New Crypto Assets Group Backed By Trump Gets Green Light

The Securities and Exchange Commission is moving in a different direction on crypto.

Chair Paul Atkins confirmed that the agency will launch the President’s Digital Assets Group, a step he says will open a new chapter in US regulation.

White House Roadmap

According to Atkins, the first objective of the new group will be to carry out recommendations from the President’s Digital Asset Markets Working Group.

His remarks came during the Wyoming Blockchain Symposium, where he introduced what he called “Project Crypto” and promised to move away from regulation by enforcement.

I had a great conversation with @TeresaGoody at @SALTConference ’s Wyoming Blockchain Symposium today about my priorities as @SECgov chairman, including Project Crypto and making IPOs great again. It’s a new day at the SEC.

Thread

pic.twitter.com/I7UIrjQFpT

— Paul Atkins (@SECPaulSAtkins) August 19, 2025

Atkins stated the SEC will not rely on old methods. Instead, the commission intends to create rules that prevent abuse but remain flexible enough for technology’s rapid development.

Atkins said the effort is part of US President Donald Trump’s extensive push for a more transparent policy on digital assets.

Investor Protection And Innovation

Atkins praised the administration for supporting a plan that he says balances investor protection with space for innovation.

He added that cooperation with Congress, the White House, and other agencies will help keep US policy consistent and aligned with international standards.

This is a clear contrast to the approach of his predecessor, Gary Gensler, who frequently said most tokens were securities under existing rules.

Critics of Gensler’s stance argued it drove innovation overseas and created a climate of uncertainty.

Atkins rejected that argument, saying very few tokens meet the definition of securities. The way tokens are packaged, marketed, and sold matters more, he explained.

Flexible Rules For DevelopersThe shift could make it easier for crypto projects to operate in the US without immediately being treated as securities.

Reports show that the President’s DAWG released a roadmap in July urging regulators to introduce rules that encourage businesses while maintaining investor safeguards. Atkins said the SEC will stick closely to that roadmap.

Exemptions & TransparencyHe explained that the commission will provide exemptions, safe harbors, and new disclosure standards tailored for crypto companies.

That would replace the “one-size-fits-all” system that has frustrated the industry for years.

Activities such as ICOs, airdrops, network rewards, and building decentralized apps may be treated more flexibly under this plan.

Atkins clarified that the new approach does not mean a free-for-all, but rather a structure designed to support responsible growth.

Featured image from Meta, chart from TradingView

Whale Sell-Off and ETF Uncertainty Drag XRP Lower: Is $2.8 Just a Stop Before Deeper Losses?

XRP slipped below the critical $3.00 level this week, extending its losing streak as whale sell-offs...

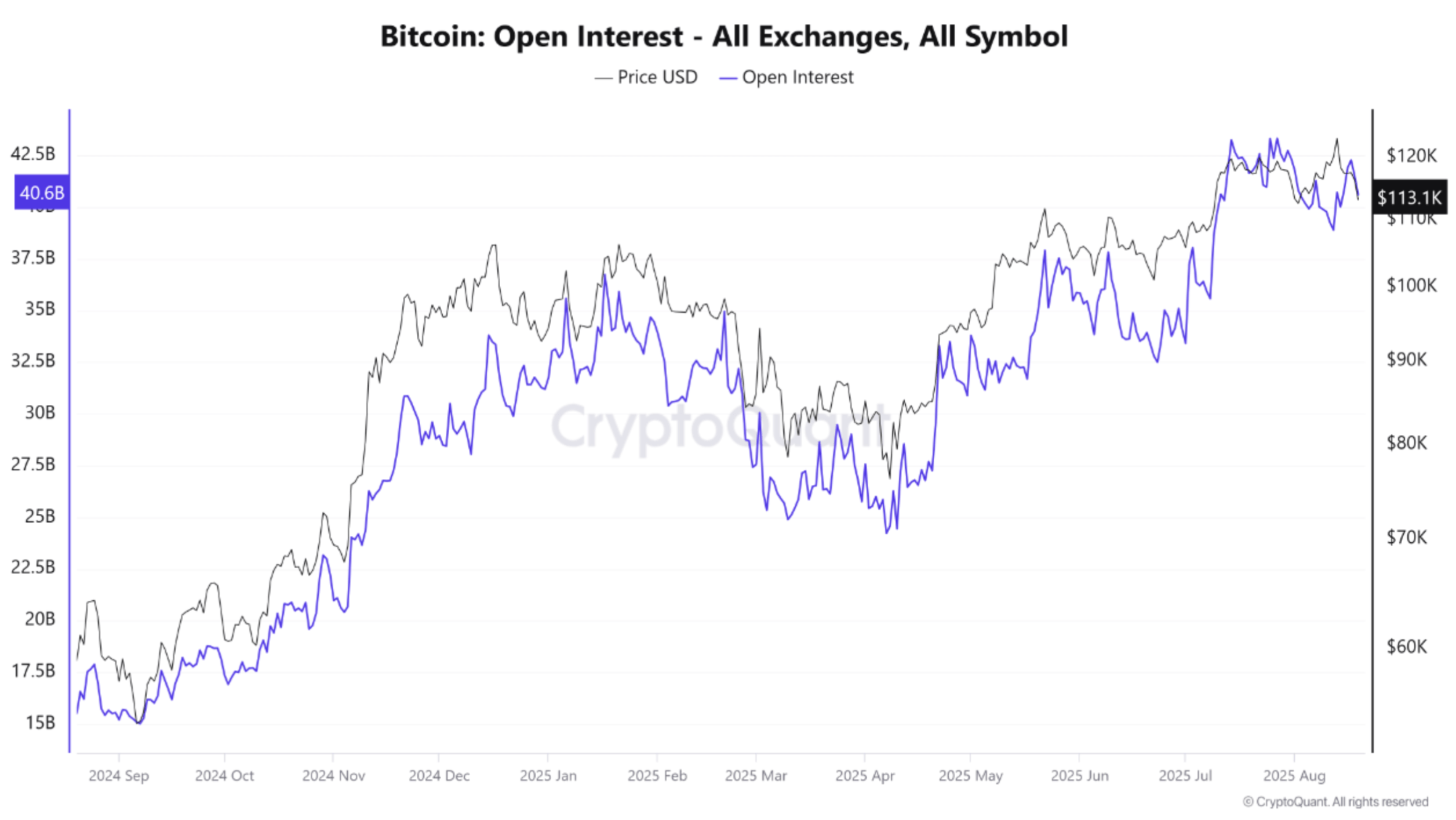

More Pain For Bitcoin? Open Interest Surpasses $40 Billion As Longs Crowd In

After hitting a new all-time high (ATH) of $124,474 on Binance on August 13, Bitcoin (BTC) has tumbl...

Ethereum Nears $4K as $4B Supply Overhang Looms: Analysts Fear Deeper Losses

Ethereum (ETH) is struggling to hold above $4,200 after a sharp sell-off triggered widespread liquid...