Calm at the Top: Gold and Stocks Soar While Crypto Stumbles

Gold and U.S. equities are both pressing to new highs, but the paths driving them couldn’t be more different. The precious metal is being pulled higher by lower real yields and steady demand from central banks and ETFs. Wall Street, meanwhile, is riding a wave of liquidity, AI-driven optimism, and one of the longest stretches of calm in recent memory. Crypto has again broken in the other direction, its latest flash crash showing how leverage continues to dictate the market’s tone.

Gold’s Relentless Climb

Spot gold has cleared $3,700 an ounce for the first time, extending a rally that has already delivered more than 40% gains this year. Investors are treating bullion as the safest way to position for easier policy, with the Fed’s recent rate cut lowering the opportunity cost of holding a non-yielding asset. A steady bid from emerging-market central banks and inflows into gold-backed ETFs have only reinforced the move.

Each fresh record has brought fresh price targets. Talk of $4,000 by year-end is no longer niche, and more ambitious forecasts are circulating as well. That exuberance may need a reality check, but it underlines how gold has become the year’s standout asset.

Stocks Show Rare Composure

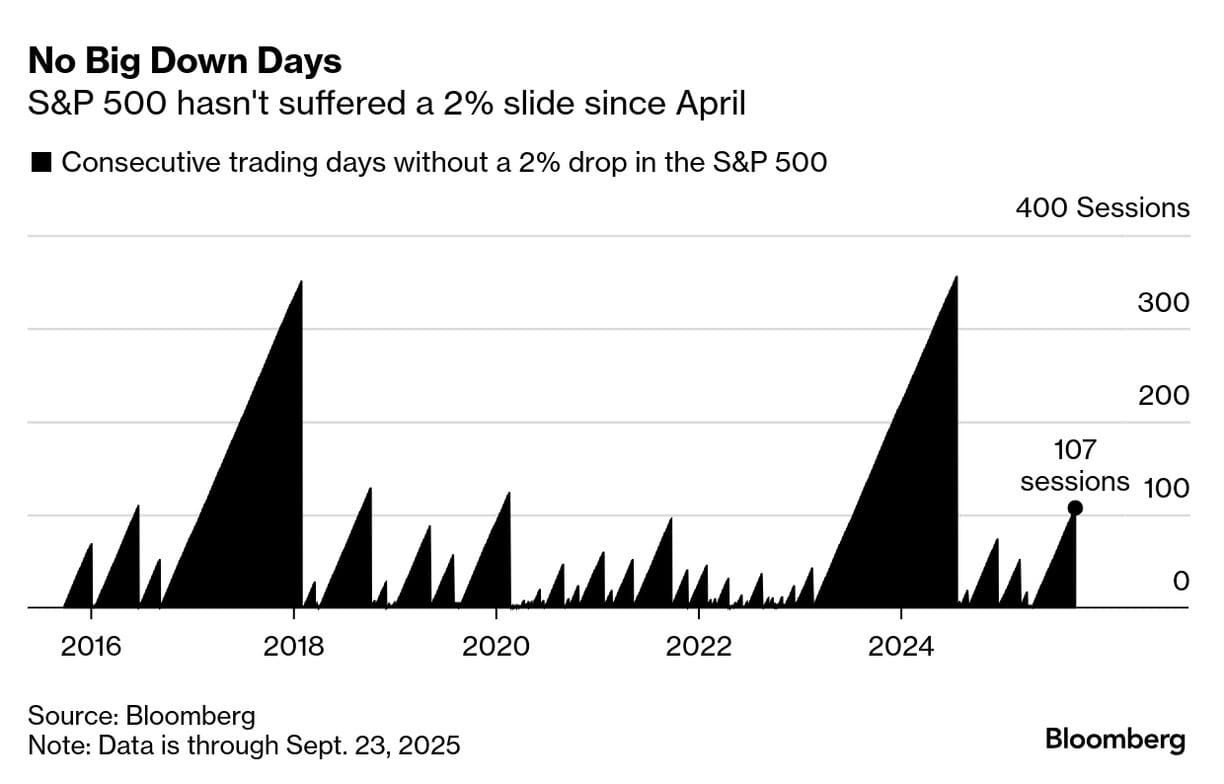

The S&P 500 has gained more than a third this year, adding trillions of dollars in market value since the tariff disputes of the spring. More striking is the smoothness of the climb. The benchmark has now gone 107 trading days without a fall of 2% or more — the longest such stretch in years.

That calm sits oddly alongside the risks still hanging over the market: global trade disputes, slowing growth, and valuations that look stretched by most historical measures. Fed Chair Jerome Powell has cautioned against assuming a straight path to easier policy, noting the challenge of deciding how far and how fast to cut. Still, earnings momentum in technology and ongoing liquidity support have kept buyers in control. Talk of a pullback has grown louder, but so far the market has shrugged it off.

Crypto’s Flash Crash

Digital assets have taken the opposite route. Bitcoin and Ether slumped this week in a sudden sell-off that erased billions in notional value. More than $1.5 billion of leveraged positions were wiped out in less than a day, with Ether longs accounting for nearly a third of that. The downdraft sent Ether down almost 9% at the lows before prices stabilized.

The episode was not sparked by a single piece of news. Instead, it was a reminder of how concentrated positions and thin liquidity can turn a routine move into a liquidation cascade. Options pricing has jumped as traders bet on bigger swings ahead. On Deribit, the largest crypto options exchange, positioning shows investors split between wagers on Bitcoin sliding toward $95,000 and surging above $140,000 — hardly a picture of stability.

This is the same pattern that has dogged crypto through the year: rallies that look strong on the surface but unravel quickly once leverage turns against the market.

Diverging Narratives

That gold and equities are both breaking records is unusual. One is traditionally a haven, the other a risk asset. Yet both are benefiting from the same backdrop: looser money. Lower rates reduce the appeal of cash and bonds, while lifting the relative case for gold and supporting higher valuations for stocks.

Crypto has not been able to join in. Instead of drawing strength from easier conditions, it remains at the mercy of its own market structure. Thin order books, heavy use of leverage, and speculative options activity leave it prone to sudden air pockets that wipe out gains in hours.

For now, gold remains the best-performing major asset this year so far, with gains of over 40 percent and counting.

Elsewhere

Blockcast

Bridging TradFi & Crypto: Reap's Daren Guo on Stablecoin Innovation

In this episode of Blockcast, Takatoshi Shibayama interviews Daren Guo, co-founder of Reap , a company pioneering stablecoin infrastructure for modern finance. Daren shares his journey from a traditional finance background, having been part of Stripe's growth team, to becoming a key player in the crypto space. He also discusses the transformative role of stablecoins in global payments, particularly their impact on cross-border transactions and financial inclusion in emerging markets.

Like what you hear? Subscribe to Blockcast on Spotify , Apple Podcasts , or wherever you listen.

ETF Exodus and Tether Talk Reignite Volatility as BTC Holds $112K

Your daily access to the backroom...

Coinbase to List Singapore Dollar Stablecoin XSGD in Landmark StraitsX Partnership

Coinbase and StraitsX ink partnership to offer XSGD to Coinbase users globally, as well as to launch...

Fitell Unveils $100M Solana Treasury, Plans Rebrand

Fitness equipment retailer Fitell Corporation (NASDAQ: FTEL) pivots to crypto with $100M Solana trea...