"Tokenization is a Freight Train That Will Eat the Entire Financial System," Says Robinhood CEO

Robinhood CEO Vlad Tenev has delivered a bold prediction for the future of finance, stating unequivocally that tokenization, the process of putting real-world assets onto a blockchain, is an unstoppable force that will consume the existing global financial system.

PSA:

— Vlad Tenev (@vladtenev) October 2, 2025

Tokenization will eat the entire global financial system

Thank you for listening https://t.co/POpqrs7J74

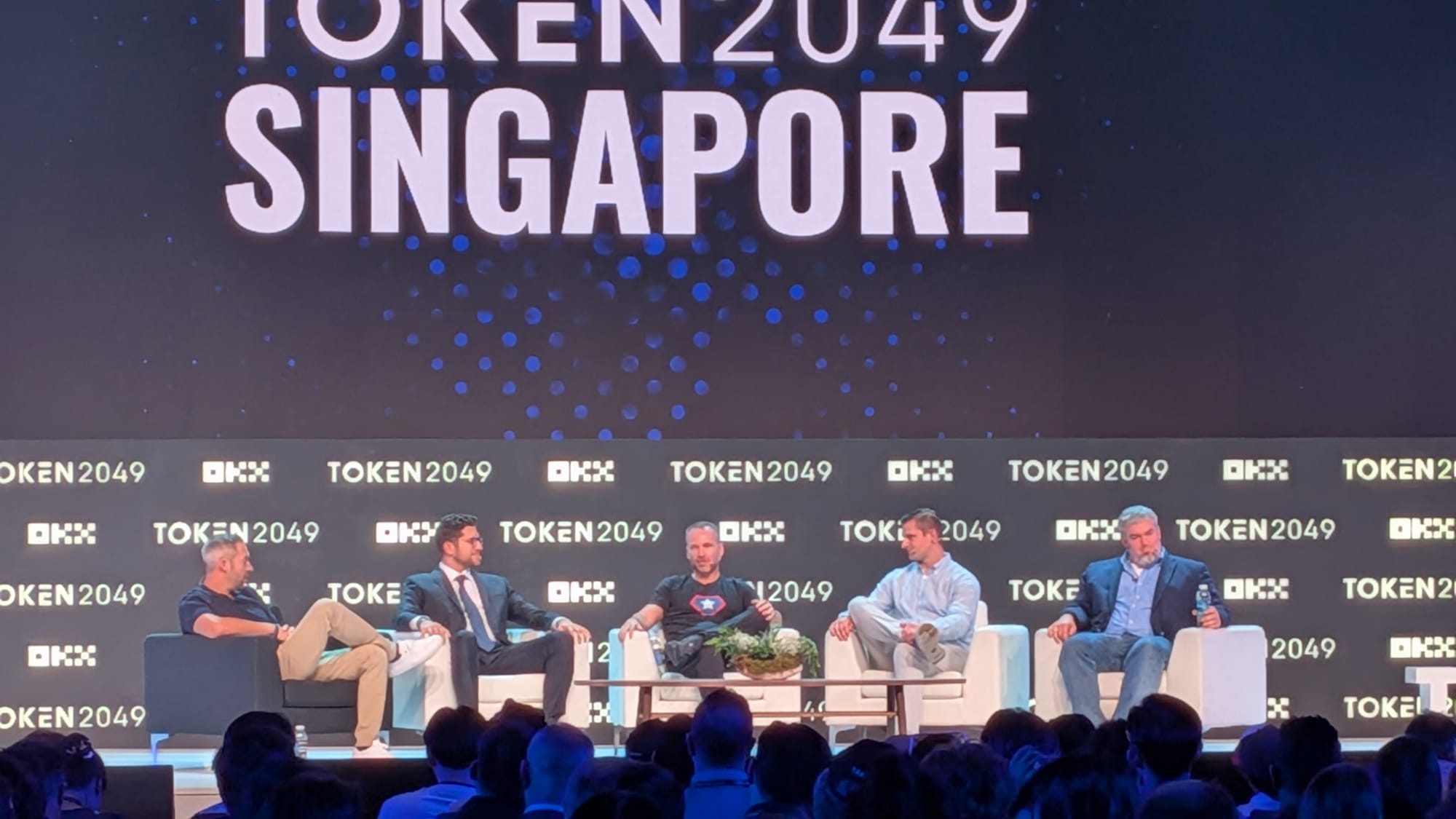

Speaking to CNBC’s Elaine Yu and later at the Token2049 conference on Thursday, Tenev positioned Robinhood as a leader in merging cryptocurrency technology with traditional finance, a strategy that saw Robinhood Markets Inc. (HOOD) stock jump, closing at $145.70, up 4.71% yesterday.

The Inevitable Merger of Finance and Crypto

Tenev said the distinction between crypto and traditional markets is rapidly disappearing, driven by the technological advantages of the blockchain.

"I actually think cryptocurrency and traditional finance have been living in two separate worlds for a while, but they're going to fully merge," Tenev told CNBC. He reiterated this view at the conference, outlining the irreversible nature of the shift.

"I think tokenization is like a freight train," Tenev stated. "It can't be stopped and eventually it's going to eat the entire financial system."

This transformation, he explained, is driven by the clear benefits tokenization offers, including unlocking real-time, 24/7 trading for assets like stocks—a capability currently unavailable in traditional markets. The ultimate goal, Tenev suggests, is for the entire equities market to eventually be "running on chain."

Regulation and the US Lag

While pushing for global adoption, Tenev acknowledged that the United States is likely to be slower than other regions, particularly Europe, in establishing comprehensive regulatory frameworks.

"Regrettably, but realistically, the US may lag behind... The US will probably be the last economy to achieve full tokenization," he said, noting that the country's existing, functional financial system reduces the urgency for a complete overhaul.

Despite the regulatory lag, Tenev confirmed Robinhood is focused on capitalizing on a global appetite for tokenized assets, having already demonstrated the technology by giving customers exposure to tokenized private company shares like OpenAI and SpaceX. He predicted that within five years, most major global markets will have a clear regulatory framework for tokenization.

Tether CEO Sets $1 Trillion Target for US Stablecoin as Industry Eyes American Market Reopening

Paolo Ardoino projects USAT could reach trillion-dollar market cap within five years, citing USDT's ...

Big Money Behind Prediction Sites: A Gamble or a Winner?

Once niche tools for forecasting outcomes, prediction markets like Kalshi and Polymarket have explod...

Bitcoin Rockets to $118.5K as Shorts Squeezed & U.S. Shutdown Spurs Rate-Cut Bets

Your daily access to the backroom...