Spot Ethereum ETF Inflows Flip Bitcoin Once Again, Will ETH Outperform BTC?

Ethereum has once again overtaken Bitcoin in the competition for institutional attention, with Spot Ethereum ETFs recording larger inflows than their Bitcoin counterparts in the past few days. This trend might be building up another chapter in the growing debate over whether Ethereum is on track to start outperforming Bitcoin in terms of price action, which might lead to another altcoin season this cycle.

Ethereum ETF Inflows Surpass Bitcoin Once Again

Data from ETF trackers show that Ethereum funds have been posting stronger inflows than Bitcoin ETFs across several sessions in recent days. According to data from Farside Investors , US-based Spot Ethereum ETFs captured around $307.2 million in net inflows on August 27, bringing the total cummulative netflow to $13.64 billion.

The bulk of these inflows came from BlackRock’s iShares Ethereum Trust (ETHA), which attracted $262.6 million on the day, while Fidelity’s FETH added $20.5 million. By contrast, Spot Bitcoin ETFs based in the US managed to attract just $81.4 million in net inflows.

The ETF inflows in the past 24 hours are not an isolated occurrence. Ethereum has now outpaced Bitcoin inflows across multiple consecutive trading days to give a glimpse into institutional sentiment toward the second-largest cryptocurrency. For example, August 26 was highlighted by a $455 million inflow into Spot Ethereum ETFs, compared to $88.1 million into Spot Bitcoin ETFs. The previous day (August 25) saw a similar pattern, with $443.9 million directed into Ethereum funds versus $219.1 million into Bitcoin.

The surge in Ethereum inflows can be traced back to the middle of July , when Spot Ethereum ETFs first surpassed Bitcoin’s daily inflows. During that period, ETH funds brought in $603 million on July 17, compared with Bitcoin’s $522 million, to establish a precedent that appears to be repeating.

Will Ethereum Outperform Bitcoin This Cycle?

The recent trend of Ethereum ETFs outperforming their Spot Bitcoin ETFs is sure to resonate well with many Ethereum proponents, who are awaiting a full-blown altcoin season led by the leading altcoin. However, the important question is whether Ethereum’s recent momentum can translate into long-term outperformance of Bitcoin.

Related Reading: Machine Learning Algorithm Predicts Ethereum Price Will Cross $9,000, Here’s When

Alongside the divergence in ETF flows, the price action of Ethereum and Bitcoin has also highlighted their contrasting trajectories in recent days. Ethereum has been trading with stronger upside pressure and less downside pressure, which allowed it to reach a new all-time high of $4,946 on August 24. At the time of writing, Ethereum is trading at $4,616 after testing an intraday high near $4,658 and a session low of $4,473.

Bitcoin, on the other hand, is steady but showing less upward momentum. At the time of writing, Bitcoin is trading at $113,100 after trading between roughly $110,465 and $113,332 on the day, which keeps its price movement tilted more towards the downside.

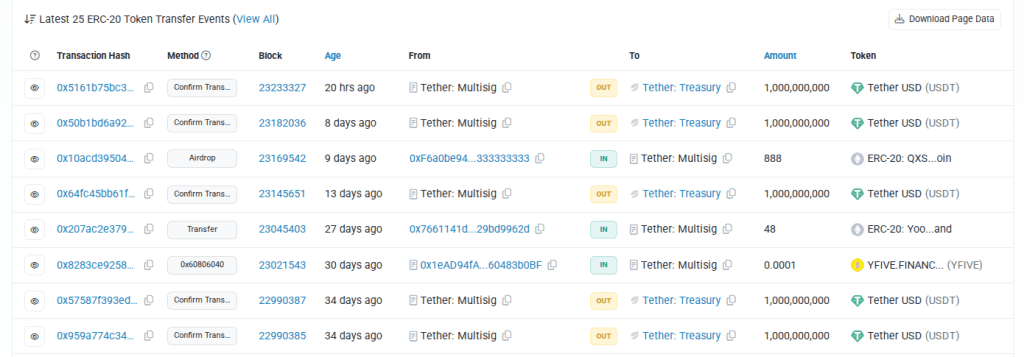

Tether Unleashes $1 Billion In New USDT As Crypto Market Recovers

Tether minted 1 billion in USDT on Wednesday, a move that market watchers say added fresh liquidity ...

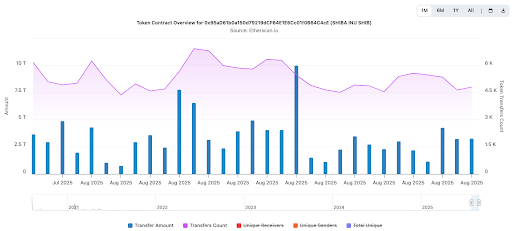

Shiba Inu Sees 300% Surge In This Major Metric, Is The Bottom In?

Shiba Inu (SHIB) is experiencing renewed interest after fresh data revealed a massive 300% spike in ...

Calm Before The Surge? Bitcoin Price Stability Signals Sustainable Rally Ahead

Bitcoin is entering a phase of unusual calm, with price volatility dropping to some of its lowest le...