Bitcoin Whales Strike Again: Strategic Selling on Binance Puts $110K in Sight

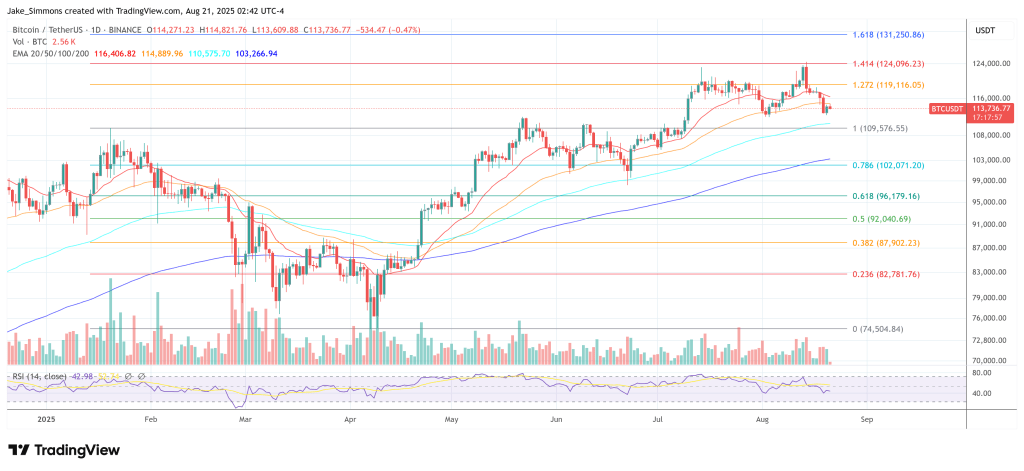

Bitcoin has retreated from last week’s record high above $124,000, slipping by over 8% in recent days. At the time of writing, the cryptocurrency trades around $113,867, reflecting a 6.3% decline over the past seven days.

The correction has raised questions about the forces driving current market dynamics, particularly the role of large holders in shaping price momentum. On-chain data has pointed to a consistent pattern of selling activity from whales on Binance, the world’s largest exchange by trading volume.

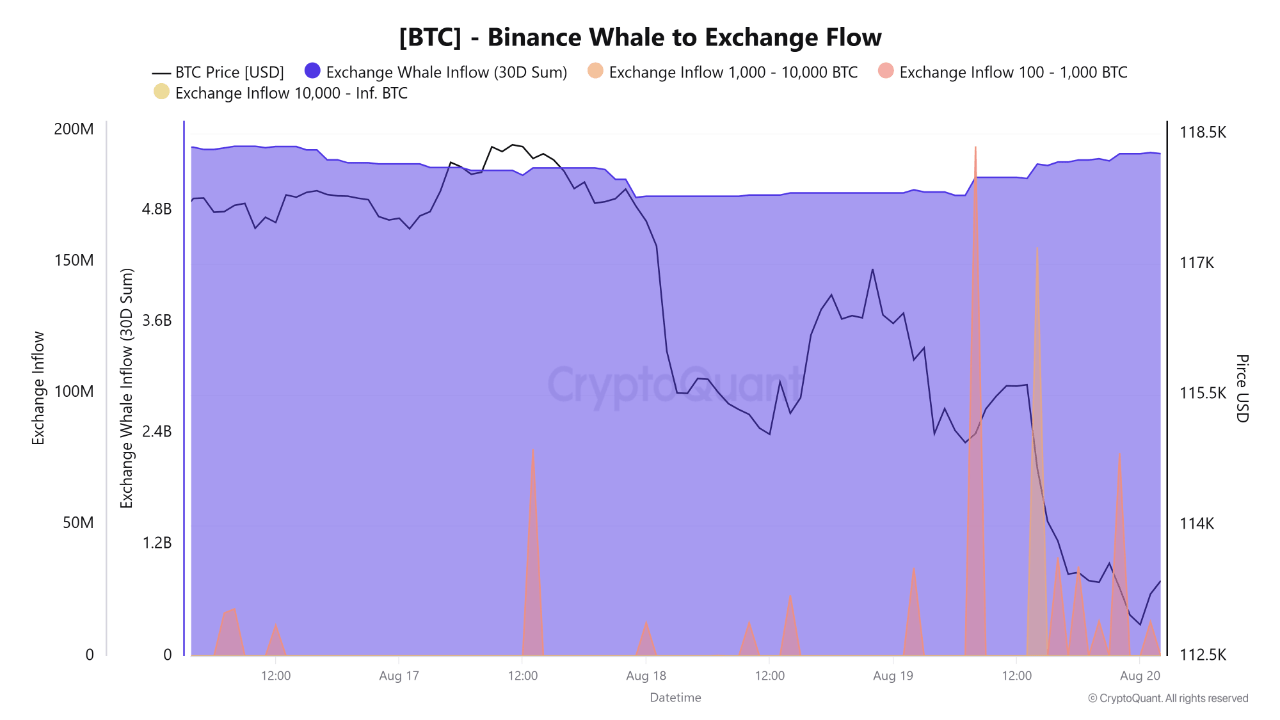

According to CryptoQuant contributor Arab Chain, these movements appear to be deliberate, with whales strategically distributing holdings near resistance levels.

The data shows a series of deposits in the 100–1,000 BTC range flowing into Binance, suggesting calculated selling activity aimed at capturing profits while minimizing sharp price impacts .

Bitcoin Whale Activity and Market Distribution

Arab Chain’s analysis highlights that Bitcoin’s recent dip to levels near $112,500 coincided with an increase in whale inflows to Binance. These deposits were not massive, singular transfers exceeding 10,000 BTC, but rather repeated transactions over several days, creating what the analyst described as a “coordinated distribution pattern.”

This behavior aligns with historical whale strategies , selling gradually at key resistance zones, in this case between $118,000 and $120,000, rather than triggering abrupt market declines.

The analyst also observed that despite these movements, the 30-day cumulative whale flow indicator has remained steady around $4.8 billion, signaling that broader accumulation trends remain intact. However, short-term pressure persists.

The data shows that each rebound attempt by Bitcoin is met with additional whale deposits to exchanges, reinforcing selling momentum. If this trend continues without a significant pickup in buying activity, Arab Chain warned that Bitcoin could face further downside, potentially testing the $110,000 support zone.

Broader Market Context and Institutional Positioning

While whale activity has been the focus of near-term market analysis, other perspectives suggest a more layered view of Bitcoin’s position.

Another CryptoQuant contributor, known as IT Tech, noted that institutional strategies such as dollar-cost averaging (DCA) via over-the-counter (OTC) desks and on-chain settlements also play a role in shaping demand.

However, these flows alone do not always determine immediate price direction. Instead, IT Tech emphasized the importance of monitoring ETF inflows, spot cumulative volume delta (CVD), and exchange premiums, such as those on Coinbase, to gain a clearer understanding of market sentiment.

This mix of whale-driven selling and institutional accumulation highlights the complexity of the current market. On one hand, short-term tactical selling on exchanges like Binance creates downward pressure, while on the other, longer-term investment vehicles continue to add to Bitcoin’s demand base .

The interaction of these factors will likely determine whether Bitcoin stabilizes above current levels or moves toward a deeper correction.

Featured image created with DALL-E, Chart from TradingView

Bitcoin Braces For Pain As $2 Trillion Liquidity Engine Shuts Off

Bitcoin’s near-term path, argues macro commentator Bruce Florian–founder of the Bitcoin Self-Custody...

Analyst Warns Investors To Avoid Bitcoin At All Cost As Price Is Going Below $60,000

Bitcoin has entered a precarious situation after falling below $114,000, and sellers continue to mou...

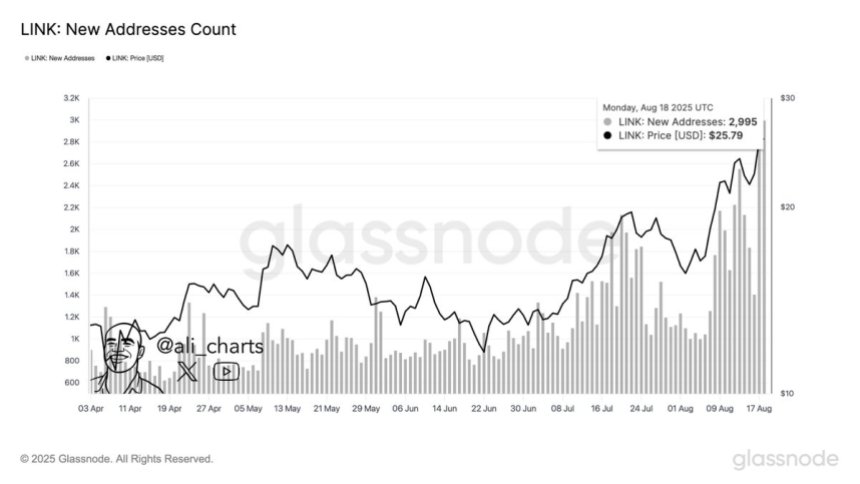

Chainlink Eyes Crucial Resistance After $25 Reclaim – Breakout Or Breakdown Next?

Chainlink (LINK) is attempting to reclaim a crucial area after recovering 10%, surpassing most of th...