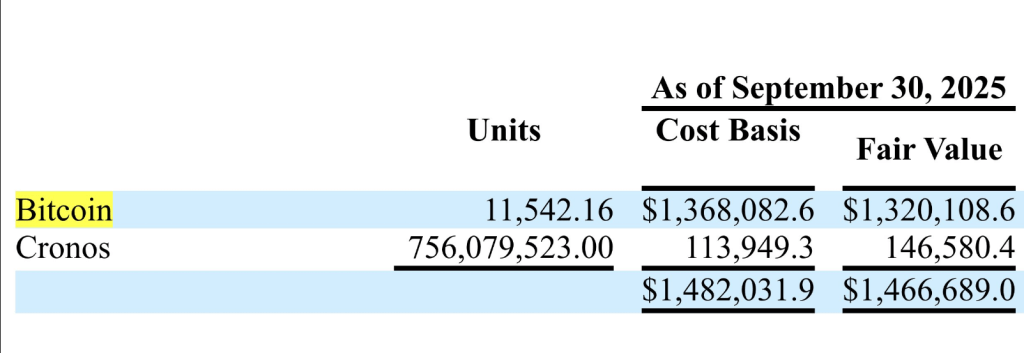

Reports have disclosed that TMTG’s bitcoin holdings were listed at more than 11,500 BTC in one filing, putting the holding value above $1.3 billion depending on the market price at reporting.

Earlier statements by the company put combined bitcoin and related securities near $2 billion. The result: big paper gains when prices rose, and big mark-to-market losses when they fell.

The company also reported about $15.3 million in income from bitcoin-related option premiums during the quarter, but that was not enough to offset the revaluations that showed up in its books.

TRUMP MEDIA AND TECHNOLOGY GROUP HOLDS OVER $1 BILLION OF BITCOIN

Trump Media and Technology Group ($DJT) has disclosed holdings of over $1.3 Billion of BTC as of September 30th 2025. $DJT holds $BTC . pic.twitter.com/WzAIOnN29y

— Arkham (@arkham) November 8, 2025

The company framed the purchases as a move to diversify its treasury. Based on reports, the bitcoin position has become a dominant feature of the company’s balance sheet. That matters because this is not a giant, well-capitalized media group with steady cash flows.

Revenue for the period remained small compared with the bitcoin bet, which magnifies how much the crypto holdings move the company’s financial picture.

Holdings And Valuation

Investors and analysts have zeroed in on timing and entry prices. According to filings and market coverage, TMTG made large purchases over months, but exact buy dates and price points were not fully broken out, leaving room for debate about how much of the loss is unrealized and how much was realized. Some coverage linked part of the loss to changes in the market price of bitcoin between purchase and reporting dates.

Using bitcoin as collateral or for financing also adds layers of risk. Reports indicate the firm has used portions of its holdings in financing arrangements, which could force sales or additional write-downs if market conditions worsen. That kind of leverage was highlighted by market watchers as a key risk for a company whose core business is still quite small.

Optimistic StanceDespite the challenges, Devin Nunes, the CEO and president of Trump Media, said the third quarter was an important period for the company’s growth. He added that they’ve strengthened their financial position with a large Bitcoin reserve and continued to build on their existing platforms.

Featured image from David Hume Kennerly/Getty Images, chart from TradingView

Best Altcoins Like SUBBD Token Amp Up as BlackRock Stays Bitcoin-Bullish

What to Know: BlackRock’s stance remains constructive: adoption curves, liquidity depth, and regulat...

MEXC Users At Risk Of Losing Their Crypto? Ex-Public Advisor Exposes ‘Structural Rot’

Crypto trader the White Whale, who had offered to serve as an advisor to crypto exchange MEXC, has r...

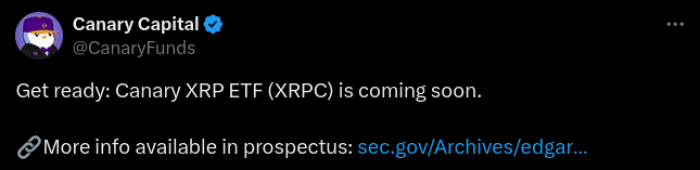

Next 1000x Crypto? Maxi Doge Nears $4M as XRP ETF Buzz Builds

What to Know: ETF chatter around $XRP is building even as policy noise persists, a mix that often se...