How Neopool Is Changing the Mining Market — and Whether It Really Does: An Outside Perspective

Mining remains one of the most technologically advanced yet controversial sectors of the cryptocurrency market. With growing demands for energy efficiency and stability, as well as increased scrutiny of environmental impact, miners worldwide are seeking solutions that allow them not only to maintain profitability but also to meet the industry’s evolving standards.

At a recent blockchain event in Dubai, I had the chance to speak with Andrey Kopeykin, CEO of Neopool, one of the industry’s fast-growing platforms. In our conversation, he emphasized:

“Today, mining is not just about the power of the equipment. Algorithms and services that enable miners to work more efficiently and transparently are becoming crucial. At Neopool, we focus on technological innovation and transparency of payouts.”

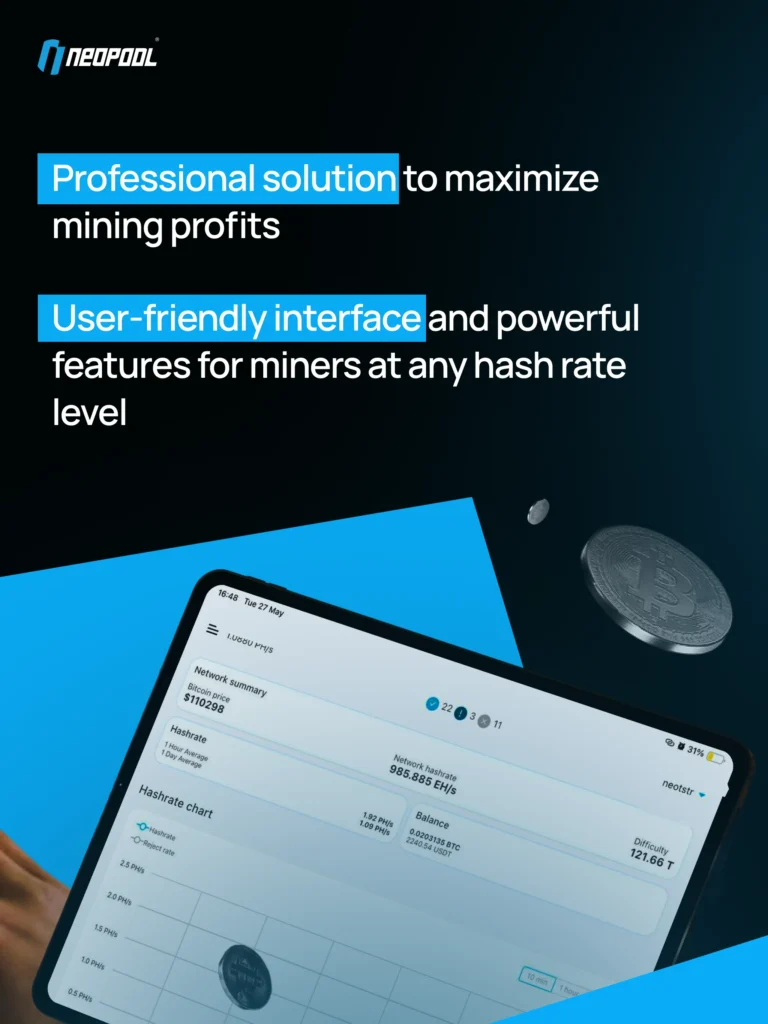

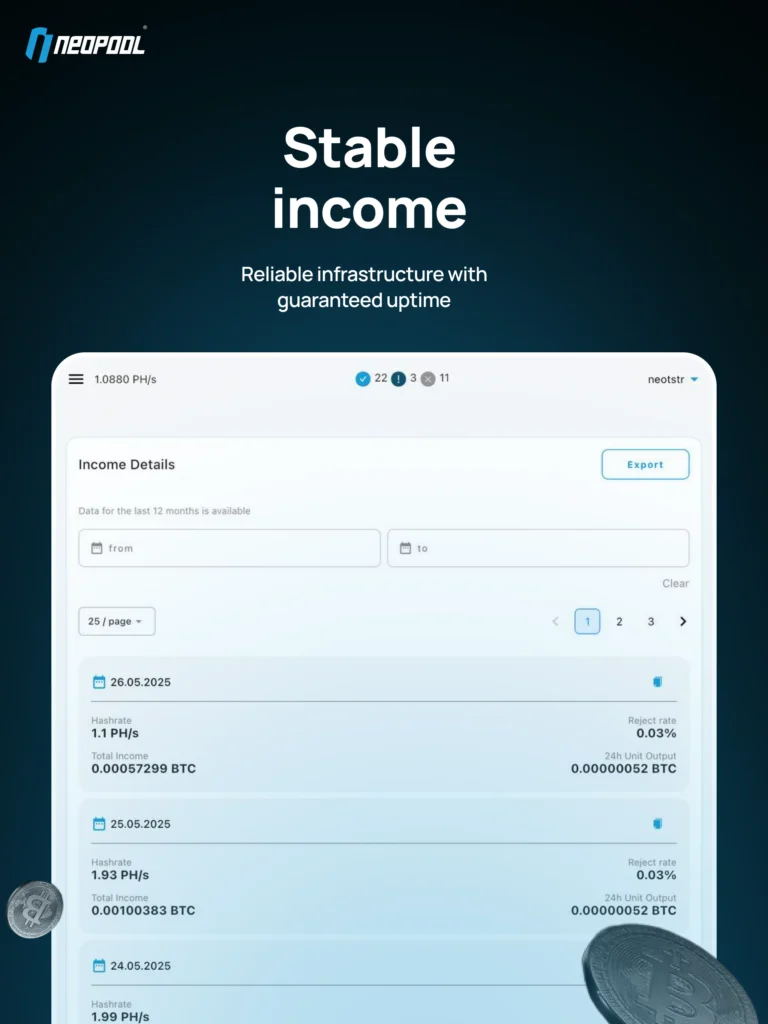

Within a short period, Neopool has entered the top 15 global mining pools by hashrate, consistently maintaining a capacity of around 15 EH/s. That’s an impressive achievement for a company positioning itself as a next-generation, tech-driven pool.

In discussions with Neopool representatives, a few notable details also emerged:

● The minimum withdrawal amount is just 0.001 BTC, making the platform accessible even for small-scale miners.

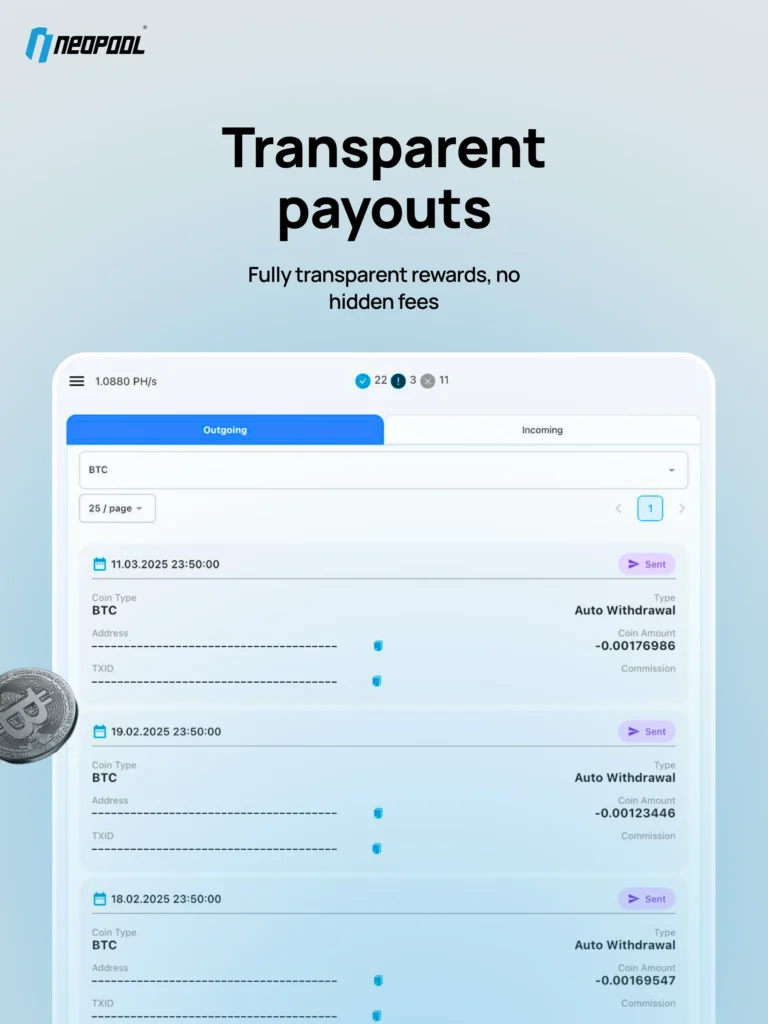

● Payouts are daily and automatic, with no hidden fees.

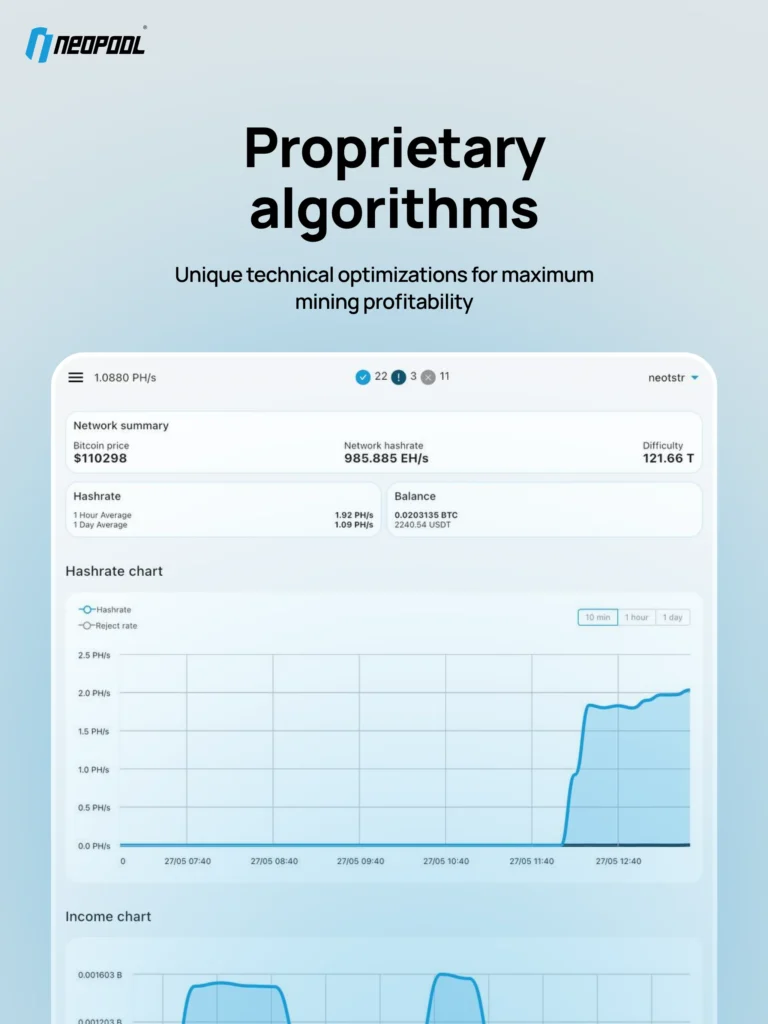

● The company employs proprietary algorithms that optimize task distribution and enhance ASIC performance.

The Market and Its New Challenges

While some companies focus solely on increasing raw hashrate, others are turning their attention to reducing costs and adopting “green” technologies. According to industry analysts, the next few years will be defined by energy efficiency and intelligent algorithms that can adapt to changing network difficulty and Bitcoin’s volatility.

Neopool, judging by its stated strategy, is aiming to carve out a niche in precisely this segment — combining technological innovation with user-friendly services.

“We understand that miners today need not only stable payouts but also confidence in tomorrow. That’s why our goal is to create a service where everyone can access transparent statistics and rely on predictable results,”

Kopeykin stressed.

Looking Ahead

It is still difficult to predict which companies will emerge as leaders in the next stage of the industry’s evolution. One thing is certain, however: the winners will be those who succeed in combining profitability with sustainability and innovation. Neopool , at the very least, is showing readiness for this race — offering technologies designed to meet the needs of both institutional players and individual miners.f

This article is not intended as financial advice. Educational purposes only.

Binance Taps Aave Protocol for On-Chain Yields on Plasma USDT

Binance launches the Aave-Plasma USDT Locked Product on Sept 25, offering up to 7% APR with daily US...

Leading Analyst Calls Bitcoin Hyper the Best Crypto to Buy Over Ethereum and Solana

Analyst names Bitcoin Hyper the top crypto pick over Ethereum and Solana, citing its Bitcoin Layer 2...

Uquid Integrates Krak to Power Borderless Crypto Payments for Web3 Shopping

Uquid has integrated Krak to its marketplace and unlocking 300+ crypto payment options for 178M prod...