The “Banking Boom” Trigger: As Fed Cuts Loom, Digitap ($TAP) Is Forecast to Absorb Trillions, Targeting $18

The post The “Banking Boom” Trigger: As Fed Cuts Loom, Digitap ($TAP) Is Forecast to Absorb Trillions, Targeting $18 appeared first on Coinpedia Fintech News

The next major wave in finance might not come from banks. It may come from bold crypto platforms poised at the intersection of payments, banking, and blockchain. With the Federal Reserve signaling interest-rate cuts and global liquidity expanding, the stage is being set for a real banking boom.

A project named Digitap ($TAP) is getting investor attention. With a working Visa card with no KYC, deflationary tokenomics, and global reach, analysts forecast that Digitap could absorb trillions in payments volume. And $TAP is projected to reach a price target of $18 by 2026.

Why Rate Cuts Matter: The Macro Tailwind for Digitap

An interest rate cut by the Federal Reserve will make borrowing cheaper, increase the volume of business activities, and encourage financial innovations. A Fed decision to lower rates signals more money in the economy, which in turn supports fintech and payment innovation.

As these factors put pressure on traditional banks to maintain tight margins, crypto-based fintech platforms are in a winning position. Digitap is right there in the middle of this perfect storm. It is not dependent on a future event to take off; it is already operational worldwide and looking for growth.

While traditional banks are busy trying to upgrade their systems, Digitap provides a simplified, borderless solution based on crypto and fiat interoperability.

Digitap: The Platform Ready for the Banking Boom

Digitap is the one-stop money platform that allows users to exchange, save, send, and spend both crypto and fiat. This is possible through cards, wallets, and offshore accounts. The card is powered by Visa and supports Apple Pay and Google Pay.

Advanced AI-powered tools allow users to switch between cards, wallets, and accounts effortlessly. The product’s privacy-first approach means no one is tracking, everything is encrypted, and the user has complete control.

Anything done within the Digitap platform is a value-add for platform holders: the platform automatically purchases and burns $TAP tokens with a portion of its revenue.

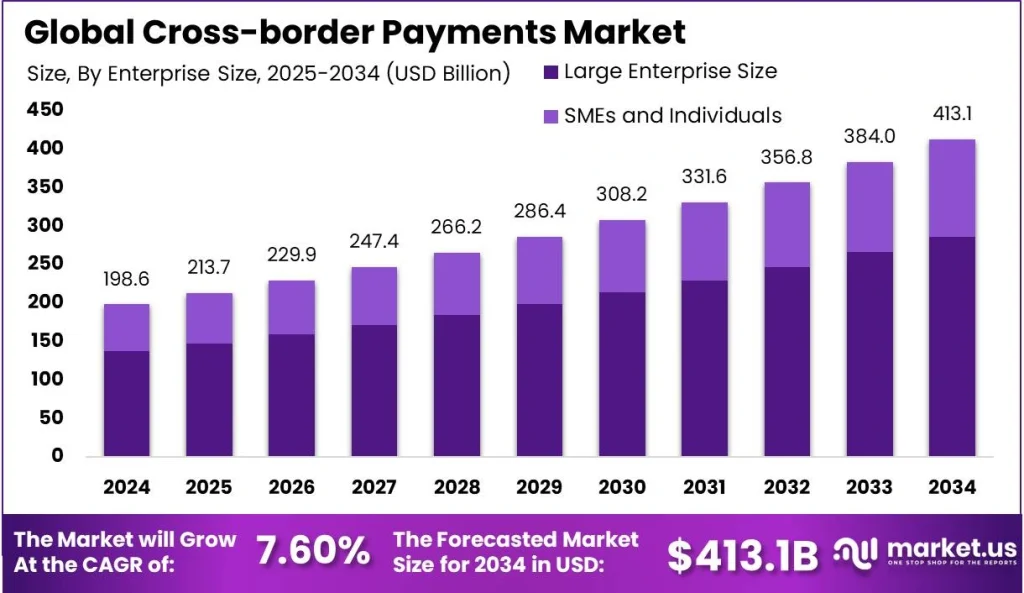

Thus, it reduces the supply and eventually brings scarcity of the tokens. With the global payments market expected to reach over

$250 trillion by 2027

, even a small share of that market represents significant potential.

Trillions in Flow: How Digitap Could Capture the Wave

The payments industry is in a position to be transformed by the rate cuts that bring about lower borrowing costs and easier money movement. Traditional banks get trapped in their old ways, while Digitap offers instant settlement with 1% remittance fees. Digitap is one of the top crypto coins, leading the way in 2025.

Digitap has its worldwide card network, multi-currency accounts, and no-KYC onboarding in place. It is capable of attracting freelancers, international businesses, and expats who require quick and cost-effective cross-border access. As payment flows shift away from legacy rails and towards crypto-enabled rails, $TAP will be well positioned to gain both volume and value.

That’s the way analysts come up with their forecast. By calculating Digitap’s increasing share of the global money-movement market, it is ready for exponential gains in the future.

Tokenomics and Target: $18 by 2026

The tokenomics of Digitap help tell the story of its long-term value. The total number of $TAP tokens is limited to 2 billion. Every transaction on the platform has an auto-buy-back and burn event. Therefore, holders are rewarded through staking, cashback, and referral programs. All measures are put in place to encourage the ecosystem’s volume rather than speculation.

Observing the presale round, the analysts note that the present pricing is still very close to the expected listings, but at a very low level.

With more than $1 million brought in the current presale and tokens priced at about $0.0194, the current entry position offers a huge upside potential. Analysts predict that Digitap could reach $18 per token if the platform starts generating significant payment volume from early supporters.

The Quiet Giant of the Next Money Shift

The next banking boom will happen with the platforms that can move money instantly, cheaply, and privately. Digitap is one of these platforms with 100% security approved by audits from Solidproof and Coinsult .

When the Fed starts cutting rates and liquidity is flowing freely again, money will be on the move. Digitap is a crypto coin that can best facilitate that. The prediction of $18 per $TAP token is not just an exaggeration but a logical result of its design and total addressable market. This is because they have a working Visa system, worldwide coverage, and a deflationary model in their favor.

For investors looking beyond short-term stunts and meme plays, Digitap offers one of the most interesting bets in this cycle.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

How High Can XRP Price Go After the FOMC Meeting Today?

The post How High Can XRP Price Go After the FOMC Meeting Today? appeared first on Coinpedia Fintech...

Big News: First Spot ETFs for Solana, Litecoin, and Hedera Go Live with $14.4M in First-Hour Volume

The post Big News: First Spot ETFs for Solana, Litecoin, and Hedera Go Live with $14.4M in First-Hou...

Official Trump Token Faces Tug-of-War Between Bulls and Bears— What’s Next for the Price?

The post Official Trump Token Faces Tug-of-War Between Bulls and Bears— What’s Next for the Price? a...