Solana, Litecoin, Hedera ETFs Ready? Experts Expect Tuesday Launch Despite Goverment Shutdown

Multiple crypto exchange-traded funds (ETFs) are set to launch this week despite the government shutdown, with investment products based on Solana (SOL), Litecoin (LTC), and Hedera (HBAR) seemingly ready to start trading as soon as Tuesday.

Big Week For Crypto ETFs

On Sunday night, Nate Geraci affirmed that the next two weeks will be key for the long-awaited spot crypto-based ETFs as Solana, XRP, LTC, and other ETF filings are “all lined up & ready for launch.”

Similarly, Bitwise CEO, Hunter Horsley, hinted that this week would be a “Big week,” suggesting progress related to its Solana Staking ETF. It’s worth noting that the crypto community has been awaiting the US Securities and Exchange Commission (SEC)’s approval of the investment products following the numerous ETF applications filed over the past few months.

Between August and September, the regulatory agency postponed the decision deadline of most applications by two months, pushing back the key dates to mid-October and mid-November. However, the government’s shutdown, which started on October 1, reduced the odds of the products receiving a green line during the expected timeline.

On Monday morning, ETF expert Erich Balchunas reported that multiple issuers were looking to launch their crypto-based ETFs this week, despite the government shutdown. According to the Bloomberg analyst, Canary Capital had filed 8-A forms for its spot Litecoin and Hedera ETFs, while Bitwise had filed one for its Solana Staking ETF.

“These are the ones rumored to be poss looking to launch (along w Grayscale solana) this week despite shutdown. Not a done deal but clearly preparations being made. Stay tuned,” Balchunas stated.

Solana, Litecoin, Hedera Products Take The Lead

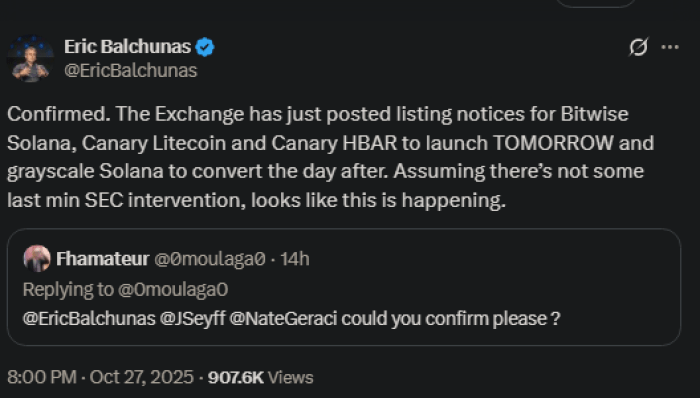

Later, Balchunas confirmed the reports that the exchange had posted listing notices for Bitwise’s Solana Staking ETF, and Canary’s LTC and HBAR ETFs to launch on October 28, while Grayscale’s Solana trust is set to convert on Wednesday. “Assuming there’s not some last min SEC intervention, looks like this is happening,” the analyst added.

Crypto Journalist Eleanor Terret also shared the news, citing Canary’s CEO, Steven McClurg, who confirmed that the Canary spot HBAR and LTC ETFs will begin trading on Nasdaq on Tuesday.

“Litecoin and Hedera are the next two token ETFs to go effective after Ethereum,” McClurg told the journalist in a statement. “We look forward to launching tomorrow.”

Terret explained that despite the government shutdown , the launch is possible because “the operation of law does not always actually require an open government.”

According to the post, the 8-A forms are “just as important” as the S-1s filings : the former formally registers ETF shares under the Securities Exchange Act of 1934, while the latter registers the investment products under the Securities Exchange Act of 1933.

After NYSE certified all the 8-A filings for the ETFs above on Monday, shares can start trading, Terret affirmed, adding:

“Here’s the key: The issuers included language in their amended S-1s that lets them automatically go effective 20 days after filing. Typically, issuers delay S-1s until the SEC takes them effective, but the legal default is that the S-1 goes automatically effective without SEC intervention. That means the agency doesn’t need to approve them manually and the filings can go live on their own, even during the shutdown. So, long story short, all the legal boxes are checked and these ETFs are on track for launch.”

Is The Dogecoin Bull Run Over? Analyst Predicts When DOGE Rallies Again

Cantonese Cat used his October 28 video to zero in on the Dogecoin market structure, arguing that th...

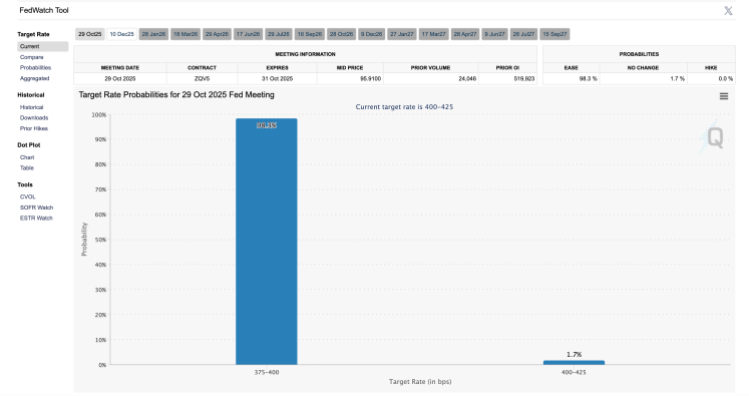

Bitcoin And Crypto Market Set To Bounce As Rate Cut Probabilities Touch 98.3%

The next Federal Open Market Committee (FOMC) meeting is fast approaching, and the bets are already ...

Litecoin Price Prediction of $135 Ahead of ETF Launch as PEPENODE Soars

What to Know: $135 Litecoin price prediction hits the market ahead of the Litecoin ETF (LTCC) reachi...