Altcoins Hit Hard as Week Starts With $1.7 Billion in Crypto Liquidations

The crypto market kicked off the week with one of its sharpest downturns of 2025, erasing more than $151 billion in market value within a single day. According to data from CoinGlass, over $1.7 billion in leveraged positions were liquidated in just 24 hours, leaving more than 402,000 traders in the red.

Ethereum (ETH) bore the heaviest losses, with nearly $500 million in liquidations, while Bitcoin (BTC) saw about $284 million wiped out. Altcoins such as XRP, Solana, Dogecoin, and Hyperliquid (HYPE) tumbled between 7–12%, erasing recent gains and signaling an abrupt end to the latest altcoins rally.

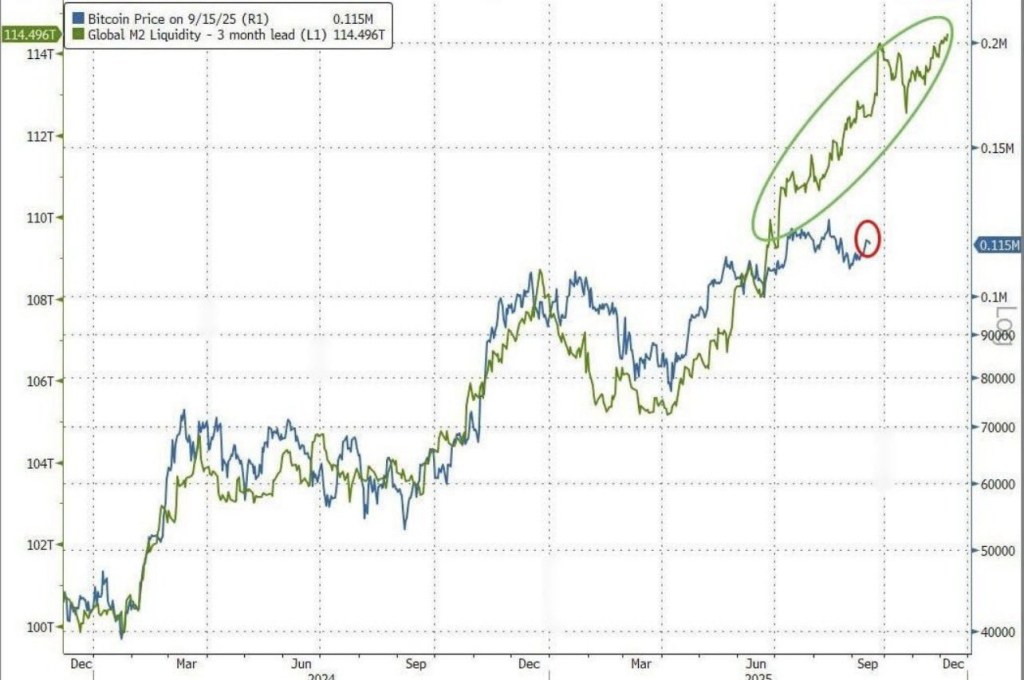

The cascade began with BTC dipping below $113,000, triggering margin calls and automated sell-offs. Within just 30 minutes, liquidations had surged past $1 billion, underscoring the fragility of highly leveraged trading environments.

Bitcoin Dominance Rises as Altcoins’ Value Drops

The sell-off also brought a sharp reversal in market sentiment. The Altcoin Season Index, which peaked at 100 points just days ago, has now dropped to 64, suggesting traders are shifting back toward Bitcoin. BTC dominance has climbed to 57%, while ETH dominance slipped to 13%.

Historically, altcoin seasons last only a few weeks before liquidity rotates back into Bitcoin. Analysts warn that the latest liquidation cascade may have ended this cycle earlier than expected.

Smaller tokens, including ASTER, WLFI, and PUMP, which recently saw speculative surges, were among the hardest hit, with more than $263 million in altcoins longs liquidated.

Healthy Shakeout or Bearish Warning?

Despite the steep losses, many analysts argue the pullback reflects a healthy reset rather than the end of the bull cycle. Overleveraged traders were washed out, creating stronger support levels for long-term holders.

Institutional demand remains intact, with Bitcoin and Ethereum ETFs recording steady inflows last week, suggesting that large investors continue to buy the dip. On-chain data also shows 420,000 ETH leaving exchanges, pointing toward accumulation despite short-term volatility.

For now, the market’s next move hinges on whether Ethereum can hold above $4,100 and Bitcoin stabilizes near the $112,000–$114,000 zone. Despite skepticism from traders, analysts predict a correction as laying the groundwork for the next upward move in the ongoing bull market.

Cover image from ChatGPT, ETHUSD chart from Tradingview

Aster Forms Bullish Hammer At Key Support – Reversal Setup?

ASTER, the native token of the decentralized perpetual exchange Aster, officially launched last week...

Solana Faces Deadly Selling Pressure After 312,233 SOL Deposit Into Coinbase – Here’s The Value

Solana (SOL) investors are witnessing rising volatility as a surge in whale activity signals deadly ...

Bitcoin Stuck In Neutral While Markets Roar — Analyst Explains Why

Bitcoin’s listless tape in the face of roaring macro risk is less a contradiction than a timing prob...