Solana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead?

An analyst has explained how Solana could decide its next big move after rising to $210, the resistance level of a Parallel Channel.

Solana Has Been Trading Inside A Parallel Channel Recently

In a new post on X, analyst Ali Martinez has talked about how the trajectory of Solana is looking from the perspective of a technical analysis (TA) pattern. The pattern in question is a Parallel Channel , which forms whenever an asset’s price trades between two parallel trendlines.

The upper line of the channel is considered a source of resistance, meaning that tops can be probable to appear on retests of it. Similarly, the lower level is assumed to provide support to the price, helping it to arrive at bottoms. A breakout of either of these bounds can signal a continuation of the trend in that direction. That is, a surge above the Parallel Channel can be a bullish signal, while a drop under it may lead to bearish action.

There are a few different types of Parallel Channels, depending on how the channel is oriented with respect to the graph axes. Channels that have a positive slope are known as Ascending Channels , while those that slope downward are called Descending Channels .

In the context of the current topic, the third and simplest type is the one of interest: a Parallel Channel that’s also parallel to the time-axis. This case corresponds to a phase of true sideways consolidation in the asset.

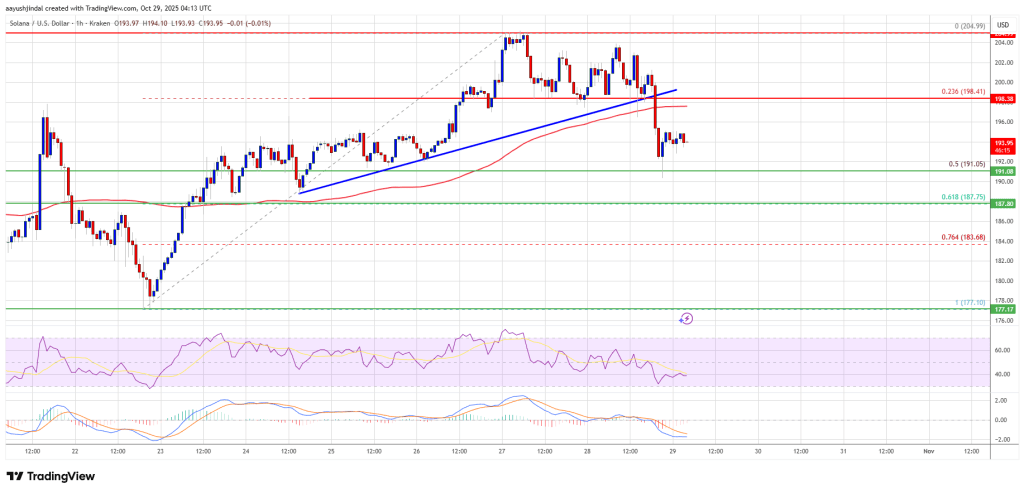

Now, here is the chart shared by Martinez that shows the Parallel Channel that the 4-hour price of Solana has been stuck inside for the last couple of weeks:

As displayed in the above graph, Solana retested the lower level of the Parallel Channel last week and successfully found support. The cryptocurrency has since been rising and nearing the resistance level, located at $210. Considering the coin’s current trajectory, the analyst has noted that its price may be heading for a retest at $210 before making its next big move. However, the direction of such a move, if one happens, remains uncertain.

Given that the $210 level corresponds to the resistance line of the Parallel Channel, it’s possible that a retest could reject Solana all the way back down to the support level around $176. It’s also possible, though, that this retest could instead lead to a breakout. In this case, SOL could naturally see a sustained bullish push. It now remains to be seen which of the two scenarios will play out for the asset if the Parallel Channel holds and a retest takes place.

SOL Price

At the time of writing, Solana is floating around $200, up over 7.5% in the last seven days.

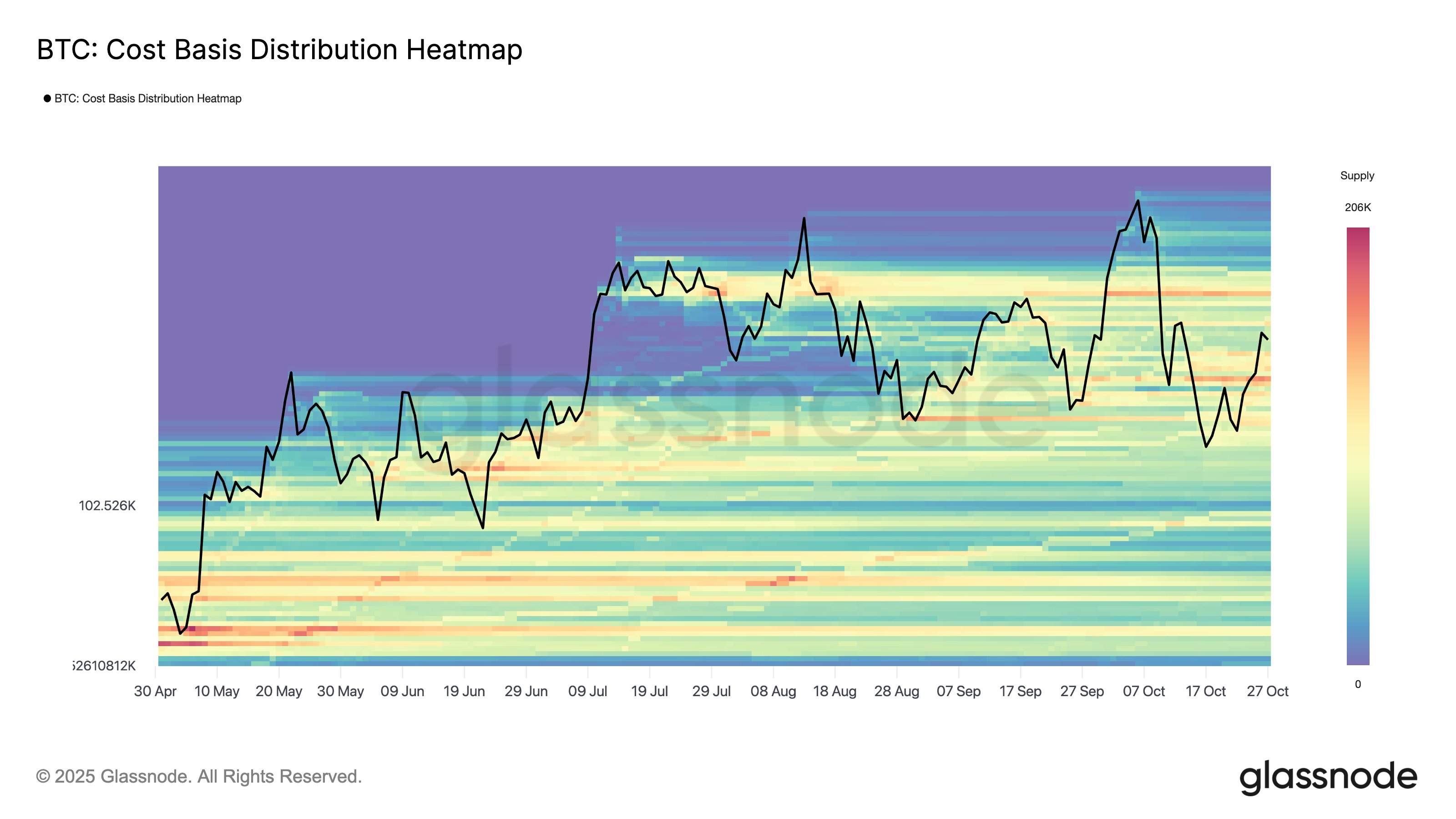

Bitcoin Cost Basis Map Reveals Key War Zone Between Bulls & Bears

On-chain analytics firm Glassnode has revealed a Bitcoin price range that defines the current battle...

Is A Crypto Melt-Up Coming? Top Expert Forecasts Liquidity Surge With Fed’s QT Shift

Market expert VirtualBacon recently suggested that the most significant event for the crypto industr...

Solana (SOL) Weakens Again — Break Below $200 Opens Door For Further Decline

Solana failed to stay above $200 and corrected gains. SOL price is now trading below $200 and might ...