Can Cardano Slip Below $0.30? ETF Speculation and Analyst Warnings Cloud ADA Outlook

Cardano (ADA) is trading around $0.78–$0.80, struggling beneath a strong resistance at $0.83–$0.85, where the 50/100/200-day EMAs converge. Prediction markets currently assign a 91%–95% chance of U.S. Cardano spot ETF approval, with dates tentatively set for late October 2025.

This narrative has helped stabilize sentiment after September’s decline. Bulls believe institutional access could mirror BTC/ETH’s ETF strategy by increasing liquidity and expanding demand.

However, options activity remains subdued, and recent long liquidations suggest traders are cautious about chasing gains before a clear breakout. If ADA closes above $0.85, potential upward targets are $0.87 (Fib 0.382) and $0.90 (Fib 0.5).

Cardano (ADA) Key Levels: $0.78 Support, Then $0.75 and $0.71

The Cardano (ADA) near-term structure is a range between $0.78 and $0.83 after a pullback from highs near $0.95. Momentum has improved from oversold levels, but Parabolic SAR remains above the price, and the trend hasn’t fully flipped.

Immediate support is at $0.78, with deeper liquidity pockets at $0.75 and $0.71; a failure there exposes $0.68 as the last major defense. Analysts also point out a developing death-cross risk on lower timeframes, implying rallies could fade without new catalysts.

Macro factors remain influential: tighter financial conditions or a Bitcoin retrace can reduce altcoin bids, capping ADA under resistance even if ETF headlines stay strong.

The 2026 Bear Case: Why Sub-$0.30 Isn’t Impossible

Beyond the next few weeks, some strategists warn of a path where ADA may revisit sub-$0.30 in 2026. The reasoning: at a roughly $34B market cap near $0.80, multiples might shrink unless usage growth significantly accelerates.

While Cardano promotes research-driven upgrades ( Ouroboros Leios , the Omega roadmap ) and has an eight-year record with no downtime, critics point to slow app adoption, capital shifting to newer ecosystems, and ETF attention potentially directing flows into a few large caps.

If global liquidity tightens, ETFs underperform, or structural demand weakens, a prolonged cycle could push ADA toward value zones below $0.30, where longer-term buyers might enter.

In the short term, watch $0.83–$0.85 for a trend reversal and $0.78/$0.75 on the downside. The ETF story provides ADA with a real catalyst, but actual delivery and demand must materialize. Without that, the 2026 sub-$0.30 scenario remains a possible risk, especially if macroeconomic headwinds emerge.

Cover image from ChatGPT, ADAUSD chart from Tradingview

Bitcoin’s $90,000 Level Holds Key To Preventing A New Bear Market, Top Analyst Says

Bitcoin (BTC) continues to navigate a phase of consolidation, hovering just above $113,000, leaving ...

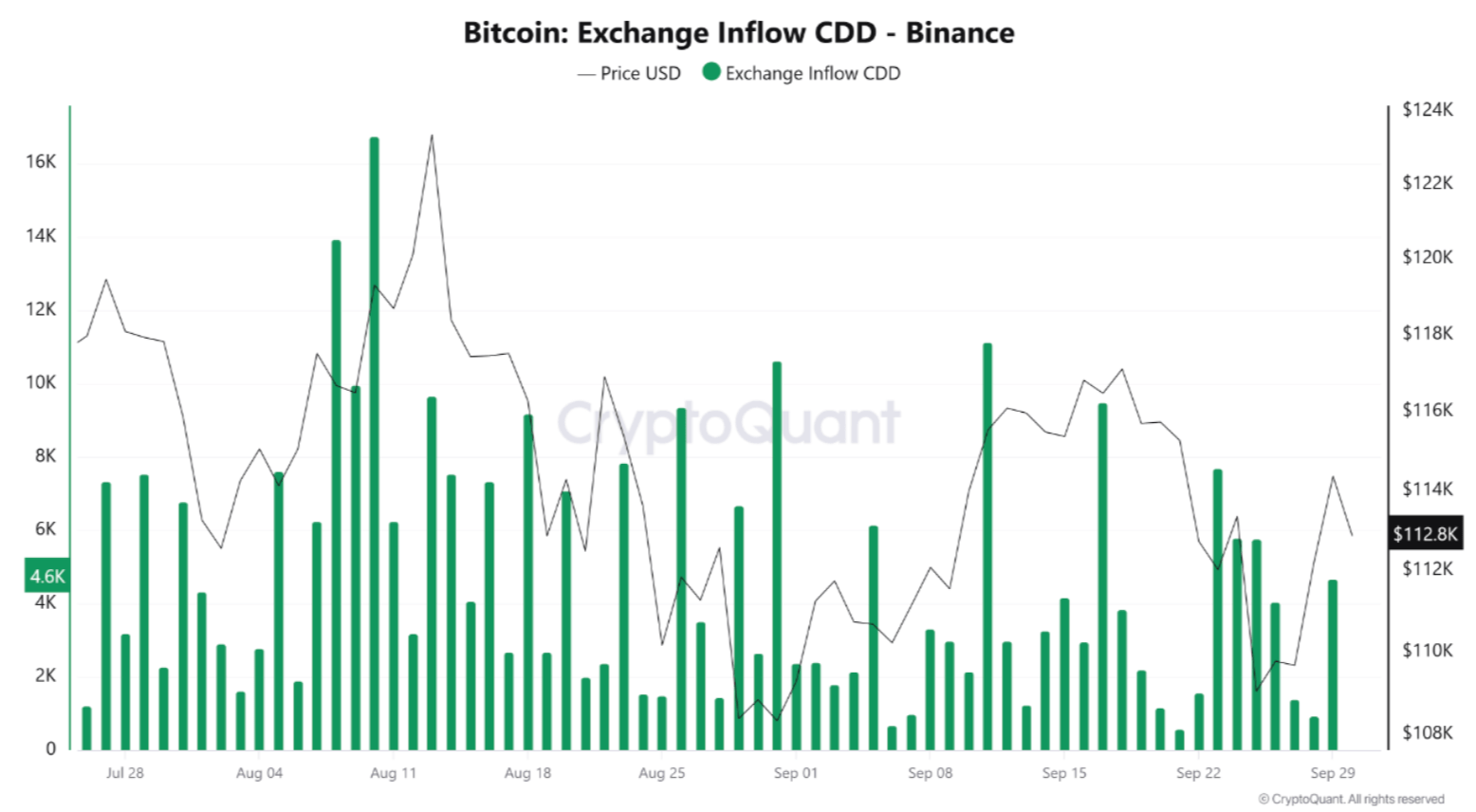

Bitcoin Defends $108,000 Support Amid Whale Selling In September – Bullish October Ahead?

Bitcoin (BTC) showed resilience over the last weekend as it defended the crucial $108,000 support le...

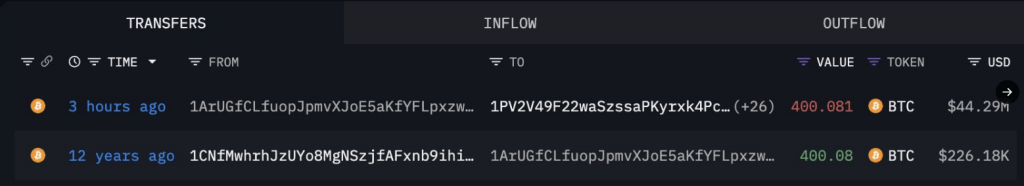

A Dormant Bitcoin Address Moves 400 BTC After More Than A Decade

A long-silent Bitcoin wallet woke up this week and emptied roughly 400 BTC into several new addresse...