Bitcoin Price Forecast: Can BTC Hit $145K After October ETF Surge?

The post Bitcoin Price Forecast: Can BTC Hit $145K After October ETF Surge? appeared first on Coinpedia Fintech News

The Bitcoin price has shown remarkable strength at the start of Q4, trading around $121,302 with a market cap of $2.42 trillion. Following a massive $1.2 billion ETF inflow on October 6th, the same day BTC hit a new all-time high (ATH) of $126,296, investor optimism continues to grow. However, people are still curious to know whether it can reach $145K or not.

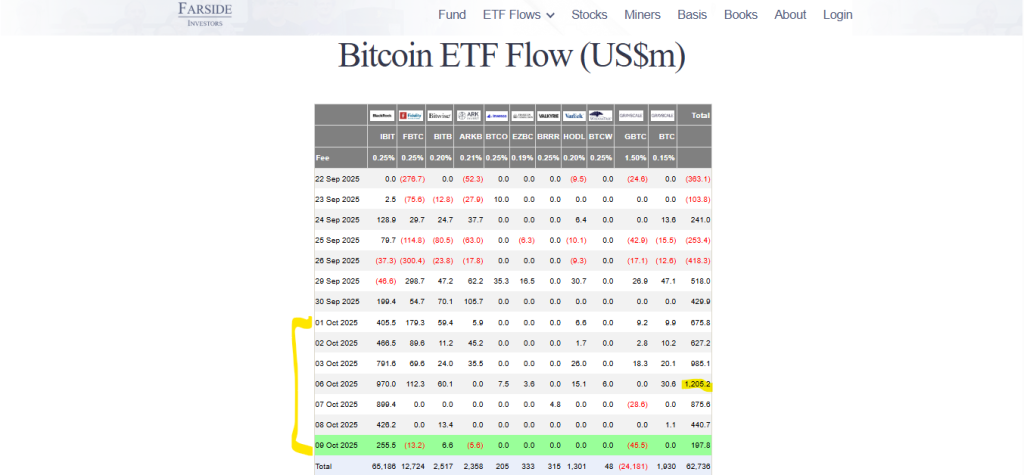

After Q3’s last month, September was marked by significant ETF outflows, and October’s turnaround has been nothing short of impressive.

All trading sessions so far have recorded positive net inflows, led by a single day largest $1.205 billion surge into spot Bitcoin ETFs . This shift marks a strong transition toward net accumulation, suggesting a broader recovery in investor appetite.

BlackRock Leads Accumulation, Stabilizing BTC Price

However, this inflow is not evenly distributed. Data indicate that out of eleven, only one dominant ETF provider is currently absorbing much of the market’s selling pressure, and that is BlackRock.

It is effectively stabilizing the Bitcoin price chart and supporting the bullish structure. Such accumulation behavior has preceded major breakouts, and the recent ATH marked on October 6th was proof of that, while other players are playing cautiously, but what if they join BlackRock soon? Then will BTC still remain slow? No, not a chance; it will explode, and many experts are betting on that to happen. Even Michael Saylor’s orange dots rising build enough optimism for the market.

Bitcoin Technical Analysis: Upward Channel Points Toward $145K Potential

At present, Bitcoin price today is holding steady around $120K, consolidating after its early-October rally. Technical patterns show BTC continuing to trade within an upward channel that has been intact for the past two years.

Historically, each bounce from the channel’s lower border has led to an eventual test of its upper limit. Now, a move like that, if repeated, could push toward the projected BTC price forecast of $145K .

Before reaching that target, however, the market must first conquer the psychological barrier at $130K. Sustained accumulation and strong on-chain trends suggest that a breakout beyond this level could trigger renewed momentum, potentially leading to new record highs before the end of Q4.

- Also Read :

- Ethereum (ETH) Price Holds Strong at $4,300 as ETF Outflows Test Investor Confidence

- ,

Lower Exchange Reserves Signal Long-Term Bullish Outlook

In addition to technical alignment, BTC’s volume profile also supports an optimistic outlook. The FRVP POC-based support that proved critical in Q3 has once again emerged as a key area for Q4. BTC is currently testing this support level, which, if held, could set the stage for the next leg higher toward $145K.

Meanwhile, Bitcoin price USD dynamics are benefiting from continuous declines in exchange reserves. Since Q3, reserves have dropped significantly, signaling that investors are moving coins off exchanges, which is a clear sign of long-term holding intentions.

With fewer coins available for sale, supply scarcity continues which is further strengthening the case for a bullish BTC price prediction narrative.

The current market conditions also suggest that it’s a matter of time before bear pressure fades, then bulls will shine even brighter.

FAQs

As per Coinpedia’s BTC price prediction, the Bitcoin price could peak at $168k this year if the bullish sentiment sustains.

With increased adoption, the price of Bitcoin could reach a height of $901,383.47 in 2030.

As per our latest BTC price analysis, Bitcoin could reach a maximum price of $13,532,059.98

By 2050, a single BTC price could go as high as $377,949,106.84

Bitcoin Price Teases Below $118k; Here is How to Trade the Tariff War

The post Bitcoin Price Teases Below $118k; Here is How to Trade the Tariff War appeared first on Coi...

Crypto Liquidations Nearly at $1B as President Trump Hints at New Trade War With China

The post Crypto Liquidations Nearly at $1B as President Trump Hints at New Trade War With China appe...

6 Meme Coins That Will Turn $10,000 into $100,000 in 2025: Shiba Inu (SHIB) Won’t Be One of Them

The post 6 Meme Coins That Will Turn $10,000 into $100,000 in 2025: Shiba Inu (SHIB) Won’t Be One of...