Solana Treasury Player SOL Strategies Goes Public On Nasdaq

SOL Strategies Inc., the company that grew out of Cypherpunk Holdings, made its Nasdaq debut this week under the ticker STKE. According to reports , the move converts the company’s Canadian listings into a US trading venue and gives American investors direct access to a firm that holds a sizable Solana treasury.

The firm’s SOL holdings were valued at roughly $83 million–$94 million around the time of the listing, and SOL token prices were trading in the $214–$220 range as markets reacted.

Nasdaq Debut And Trading Volatility

According to market watchers, STKE opened around $12.85 on Nasdaq before tumbling to roughly $8.18 in early trades, showing heavy volatility in the first session.

The company still maintains a presence in Canada, where it trades as HODL on the Canadian Securities Exchange, and its OTCQB shares (CYFRF) are being migrated into the Nasdaq listing.

Reports have disclosed that the early price swings were driven by speculative flows and the usual market churn that follows a high-profile uplisting.

A Bigger Picture On Holdings

SOL Strategies has been built as a Solana-focused treasury and operational group. It runs validators, takes part in staking, and invests in projects inside the Solana ecosystem.

The company’s holding size puts it among notable North American SOL treasuries, though some peers hold far more. For example, coverage shows Upexi Inc. holds about 1.9 million SOL, which was valued at roughly $319 million, while DeFi Development Corp holds about 1.18 million SOL, worth about $198 million at market rates cited in reports.

Market Reaction And Investor InterestAccording to market coverage, the Nasdaq listing gave SOL Strategies fresh visibility and attracted both retail traders and institutional curiosity.

The share-price swings were large enough to draw headlines, and trading volume spiked as investors weighed the risks and rewards of a treasury-backed crypto firm now trading on a major US exchange.

Some traders treated STKE as a way to get indirect exposure to SOL, while others saw it as a pure equity play in a niche operator.

Regulatory And Competitive IssuesSOL Strategies is smaller than several competitors, raising questions about scale and sustainability if SOL volatility returns.

Regulators and market watchers will likely keep a close eye on how crypto treasuries are presented to investors, and on disclosures about staking, validator income, and treasury management.

Featured image from Google Images, chart from TradingView

Mantle Becomes Top Gainer as Bybit Deal Pushes MNT to ATH: Can the Rally Last?

Mantle (MNT) has emerged as the top gainer in the crypto market, soaring to a new all-time high of $...

Ripple Carries Out Massive RLUSD Burns, What’s Going On?

Ripple has carried out a series of large RLUSD burns in recent weeks to remove millions of the stabl...

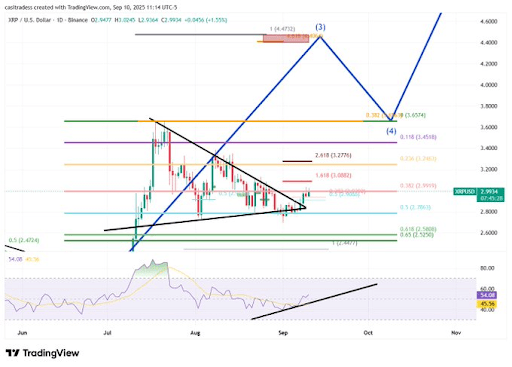

Pundit Reveals What XRP Price Will Be If Ethereum Hits $25,000

Crypto analyst Whale Guru has outlined his targets for altcoins on their next massive pump to the up...