Bitcoin Sharpe Signal Slips Into Negative Territory — More Pain For BTC?

The price of Bitcoin has struggled so far in the month of November, briefly falling below the psychological $100,000 level twice already. Although the flagship cryptocurrency appears to be in a state of calm this weekend, a recent on-chain evaluation shows the possibility of more price corrections in the short term.

Bitcoin Risk-Adjusted Returns See Growing Downturn

In a Quicktake post on the CryptoQuant platform, data analytics platform Arab Chain revealed that there seems to be a growing amount of risks for Bitcoin market participants on Binance. This on-chain observation revolves around the Bitcoin Sharpe Signal metric on Binance, which tracks the efficiency of the returns relative to the risks taken by investors on the world’s largest crypto exchange.

For context, a high or positive reading from this metric indicates that investors are getting good rewards for the risks they take on. Contrarily, a low or negative reading suggests the predominance of volatility over returns — a typical sign of waning investor confidence.

According to Arab Chain, the Sharpe Signal has recently fallen to a negative value of about -0.277. What’s interesting is, this occurred around the same period when Bitcoin saw a decline to the $101,747 level . This indicates what the analyst described as “a clear decline in the quality of risk-adjusted returns on Binance.”

Prior to this decline in the Sharpe Signal, the Binance network had consistently seen values above 0.2 — a period of “reward-over-risk” between July and September. It is worth mentioning that this period also coincided with a run of relatively positive momentum for the Bitcoin price.

Outlook For Bitcoin Price

Regardless of the weakening Sharpe Signal, Arab Chain explained that a full-scale capitulation is not necessarily what is in play. At the moment, there appears still to be a relatively stable amount of trading volume.

This means the current decline is not directly being driven by liquidations or impulsive sales. Instead, it suggests less involvement of institutional investors. As a result, the market may just be experiencing a temporary correction or “cooldown” phase, as is expected after major price rallies.

In a case where risk remains relatively higher than the rewards (more negative or sustained negative Sharpe Signal readings), the Bitcoin price could see more correctional movement, especially in the short term. However, the Bitcoin market could quickly see a local price bottom formation if the Bitcoin Sharpe Signal on Binance ascends into the positive region.

As of this writing, Bitcoin is valued at approximately $101,750, reflecting no significant price change in the past 24 hours.

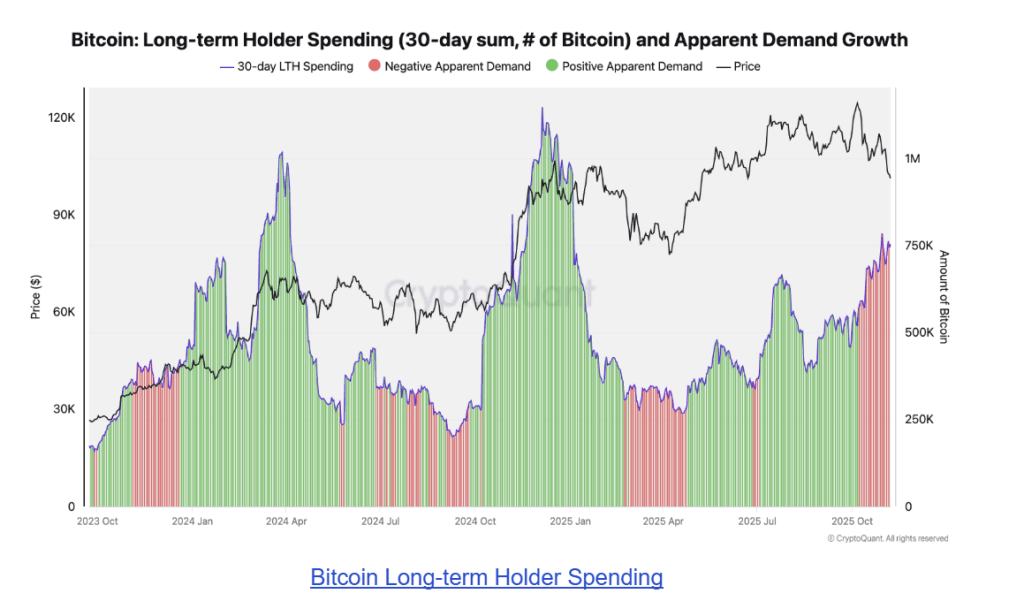

Big Bitcoin Holders Are Selling, But Few Buyers Are Stepping In As Demand Weakens

Bitcoin’s price has struggled to maintain stability above $102,000 in recent days, and data shows th...

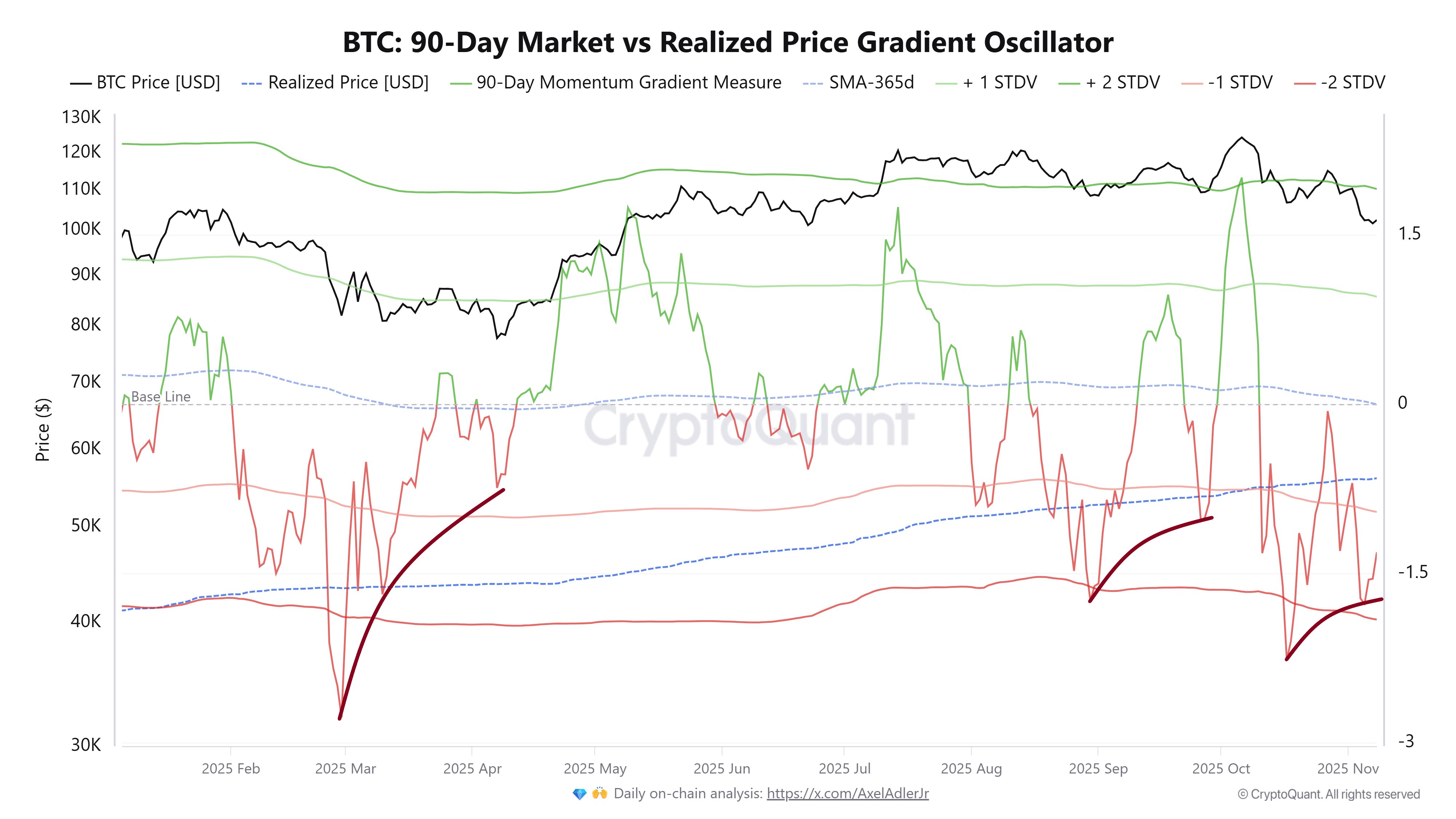

Bitcoin Correction Nears Peak Point — Is A Rebound Underway?

The Bitcoin market has suffered through a disappointing performance over the past few weeks, leading...

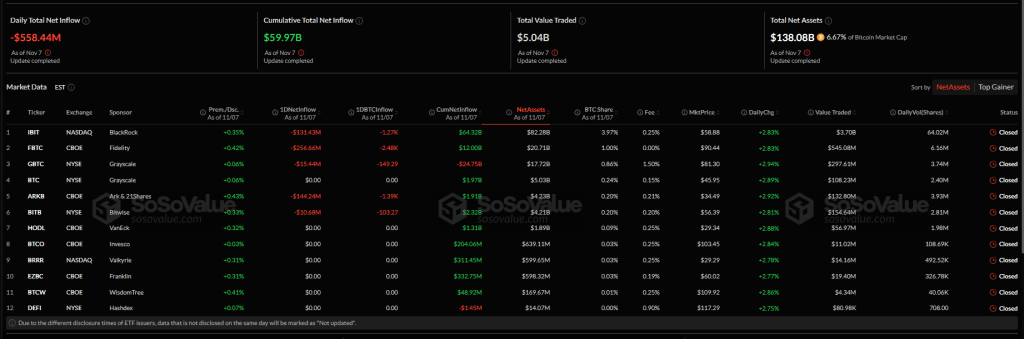

Bitcoin’s Big Money Is Moving — Old Whales Selling At A Furious Pace

Bitcoin-focused ETFs recorded their largest single-day outflow since August, pulling a combined $558...