Bitcoin Will Soak Up Trillions From China And Russia, Billionaire Predicts

Pantera Capital founder Dan Morehead believes a geopolitical shift in reserve management will push adversaries of the United States into Bitcoin at massive scale, calling it “inevitable” that China and Russia eventually hold “trillions of dollars” worth of the asset.

Speaking on Blockworks’ Empire podcast released this week, the billionaire framed the prediction as part of a longer-term rotation in global reserve assets and a response to sanction risk embedded in dollar-denominated holdings. “I think it’ll take a decade or two,” Morehead said, adding that the first movers will likely include US-aligned Gulf states before “the big one” arrives with countries “antagonistic to the United States, like China or Russia.”

Why Russia And China Will Adopt Bitcoin

Morehead anchored his argument in the historical cadence of reserve transitions and the vulnerability of holding claims on a rival’s financial system. “You gotta remember, the reserve currency’s changed every 80 or 100 years… no one’s ever really lasted for more than, let’s call it 100, 110 years,” he said.

While calling it “inconceivable that the dollar will be supplanted” overnight, he warned that countries with large US Treasury positions face concentrated political risk. Citing China’s portfolio, he argued: “It’s really pretty crazy to have your entire country’s life savings in an asset that your potential adversary could literally just cancel.” In his view, that calculus makes it “inevitable” that such countries “will have started to save in Bitcoin and other cryptocurrencies” within the next decade.

The provocation lands amid measurable changes in how major economies hold US debt . Official Treasury data for July 2025 show China’s reported Treasury holdings at $730.7 billion, the lowest since 2008 and down markedly over the past decade, a decline often read as gradual diversification of reserves rather than abrupt abandonment.

JUST IN: BILLIONAIRE DAN MOREHEAD JUST SAID IT’S “INEVITABLE” CHINA AND RUSSIA WILL HOLD TRILLIONS OF DOLLARS IN #BITCOIN

NATION STATE GAME THEORY. IT’S HERE

pic.twitter.com/tOQO9tHYNi

— The Bitcoin Historian (@pete_rizzo_) September 23, 2025

Japan remains the largest holder at roughly $1.15 trillion, with the United Kingdom near $900 billion. The broader pool of foreign-held Treasuries nonetheless hit a record in July. These figures illustrate that while the dollar system remains deep and liquid, China’s share is slipping at the margin—the exact dynamic Morehead argues could accelerate alternative reserve strategies over time.

Morehead’s timeline also intersects with a flurry of policy proposals that, if enacted, would normalize sovereign Bitcoin exposure. In March, US President Donald Trump signed an executive order establishing a Strategic Bitcoin Reserve and a national digital asset stockpile. Wyoming legislators separately advanced a bill to permit limited Bitcoin investments—capped at 3%—within certain state funds, an incremental step toward institutional reserve management in digital assets at the state level.

Outside the US, Gulf governments are already experimenting at the edges of sovereign crypto exposure—another plank in Morehead’s thesis. The United Arab Emirates’ has launched state-backed mining initiatives and disclosures suggesting several thousand BTC accumulated on the balance sheet via those operations.

Skeptics will note that moving “trillions” of dollars into Bitcoin would require not only policy shifts but also market structure capable of absorbing sustained sovereign demand without disorderly volatility. Liquidity depth has improved with US spot ETF adoption and growing derivatives markets, yet Bitcoin’s free float, custody frameworks, and cross-border payment rails still face periodic stress.

Morehead, however, situates the thesis in a long arc rather than a short-term trade. “I don’t think it’s gonna happen overnight,” he said, emphasizing a horizon of “a decade or two” and a phased path in which US-aligned adopters pave the way for politically non-aligned states that prize censorship resistance and sanction insulation.

For China and Russia specifically, the impetus would be as much strategic as financial. China’s willingness to chip away at Treasuries aligns with its broader push to diversify reserves into gold and other assets, while Russia’s post-2014 and 2022 sanctions experience has already driven a dramatic reconfiguration of its reserve composition.

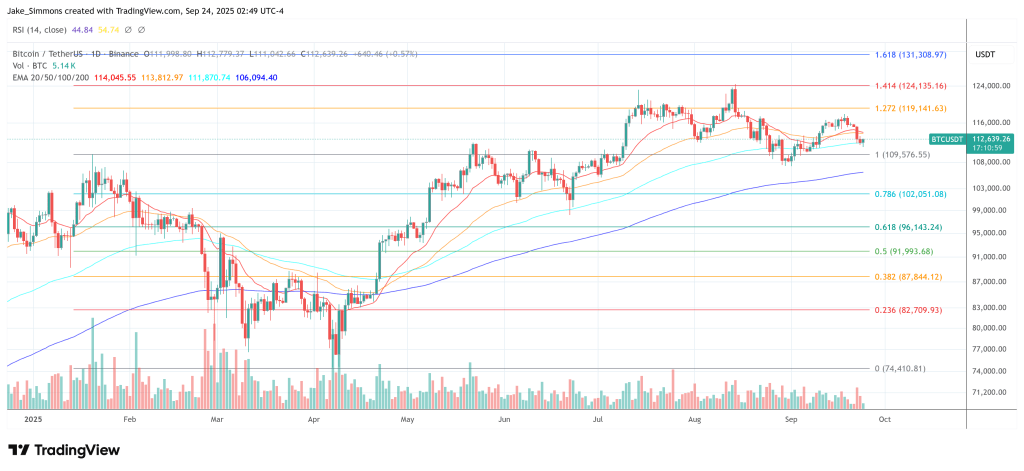

At press time, Bitcoin traded at $112,639.

XRP Supply Shock Incoming As Axelar And Flare Target 8 Billion Tokens

In a week dominated by deleveraging headlines, two interoperability- and DeFi-focused initiatives ar...

BlackRock’s BUIDL Fund Seeks Expansion Into XRP Ledger, Fueling PEPENODE’s $1.4M Presale

BlackRock’s $2B Institutional Digital Liquidity Fund (BUIDL) fund is seeking expansion into XRP Ledg...

These Analysts Predicted The Bitcoin Price Crash And Their Forecasts Say It’s Not Over

The Bitcoin price crash began over the weekend and has since seen he digital asset break below the $...