Bitcoin Accumulation: Here’s The Massive Tether Buy That Has Got The Community Talking

USDT issuer Tether has added a significant amount of Bitcoin to close out the third quarter, a development that has caught the attention of the crypto community. Tether’s CEO, Paolo Ardoino, also confirmed this purchase, as the company ranks among the largest BTC treasury companies .

Tether Adds 8,889 BTC To Bitcoin Holdings

Arkham data shows that Tether bought 8,889 BTC for $1 billion, with the coins transferred from Bitfinex’s hot wallet to the USDT issuer’s Bitcoin reserves wallet. The company now holds 86,335 BTC, which is valued at $10.23 billion. Ardoino also confirmed the purchase in an X post , highlighting their effort to keep accumulating BTC.

BitInfoCharts data shows that Tether is currently one of the largest Bitcoin holders, controlling 0.4% of the flagship crypto’s supply. Meanwhile, based on BitcoinTreasuries data , the USDT issuer will rank as the second-largest BTC treasury company, just behind Michael Saylor’s Strategy .

Notably, Tether also has more Bitcoin exposure through its stake in Twenty One Capital (XXI) , which is currently the third largest BTC treasury company, behind Strategy and Mara Holdings. XXI holds 43,514 BTC on its balance sheet, some of which it received from Tether as part of the USDT issuer’s investment.

Meanwhile, Tether has made it clear that it intends to continue buying as much Bitcoin as possible. Ardoino stated last month that while the world continues to become darker, they will continue to invest part of their profits in safe assets like BTC, gold, and land. This came as he clarified that his company wasn’t selling Bitcoin to buy more gold but was instead buying both assets for their reserves.

It is worth mentioning that Tether generates the most revenue among crypto protocols. DeFiLlama data shows that the stablecoin issuer has earned $22.27 million in revenue in the last 24 hours and $155.27 million in the last seven days. As such, the firm makes enough profits to keep buying BTC.

The Bottom For BTC

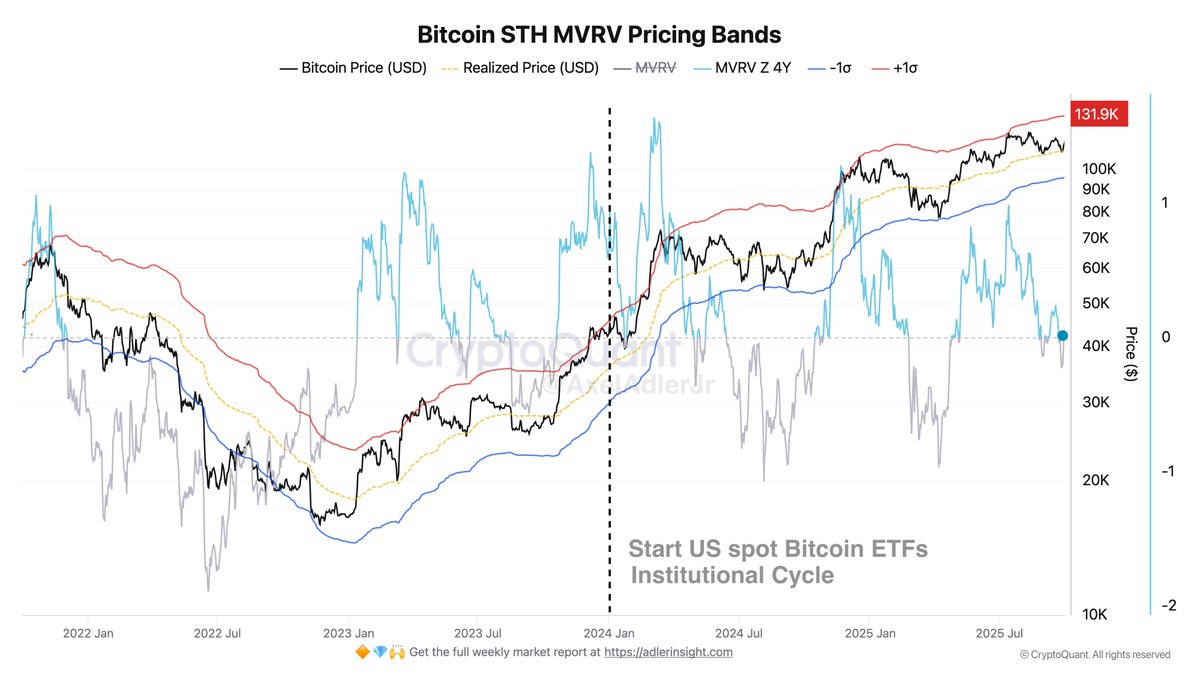

Notably, Tether’s latest Bitcoin purchase came just as the BTC price bottomed out. The USDT issuer had bought these coins when the flagship crypto was trading at around $110,000. Since then, BTC has staged a parabolic rally, beginning this month with a gain of around 6%. Bitcoin had dropped to as low as $108,000 about a week ago.

Bitcoin is expected to record significant gains this month based on historical data . October is its second-best performing month, recording average gains of 20% over the years. Factors like a Fed rate cut could also help spark massive gains for the flagship crypto.

At the time of writing, the Bitcoin price is trading at around $118,400, up over 3% in the last 24 hours, according to data from CoinMarketCap.

Bitcoin Dynamics Show Healthy Market Structure: Analyst Sets $130K Target

Bitcoin has reclaimed key levels above the $118,000 mark, shifting momentum back in favor of the bul...

Space Meets Crypto—Spacecoin Executes 1st Blockchain Transaction Beyond Earth

Spacecoin says it has relayed a blockchain transaction entirely through space, moving data from one ...

PrimeXBT Insights: WLFI and the Trump connection, opportunity or just hype?

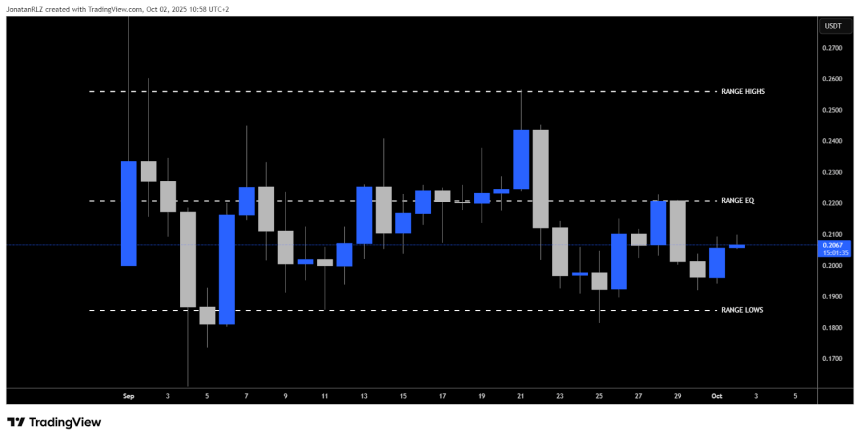

By Jonatan Randin, Market Analyst at PrimeXBT World Liberty Financial (WLFI) is one of the most high...