Bitcoin Miner TeraWulf Lands Google Partnership in $3.7B AI Infrastructure Deal

Bitcoin mining company TeraWulf has secured a massive AI infrastructure agreement with Google's backing, marking one of the largest crypto-to-AI pivots as miners grapple with challenging post-halving economics.

The company announced 10-year colocation agreements with AI platform Fluidstack worth $3.7 billion, with potential to reach $8.7 billion through lease extensions. Google will backstop $1.8 billion of Fluidstack's obligations and receive warrants for approximately 41 million TeraWulf shares, representing an 8% equity stake, the company announced on Thursday.

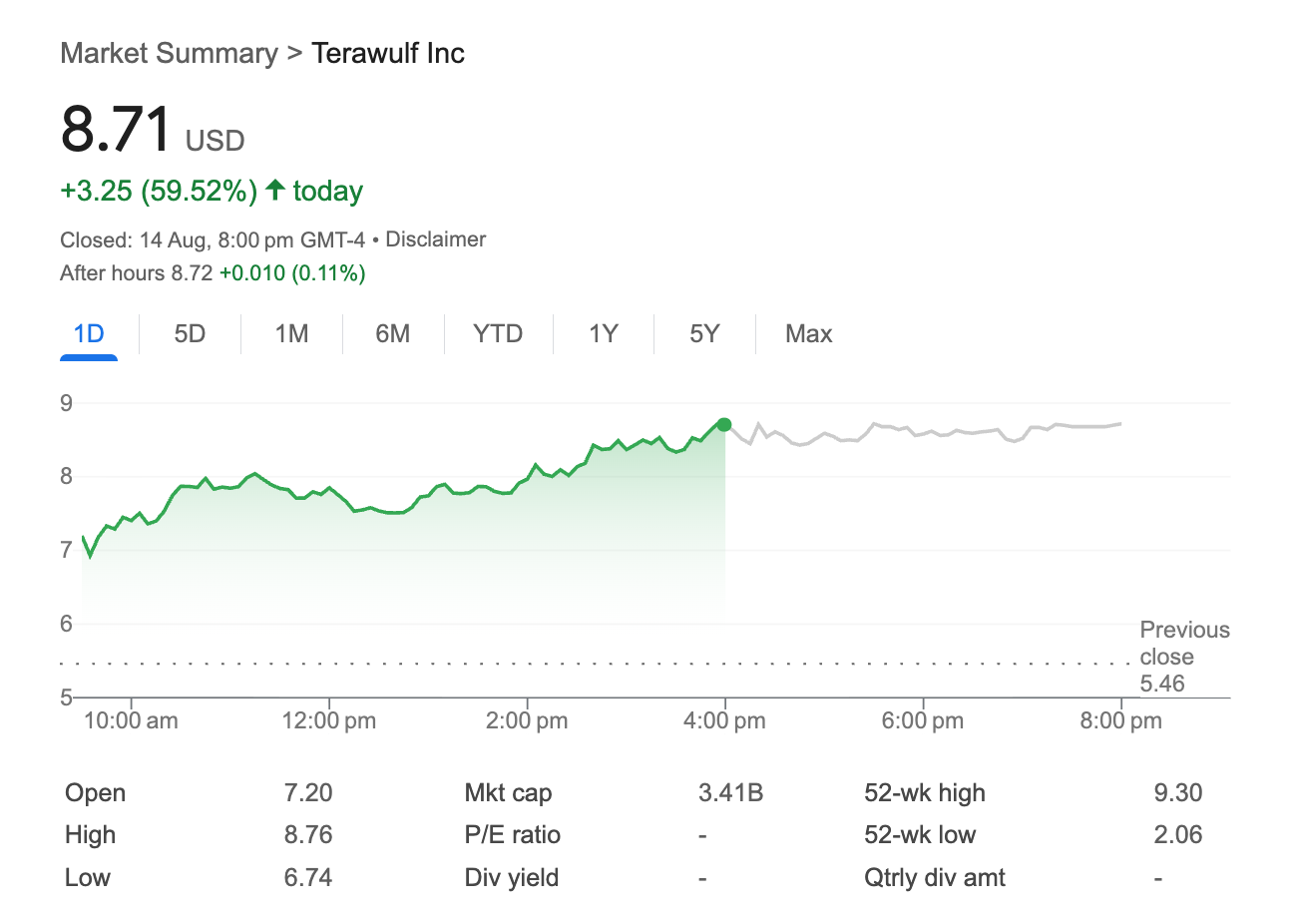

WULF shares surged on the news before settling around $8.71, up 59.52% for the day. The rally pushed the company's market cap to $3.41 billion and brought shares back into positive territory for 2025.

The deal reflects the broader trend of Bitcoin miners diversifying into AI and high-performance computing as mining profitability comes under pressure. TeraWulf's Bitcoin production dropped to 485 BTC in the second quarter from 699 BTC a year earlier, while the company reported a $61.4 million net loss in Q1 before returning to profitability in Q2.

Under the agreement, TeraWulf will deliver over 200 MW of computing capacity at its Lake Mariner facility in New York, purpose-built for liquid-cooled AI workloads. The first 40 MW is expected online by mid-2026, with full deployment by year-end.

The Google partnership provides crucial financial backing as TeraWulf invests $8-10 million per MW in infrastructure buildout. The company expects 85% net operating income margins on the AI hosting business, translating to roughly $315 million annually.

For crypto miners facing volatile Bitcoin prices and rising energy costs, the deal demonstrates how companies are leveraging existing infrastructure and energy expertise to tap into AI's explosive growth. The transition allows TeraWulf to maintain its zero-carbon energy focus while accessing more stable, long-term revenue streams.

Hot PPI Print Pauses Crypto’s Rally, But Demand Still Absorbs Supply

Your daily access to the back room....

Is a 0.5% September Fed Rate Cut Viable?

Hints of deeper Fed cuts and cooling inflation are fueling record highs in Bitcoin and Wall Street, ...

Hong Kong Securities Regulator Tightens Crypto Custody Standards

SFC issues new guidelines for virtual asset platforms following overseas incidents and domestic secu...