8 Years In Hiding—Now $3 Billion In Ether Comes Alive

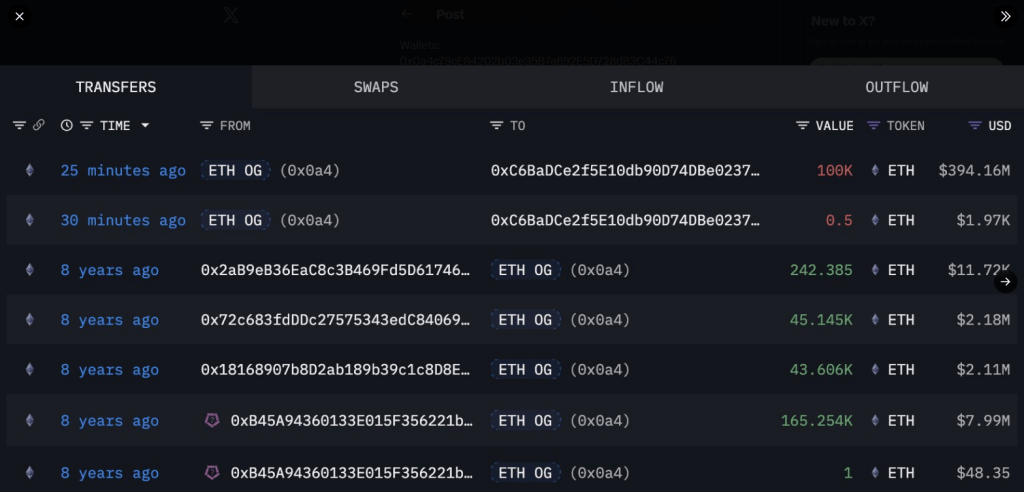

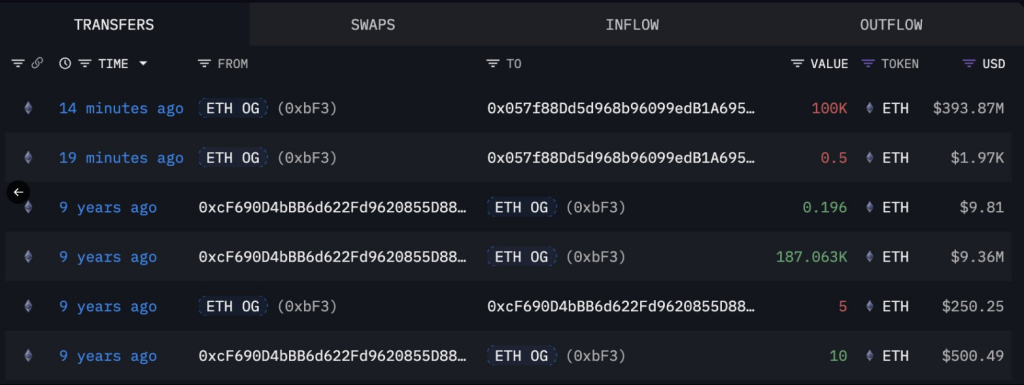

A major Ethereum holder that had been quiet for years suddenly moved roughly 200,000 ETH Friday, worth about $800 million at current prices.

Based on reports from on-chain trackers, the investor controls a total of 736,316 ETH spread across eight wallets — holdings that are now valued nearly $3 billion.

The activity caught attention because several of those addresses had been inactive for years, making this one of the more notable returns by an early-era holder.

Whale Moves Into Staking

According to blockchain observers, the transferred coins were not sent to trading venues. Instead, the funds were directed into new addresses tied to staking services, including Ethereum’s Plasma infrastructure, where assets can earn yield while remaining locked.

Two wallets that have been dormant for over 8 years just woke up and moved 200K $ETH ($785M) to 2 new addresses.

This Ethereum OG originally sourced their $ETH primarily from #Bitfinex , currently holds a total of 736,316 $ETH ($2.89B) across 8 wallets.

Wallets:… pic.twitter.com/wVFzXZcL0o

— Lookonchain (@lookonchain) September 26, 2025

Emmett Gallic, an analyst who flagged the movement, described the action as “bullish.” The choice to stake rather than sell has been noted by market watchers as a possible signal of long-term confidence in Ethereum’s prospects.

On-Chain Records Point To Early Holders

Reports have disclosed that much of the ETH came from Bitfinex and mining pools active around 2017. Some of the wallets had last moved funds about four years ago; others had been dormant for over eight years.

At the time those coins were last active, their combined worth was about $30 million. That figure contrasts sharply with today’s value, which approaches $3 billion, highlighting how much the asset has changed hands in value even for those who stayed put.

Price Pressure And ETF OutflowsEthereum’s price was under stress when the whale reappeared. Based on market data, ETH dipped to $3,829 today, a low not seen since August.

Reports show institutional vehicles have been selling recently: ETFs recorded roughly $547 million in outflows over four consecutive days earlier this week.

On Thursday, all ETFs logged net outflows except BlackRock , which posted neither inflows nor outflows that day. That said, BlackRock had sold close to $27 million worth of ETH the previous day. These moves appear to have helped push the price lower ahead of the whale’s action.

Market Reaction And What It May MeanAnalysts have pointed out that a large transfer like this would normally stoke fears of a liquidation. In this case, the absence of exchange deposits seemed to calm some traders.

Staking shifts coins off liquid markets and can reduce immediate sell pressure. Still, the broader sell-off from ETF products has been sizable and may keep acting as a drag on price until flows stabilize.

Featured image from Unsplash, chart from TradingView

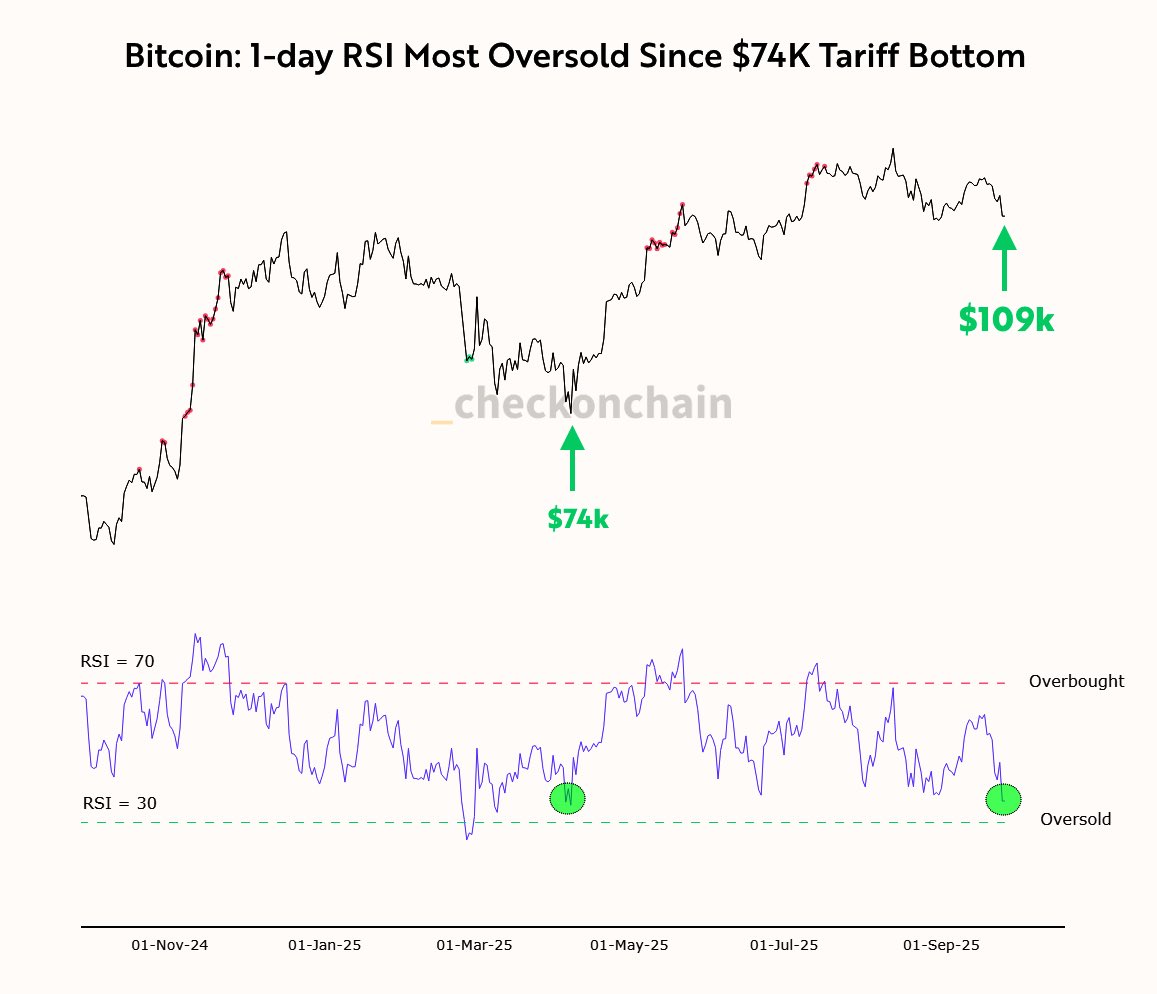

Bitcoin Daily RSI At Most Oversold Level Since April — Time To Buy?

The price of Bitcoin has been under intense bearish pressure over the past week, falling below the $...

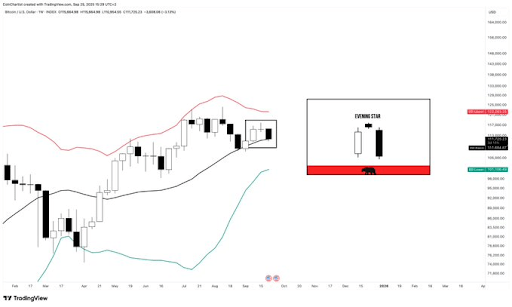

Bitcoin Price Forms Bearish Evening Star Pattern On Weekly Chart, But Can Price Go Below $100,000?

Market expert Tony Severino has raised some concerns with the current Bitcoin price action on the we...

Bitcoin Cycle Confluence Hints No Bottom Before October – What This Means

Bitcoin’s market structure is showing signs of cycle alignment that could delay a true bottom until ...