XRP’s Next Earthquake: Billions Set To Flow In, ‘Supply Shock’ Coming—Analyst

According to reports, Evernorth — a Ripple-backed treasury firm — has agreed to merge with Armada Acquisition Corp II and plans to list under the XRPN ticker.

The SPAC deal aims to raise $1 billion to build what Evernorth calls a large XRP treasury. Ripple and co-founder Chris Larsen contributed XRP to the project.

Nine days after the SPAC announcement, reports said Evernorth had already received $1 billion worth of XRP. The merger is targeted to close in Q1 2026.

On Contributions & Cash Buying

Because the early inputs were paid in XRP rather than cash, immediate upward pressure on exchange order books did not happen.

Market purchases require fiat or cash to be placed into public markets. SBI’s announced $300 million cash pledge is one example of money that could be used to buy XRP outright.

But so far most of the headline amounts are XRP moved into a treasury, not fresh cash hitting exchanges.

It is my understanding the new @evernorthxrp venture will raise $1BN through XRP direct investment, as announced and as we’ve seen on the chain.

So you thinking “how will that affect open market XRP?”. Let me explain.

There next plan is to IPO on stock exchange. This will raise…

— Vincent Van Code (@vincent_vancode) October 27, 2025

Analyst Signals Incoming ‘Shock’

Vincent Van Code, a software engineer and active voice in the XRP community, told followers on X that the bigger event may still be ahead.

He said the IPO itself could bring billions in new cash. If those funds are later used to buy XRP on the open market, he warned, existing supply could tighten and a “supply shock” might follow.

Van Code did not offer a fixed timetable. Other commentators, including a market voice known as Nietzbux, have already framed the development as strongly bullish for XRP.

Why The Timing Matters

Why The Timing Matters

Based on reports, the sequence is what could change prices: cash raised first, then purchases on public markets. If that order is reversed — cash arrives and large buys follow quickly — liquidity could be tested.

Exchanges have varying depth. A single large buyer can move prices more in thin markets than in thick ones. That is simple market mechanics. It is also why some community members are watching the SPAC schedule closely.

XRP’s Role And The Broader NarrativeThere will come a time where XRP and XRPL is just where you keep most of your wealth. That is called Treasury.

Hint hint.

— Vincent Van Code (@vincent_vancode) October 17, 2025

A number of developers and analysts now speak of XRP not only as a payment bridge but also as a treasury asset inside the XRPL ecosystem.

Van Code suggested that a time may come when people keep a big share of their wealth in XRP and on the XRP Ledger.

Ripple’s CTO David Schwartz has emphasized similar ideas about self-custody and on-ledger utility. Those themes are being reused as part of the argument for long-term demand.

Featured image from Gemini, chart from TradingView

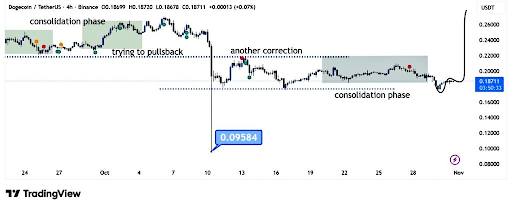

Here’s What Happens To The Dogecoin Price After The Consolidation Phase Ends

Dogecoin has spent the past several days locked in a tight decline that has seen it push lower. The ...

Cardano (ADA) Price Drops 5% Amid Trader Shorts, Hoskinson Blames Community for DeFi Struggles

Cardano (ADA) continued its downward slide on Monday, falling over 5% to trade around $0.57, extendi...

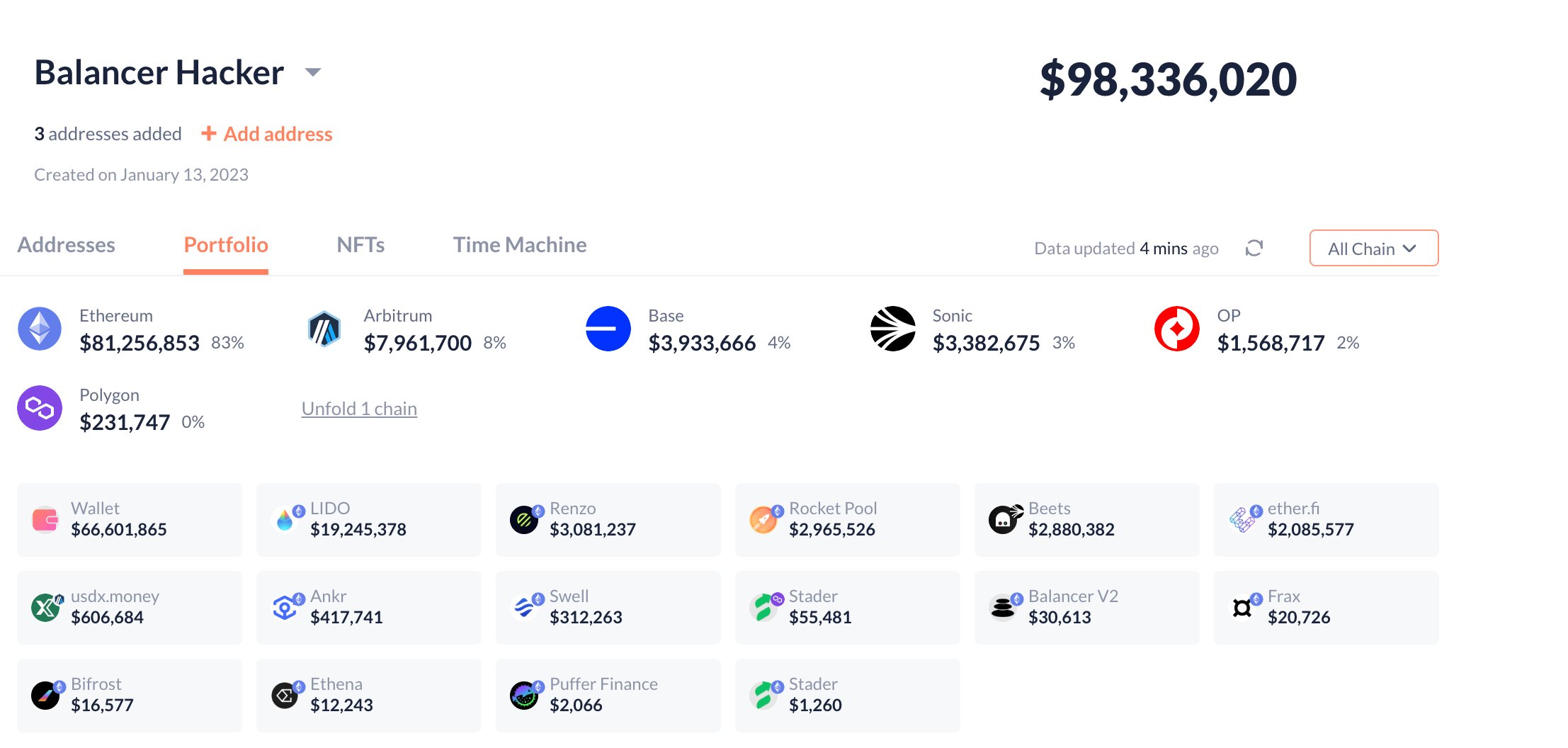

Balancer Protocol Sees $70M Exit In Suspected Crypto Exploit

Balancer, one of the most established decentralized finance (DeFi) protocols with more than $700 mil...