Dogecoin Holds Support as Analysts Eye Technical Setup That Could Trigger a $2 Super Rally

Dogecoin (DOGE) continues to show resilience as it holds above the critical $0.21 support level, a price zone that has repeatedly acted as a launchpad for bullish momentum. At the time of writing, DOGE trades at $0.216, up 0.34% in the last 24 hours.

Analysts highlight the emergence of a bullish cup-and-handle pattern with an initial target of $0.30, but the long-term projections are even more ambitious, pointing toward a potential 850% rally to $2 if momentum accelerates.

A recent whale transfer of 900 million DOGE ($200 million) to Binance temporarily triggered selling pressure, but strong buying support quickly stabilized prices. This recovery is seen by many traders as a sign of institutional and retail.

Technical Patterns Hint at Breakout Potential

Dogecoin’s technical indicators paint a mixed but promising picture. The Relative Strength Index (RSI) sits at 47, suggesting neutral momentum and leaving room for an upward push.

While DOGE trades below short-term moving averages (7, 20, and 50-day), it remains above its 200-day SMA at $0.20, a sign of long-term structural strength.

The Moving Average Convergence Divergence (MACD) still shows mild bearish momentum, but signals of stabilization around $0.21 hint at a potential reversal.

Meanwhile, Bollinger Bands indicate DOGE is trading near the lower range, with room to test $0.24 resistance. A confirmed breakout above $0.24 could unlock the path toward $0.30 and, eventually, higher levels if market sentiment improves.

September could prove decisive for DOGE. Crypto strategists believe the defense of $0.21 support may be the catalyst for a parabolic rally. If bullish momentum sustains, the cup-and-handle breakout pattern could evolve into a multi-stage rally, with $0.30 as the short-term target and $2 as the ultimate bull case scenario.

Beyond technicals, regulatory optimism is adding fuel. With the U.S. SEC nearing decisions on crypto ETF approvals, including a potential Dogecoin ETF, analysts see institutional inflows as a major accelerant for future price action.

For traders, the $0.20–$0.21 range presents a favorable risk-reward setup with clear stop-loss levels. If DOGE holds the line, the meme coin may be preparing for its most significant breakout yet.

Cover image from ChatGPT, DOGEUSD chart from Tradingview

Old Bitcoin Supply Keeps Moving Into ETFs: Data Shows Three Waves So far

On-chain data shows the Bitcoin spot exchange-traded funds (ETFs) have seen three waves of major inf...

Bitcoin Bull Run Nears Its Climax: Cycle Peak Indicates 95% Completion

Bitcoin (BTC) has recently reached a new weekly high above the $112,000 mark, signaling a potential ...

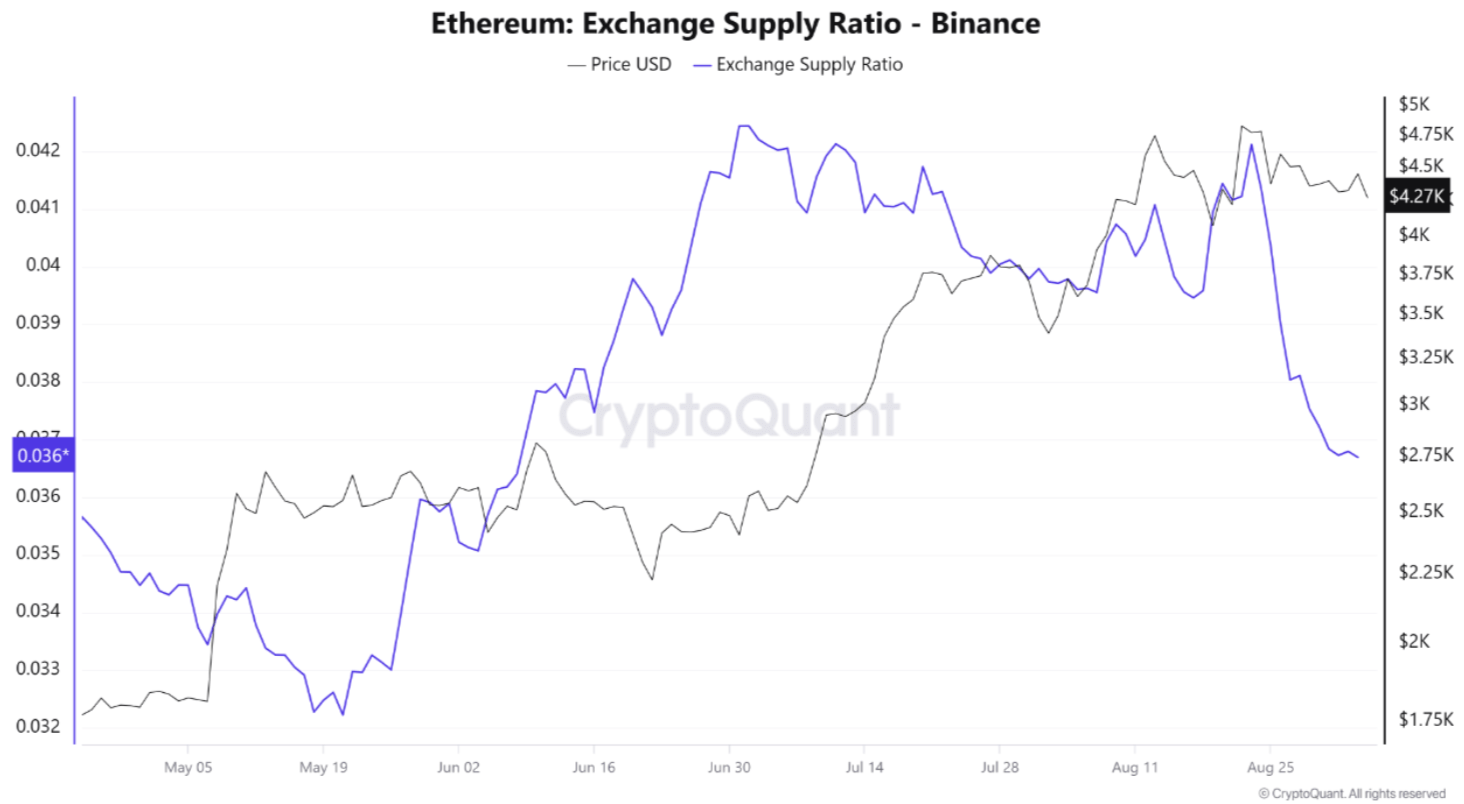

Ethereum Outflows Drive Binance Supply Ratio Under 0.037, Signaling Bullish Setup

After hitting its latest all-time high of $4,956 on August 23 on Binance, Ethereum (ETH) has been tr...