Google Launches Cross-Border Payments Platform GCUL

The post Google Launches Cross-Border Payments Platform GCUL appeared first on Coinpedia Fintech News

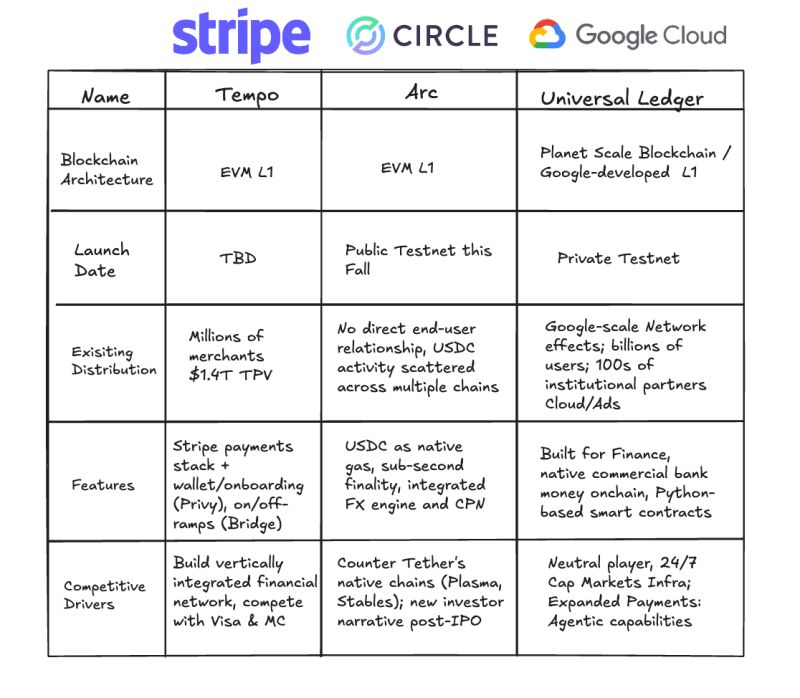

Google Cloud is entering financial technology with its new blockchain platform, Google Cloud Universal Ledger (GCUL) . The platform aims to make global payments faster, cheaper, and more transparent, while challenging the dominance of the existing players in this market, like Circle, Stripe & and Ripple.

Currently in private testing, GCUL is targeting a multi-trillion-dollar global payments market.

What’s All about GCUL?

According to Google Cloud’s head of Web3 strategy, Rich Widmann , GCUL is a Layer 1 blockchain built for financial institutions. It supports Python-based smart contracts and is designed to help banks, payment companies, and intermediaries who want to modernize their services without the headaches of traditional systems.

Some in the crypto community have raised concerns, arguing that GCUL is more like a consortium chain than a decentralized network. Thus, Google highlighted that the platform is designed to be:

- Simple: offer a single API for multiple currencies, no need for complex infrastructure.

- Flexible: scalable smart contracts (in Python) for payment automation and digital assets.

- Safe: permissioned but compliance-focused, using Google’s secure technology and requiring KYC-verified accounts.

If successful, GCUL could transform payments with lower costs and fewer errors, while unlocking 24/7 settlement.

How It Competes Against Competitors

This comes at a time when the digital payments race is heating up with Ripple, Circle, and Stripe all building blockchain solutions. Ripple pushes XRP for fast remittances, Circle just launched its own blockchain Arc, and Stripe is testing Tempo for developers.

But Google’s GCUL wants to stand out by being neutral and open for any financial institution to use.

The numbers show why this battle matters. Stablecoin volumes tripled in 2024, with $30 trillion in transactions, far surpassing PayPal with $1.6 trillion and even Visa’s $13 trillion.

Google hopes GCUL can tap into this growth by offering low fees, compliance tools, and instant settlement.

Partnership with CME Group

Google first unveiled GCUL in March alongside CME Group, which is already testing tokenization and wholesale payments on the platform. The first phase of testing has been completed, with broader trials planned later this year.

If all goes well, new services could officially roll out in 2026.

Bloomberg Analyst Weighs In on XRP ETF Demand as SEC Delays Decision

The post Bloomberg Analyst Weighs In on XRP ETF Demand as SEC Delays Decision appeared first on Coin...

Japanese Firm Metaplanet Plans $1.2B Share Sale to Buy More Bitcoin

The post Japanese Firm Metaplanet Plans $1.2B Share Sale to Buy More Bitcoin appeared first on Coinp...

XRP: The Most Attacked Crypto That Keeps Getting Free Marketing

The post XRP: The Most Attacked Crypto That Keeps Getting Free Marketing appeared first on Coinpedia...